Knowledge exhibits the Bitcoin derivatives buying and selling quantity has been greater than the spot one throughout BTC’s newest restoration rally past $100,000.

Bitcoin Buying and selling Quantity Ratio Has Declined Beneath The 1.0 Mark Lately

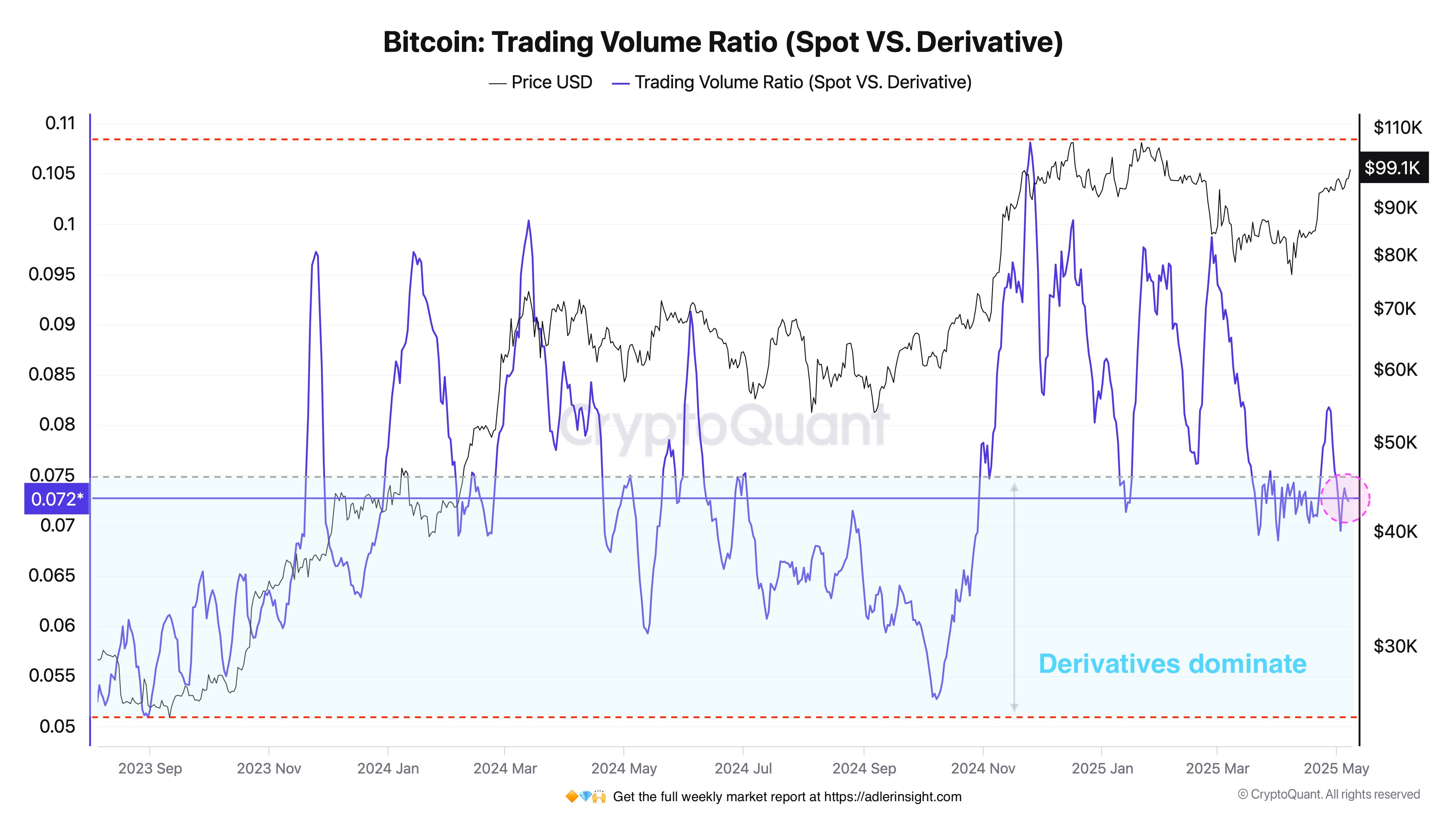

In a brand new put up on X, CryptoQuant writer Axel Adler Jr has talked concerning the development within the Buying and selling Quantity Ratio for Bitcoin. The “Buying and selling Quantity Ratio” is an indicator that retains monitor of the ratio between the quantity of the asset changing into concerned in buying and selling on spot exchanges and that on derivatives ones.

When the worth of this metric is larger than 1, it means the spot platforms are witnessing a better quantity of buying and selling quantity than the derivatives ones. Then again, it being underneath the brink suggests the dominance of derivatives buying and selling exercise among the many traders.

