- Cardano Eyes $1.20 After Bullish Breakout: ADA surged 16% over the previous week, breaking by way of the $0.74 resistance zone and holding round $0.78. If the rally continues, the subsequent goal is $1.20, with additional upside towards $1.77 based mostly on Fibonacci ranges.

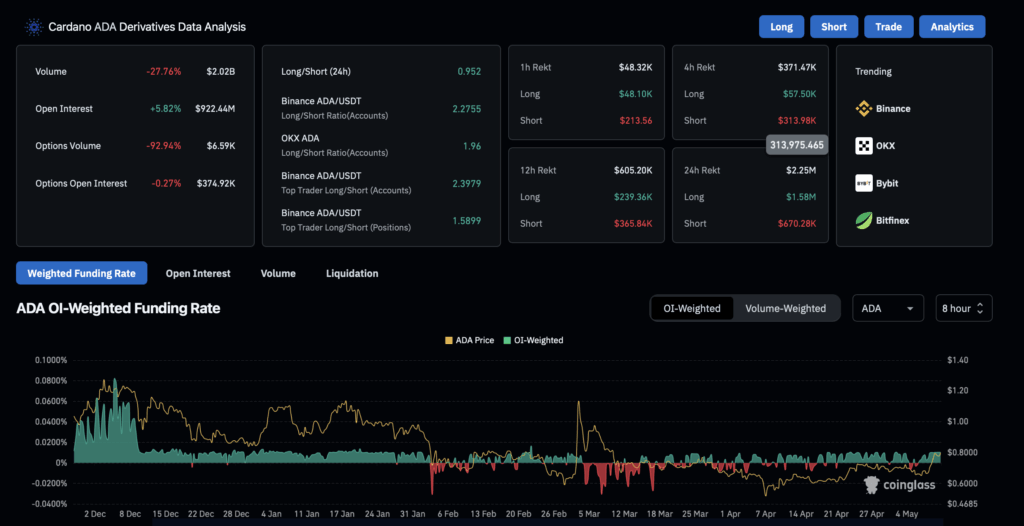

- Derivatives and Open Curiosity Surge: Open Curiosity in ADA derivatives crossed $900 million, with the OI funding price holding regular at 0.0103%. If OI climbs nearer to $1 billion, it may gas further momentum.

- Staking Exercise Boosts Bullish Outlook: Cardano’s staking exercise continues to rise, with 22.08 billion ADA staked throughout 2,764 swimming pools, representing $17.22 billion in locked property. The 1COMM staking pool stays a standout with 69.04 million ADA staked.

Cardano (ADA) is holding regular round $0.78 after a 1.04% acquire on Might 9, protecting its 16% weekly rally intact. Regardless of a slight slowdown, optimism is constructing within the derivatives market as Open Curiosity (OI) crosses $900 million, hinting at a attainable push towards $1.20 if momentum holds.

Bullish Breakout Above $0.74 – Is $1.20 Subsequent?

After practically 60 days of consolidation, ADA lastly broke by way of the $0.74 resistance zone, a degree that had saved bullish reversals in verify. This breakout marks a 20% transfer up from the 7-day low at $0.6425, setting the stage for additional positive aspects.

Trying again, ADA’s earlier rally to $1.20 in early March was adopted by a pointy 60% drop to $0.5107 in simply over a month. Since then, the $0.74 zone, which aligns with the 61.80% Fibonacci degree, acted as a cap on the upside. However with ADA now closing at $0.7693, that zone has flipped to help, suggesting a possible pattern shift.

On the broader timeframe, ADA’s worth construction since December 2024 kinds a right-angled descending broadening wedge, with the $1.20 zone because the higher boundary. A profitable breakout from this sample may see ADA pushing towards the 100% Fibonacci degree at $1.22. If that degree is cleared, the subsequent goal is the 1.272 Fibonacci degree at $1.77.

EMAs and MACD Present Bullish Indicators

Cardano’s rally has pushed it above the 50, 100, and 200-day EMAs, rising the chances of a golden crossover between the 50-day and 200-day EMAs. In the meantime, the MACD line has crossed above the sign line, a traditional bullish sign that helps the prolonged restoration outlook.

If ADA can maintain above $0.74, the subsequent check would be the $1.20 resistance zone. But when that degree fails, ADA may drop again to the 50% Fibonacci help at $0.62.

Open Curiosity Crosses $900M – What It Means

As ADA holds above $0.74, derivatives exercise is choosing up. Open Curiosity has surged previous $900 million, whereas the OI weighted funding price stays flat at 0.0103% — indicating a balanced market. If OI continues to climb towards $1 billion, it may present the gas wanted for an additional leg up.

Staking Exercise Helps Bullish Thesis

Staking exercise on the Cardano community can be ramping up. In accordance with PoolTool, there are actually 2,764 lively staking swimming pools, with 1.33 million addresses staking a complete of twenty-two.08 billion ADA — roughly $17.22 billion at present costs.

Amongst them, One Group ADA (1COMM) stands out, with 69.04 million ADA staked, making it one of the trusted swimming pools within the community.

Key Ranges to Watch:

- Help: $0.74, $0.62

- Resistance: $1.20, $1.22, $1.77

- Breakout Affirmation: Sustained transfer above $1.20 with quantity may open the door to $1.77, whereas a break under $0.74 may invalidate the bullish setup.