- Bitcoin Breaks $100K: Bitcoin surged previous $100,000 on Might 9, hitting $104,150 for the primary time since February, fueled by a $925 million liquidation wave, largely from quick positions.

- Technical Evaluation – Overbought But Supported: Regardless of the RSI signaling overbought circumstances, BTC stays supported by a number of shifting averages and a bullish MACD crossover, with analysts eyeing $106K and $109K as key resistance ranges.

- Bullish Targets and Lengthy-Time period Outlook: Analysts venture additional features, with AlphaBTC focusing on $106K, Egrag Crypto aiming for $170K, and Binance CEO CZ speculating on a possible surge to $500K–$1M amid institutional curiosity and authorities accumulation.

Bitcoin (BTC) is again within the six-figure membership. After months of range-bound buying and selling, BTC surged above $100,000 on Might 9, hitting $104,150 throughout the late New York session. That’s the primary time it’s touched six figures since February 4, pushed by a contemporary wave of liquidity and a significant quick liquidation.

Liquidity Wipeout Fuels BTC Rally

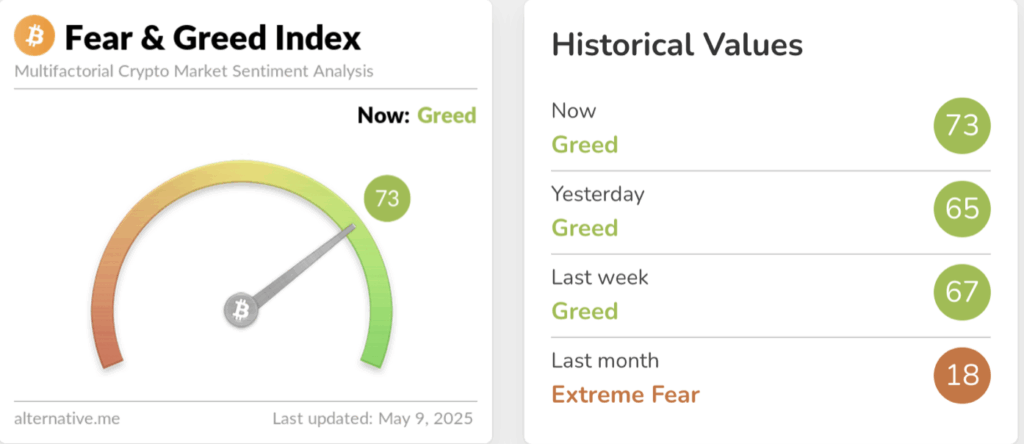

The spike wasn’t only a gradual climb. BTC worn out over $925 million in liquidations inside 24 hours, with $800 million of that coming from quick positions, marking the biggest quick squeeze since 2021, in line with CoinGlass. Because of this, the Crypto Worry & Greed Index shot up from 65 to 73, displaying an increase in market greed.

Curiously, there’s nonetheless vital vendor curiosity sitting across the $109,500 stage, with ask-orders value $2.85 billion. That means this rally would possibly nonetheless have some steam left in it, a minimum of within the quick time period.

Technical Evaluation — Overbought, However Supported

Crypto analyst GemXBT factors out that BTC is trying a bit overheated on the each day chart. The Relative Power Index (RSI) is now above 70, a basic overbought sign. However the Transferring Common Convergence Divergence (MACD) indicator stays above the sign line, and BTC remains to be buying and selling comfortably above the 5MA, 10MA, and 20MA — a robust bullish alignment.

“Bitcoin (BTC) is at the moment in an uptrend, supported by a number of shifting averages and a bullish MACD crossover,” GemXBT notes. “Nonetheless, that RSI studying suggests warning.”

BTC Worth Targets — What’s Subsequent?

Analysts at the moment are eyeing some formidable targets for Bitcoin. AlphaBTC, a preferred dealer, means that BTC may prolong this run to $106,000, based mostly on Fibonacci retracement ranges lining up with key assist zones. “I’m liking how these Fibonacci ranges align — makes me suppose $106K+ is on the playing cards earlier than a correction,” he stated.

Different merchants are much more optimistic. Egrag Crypto, one other crypto analyst, is focusing on $170,000, supplied BTC can shut above its earlier all-time excessive of $109,000. “If we don’t break above $109K, it’s only a bull entice. If we do — $170K is feasible,” he acknowledged.

After which there’s Binance CEO Changpeng Zhao, who’s trying far past. Zhao not too long ago steered that Bitcoin may hit between $500,000 and $1 million throughout this bull cycle, fueled by institutional shopping for, authorities accumulation, and a pro-crypto stance from the US underneath President Trump.

Bull Flag Targets $180,000

From a technical perspective, Bitcoin has fashioned a bull flag sample on the weekly chart, with the breakout occurring on April 22 when BTC surged above $88,000. If this sample performs out, the upside goal is round $182,200 — a 75% acquire from present ranges.

“The bull flag breakout is actual, and the goal is evident. Now it’s about sustaining momentum and never falling again beneath $88K,” AlphaBTC famous.

Key Ranges to Watch:

- Assist: $88,000, $100,000

- Resistance: $106,000, $109,000, $170,000

- Breakout Goal: $182,200

As at all times, keep watch over these liquidation zones and look ahead to quantity confirmations. This rally could have legs, however overbought alerts are beginning to flash, so proceed with warning.