Now, right here is the chart shared by the analyst that exhibits the development within the Bitcoin Buying and selling Quantity Ratio over the past couple of years:

As displayed within the above graph, the Bitcoin Buying and selling Quantity Ratio has been sitting underneath the 1 mark not too long ago, suggesting quantity on the derivatives platforms has been outpacing that on the spot ones.

This has maintained whereas the cryptocurrency has gone by its newest leg of the restoration rally, which has taken its worth again above the $100,000 stage. From the chart, it’s seen that the development was completely different throughout final month’s rally.

This earlier leg of the run was accompanied by a spike within the Buying and selling Quantity Ratio above the 1 stage, a sign that spot trades have been probably the principle gasoline behind it.

Traditionally, sustainable worth rallies have typically been of this type; runs which can be borne out of excessive speculative exercise on the derivatives market are usually unstable.

On condition that the derivatives market has dominated on this rally up to now, it’s attainable that it may have hassle lasting. Although, it solely stays to be seen how issues would develop for Bitcoin.

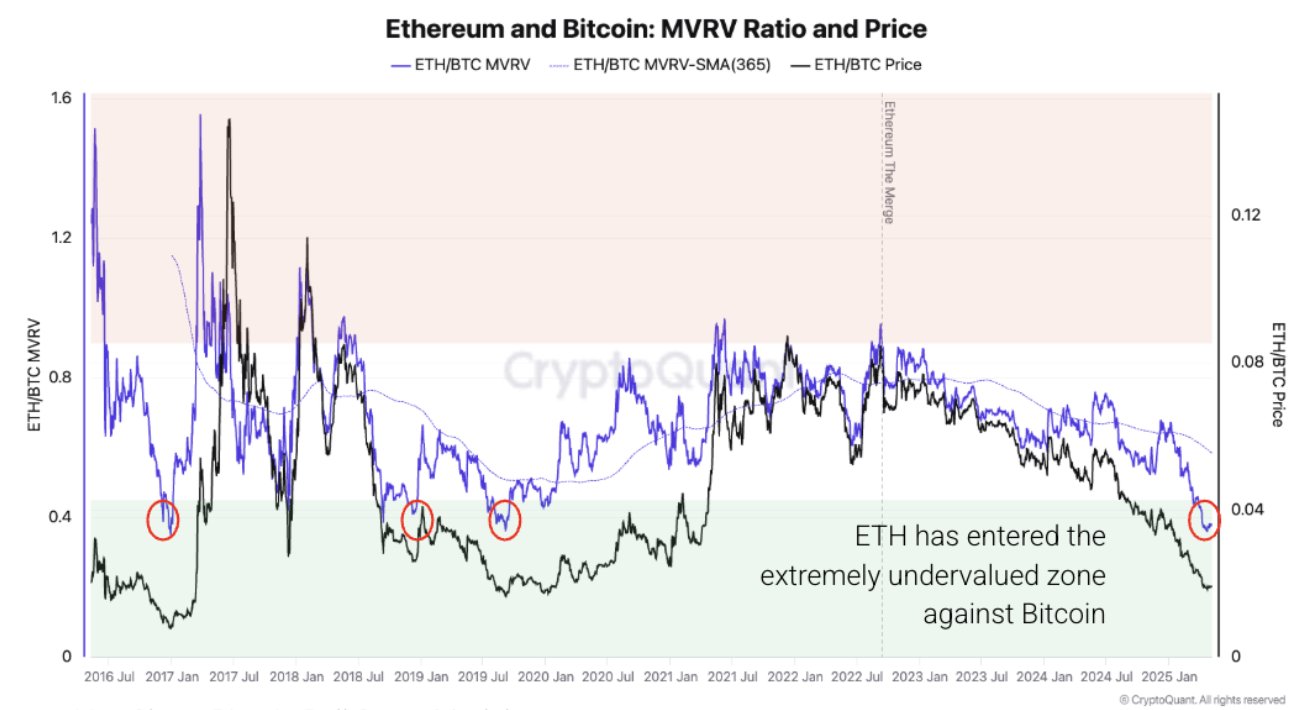

In another information, Ethereum is extraordinarily undervalued in comparison with Bitcoin, because the on-chain analytics agency CryptoQuant has revealed in an X put up.

The indicator shared by the analytics agency is the ratio between the Ethereum and Bitcoin Market Worth to Realized Worth (MVRV) Ratios. The MVRV Ratio is a well-liked on-chain metric that principally retains monitor of the profit-loss scenario of the traders as an entire.

As is seen within the chart, the MVRV Ratio of ETH could be very low in comparison with the one for BTC proper now. “Traditionally, this led to Ethereum outperforming,” notes CryptoQuant. “Nevertheless, provide strain, weak demand, and flat exercise may stall a rebound.”

BTC Worth

Following a surge of practically 3% within the final 24 hours, Bitcoin has managed to interrupt above the $101,000 stage.