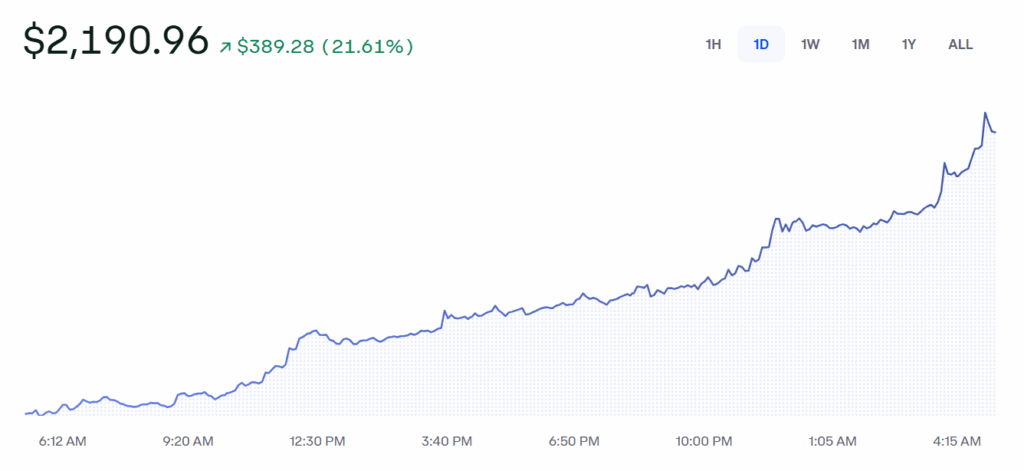

- Ethereum surged 15% to reclaim $2,000 after a US-UK commerce deal boosted market sentiment and institutional shopping for.

- Abraxas Capital bought 49,644 ETH as trade reserves dropped by 132,000 ETH, signaling mounting shopping for strain.

- Analysts eye the $2,100–$2,250 vary as key resistance, however overbought indicators counsel a possible short-term pullback.

Ethereum surged 15% on Thursday, reclaiming the $2,000 mark after information broke of a “full and complete” commerce settlement between the US and UK. The deal features a diminished baseline tariff of 10% and removes levies on aluminum and metal, fueling optimism throughout world markets.

ETH’s restoration follows a tough Q1, the place tariffs and commerce tensions dragged it down. Now, on-chain information reveals institutional patrons are piling in. Abraxas Capital snapped up 49,644 ETH on Binance and Kraken, in line with Lookonchain. In the meantime, Ethereum’s trade reserves dropped by 132,000 ETH in 4 days — an indication of mounting shopping for strain.

Bullish Indicators in Derivatives and Institutional Shopping for

The bullish vibe extends to the derivatives market, too. Ethereum’s open curiosity (OI) hit 12.08 million ETH ($25.04 billion), suggesting a surge in unsettled contracts as merchants place for extra upside. In the meantime, Bitcoin’s rally to $100,000 — its first time above that stage since February — has additionally buoyed sentiment throughout the crypto house.

Including to the momentum, the Ethereum Basis simply awarded $32.64 million in grants to ecosystem tasks geared toward protocol progress, cryptography, and zero-knowledge proofs. This comes days after the profitable Pectra improve, with the following improve, Fusaka, already within the pipeline for late 2025.

What’s Subsequent? ETH Eyes Key Resistance

With ETH reclaiming $2,000, analysts are eyeing the 100-day SMA vary between $2,100 and $2,250 as the following key resistance. If bulls can push by way of, a full-blown restoration might be within the playing cards.

Nevertheless, the RSI and Stochastic Oscillator are each flashing overbought indicators, hinting at a potential short-term pullback. Over $188 million in ETH futures have been liquidated up to now 24 hours, with most of it coming from quick positions — an indication that some merchants are nonetheless betting towards the rally.