BlackRock has up to date its S-1 registration assertion for the iShares Bitcoin Belief (IBIT), introducing new language that outlines the potential dangers posed by quantum computing.

This revision, filed on Might 9, displays rising trade consciousness of how superior computing applied sciences might impression cryptographic methods utilized in digital property.

BlackRock Flags Theoretical Quantum Dangers to Bitcoin Safety

Within the submitting, the asset supervisor warned that future developments in quantum computing could undermine the safety framework underpinning Bitcoin.

Ought to quantum expertise evolve far past its present state, it might render the cryptographic algorithms utilized by Bitcoin out of date.

This might enable malicious actors to use vulnerabilities, together with gaining unauthorized entry to wallets that retailer Bitcoin for the belief or its buyers.

Whereas quantum computing continues to be creating, BlackRock emphasised that the expertise’s full capabilities stay unsure.

Nonetheless, the agency considers it essential to reveal any theoretical threats that might have an effect on the efficiency or safety of its crypto funding merchandise.

Bloomberg ETF analyst James Seyffart stated the replace is a key issue that’s commonplace in ETF filings. He defined that issuers routinely listing all potential threats, irrespective of how distant.

“To be clear. These are simply primary threat disclosures. They’re going to spotlight any potential factor that may go unsuitable with any product they listing or underlying asset thats being invested in. It’s fully commonplace. And actually makes full sense,” Seyffart added.

Notably, BlackRock’s submitting additionally covers issues about regulatory actions, power consumption, mining focus in China, community forks, and prior market occasions just like the collapse of FTX.

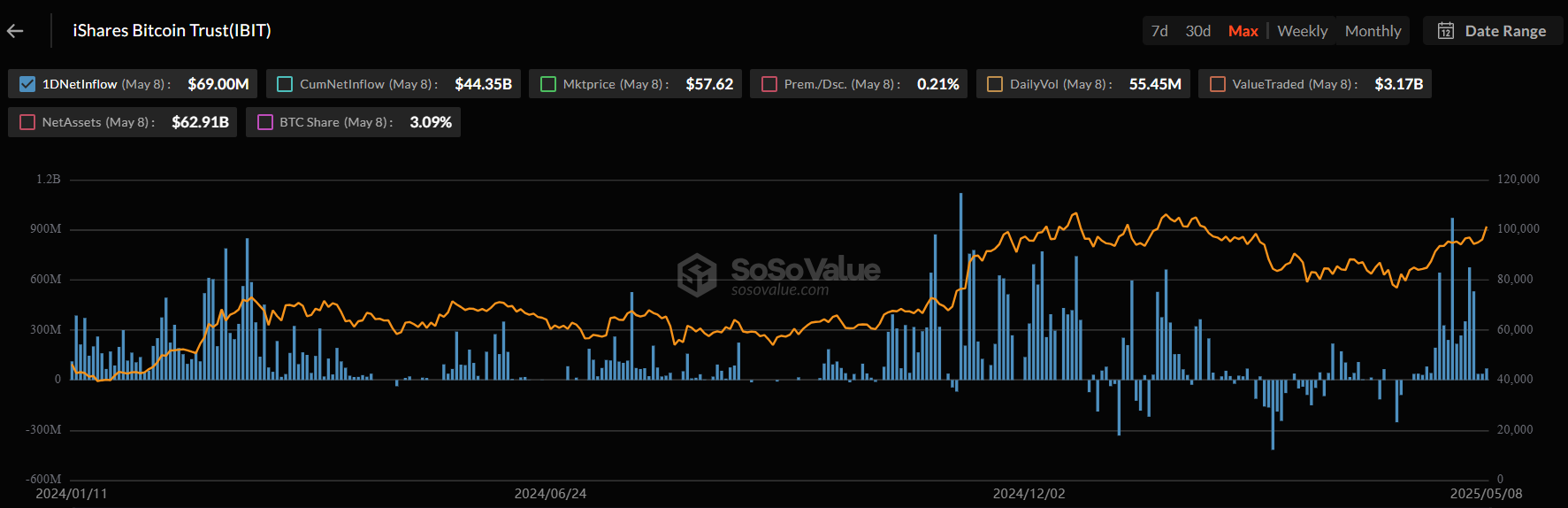

Regardless of these warnings, IBIT stays the most important spot Bitcoin ETF available on the market. It has recorded 19 consecutive days of inflows, attracting greater than $5.1 billion throughout the reporting interval.

Ethereum ETF Submitting Provides In-Type Redemption Construction

In a separate submitting, Seyffart revealed that BlackRock additionally amended its S-1 utility for its spot Ethereum ETF.

The brand new model consists of plans to help in-kind creation and redemption—a mannequin permitting buyers to swap ETF shares immediately for Ethereum, as an alternative of utilizing money.

This construction might decrease transaction prices and cut back market friction. It additionally avoids changing crypto into fiat foreign money, which is at present required below the cash-based mannequin. The strategy could assist issuers reduce worth slippage and save on buying and selling charges.

The SEC has but to approve in-kind redemption fashions for crypto ETFs, however analysts count on progress this 12 months.

“Eric Balchunas & I count on SEC approval for in-kind sooner or later this 12 months…Notably, the primary utility for any of the Ethereum ETFs to permit In-kind create/redeem has a last deadline round ~10/11/25,” Seyffart famous.

BlackRock’s submitting follows the agency’s assembly with the US Securities and Change Fee (SEC) to debate crypto ETF staking and securities tokenization.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.