Regardless of the rising bullish sentiment throughout the broader crypto market, Onyxcoin (XCN) gained solely 5% prior to now week. Though buying and selling quantity jumped 77.7% in the present day, reaching $82.3 million, the altcoin continues to face resistance.

Momentum is rising, with the RSI climbing and a golden cross forming. However not all alerts are bullish. The BBTrend stays unfavorable, exhibiting warning. Merchants are watching to see if XCN can maintain its breakout or if bears will take over.

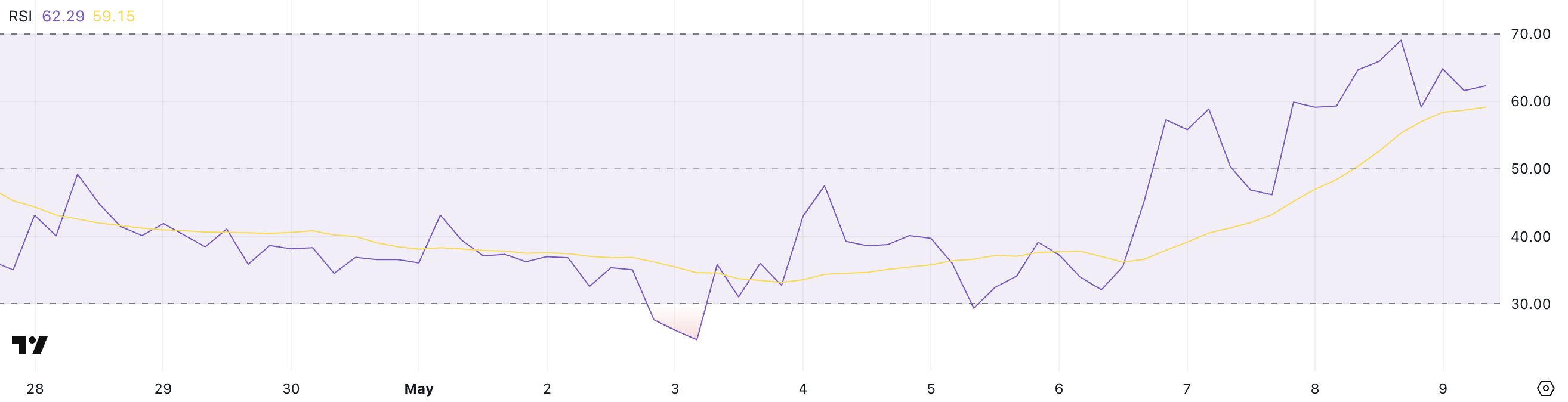

XCN RSI Surges to 62 as Bullish Momentum Builds

Onyxcoin has proven a powerful uptick in momentum, with its Relative Energy Index (RSI) climbing from 46.15 to 62.29 in simply two days.

This speedy rise alerts elevated shopping for stress and means that bullish sentiment is gaining power.

RSI is a extensively used momentum indicator that ranges from 0 to 100—readings above 70 usually point out overbought circumstances, whereas ranges beneath 30 counsel the asset could also be oversold.

With XCN’s RSI now at 62.29, the token is nearing overbought territory however nonetheless has room to climb.

Importantly, Onyxcoin hasn’t crossed the 70 threshold since April 23, highlighting that whereas momentum is constructing, it hasn’t but reached ranges that usually precede a pullback.

If the RSI continues rising, it might help additional value beneficial properties, although merchants will watch intently for indicators of exhaustion.

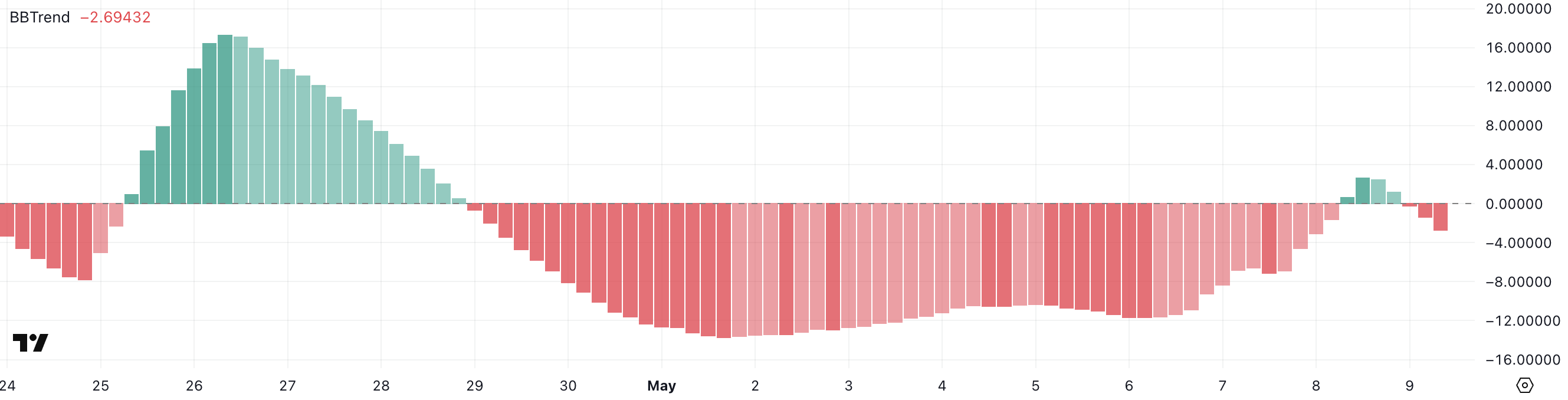

Onyxcoin’s BBTrend Turns Adverse Once more After Temporary Restoration

Onyxcoin BBTrend indicator is at the moment at -2.69, reflecting a renewed weakening in momentum after a short restoration. Between April 29 and Could 8, the BBTrend remained unfavorable, signaling a bearish bias throughout that stretch.

On Could 8, the indicator briefly flipped into constructive territory, peaking at 2.66—suggesting a possible pattern reversal—however that transfer was short-lived.

In the previous couple of hours, the BBTrend has reversed once more, falling sharply from -1.41 to -2.69, reinforcing a return to bearish stress within the brief time period.

The BBTrend (Bollinger Band Development) is a technical indicator that measures the power and route of a pattern primarily based on the gap between value and the Bollinger Bands.

Optimistic values usually point out upward momentum and a possible continuation of bullish value motion, whereas unfavorable values level to downward momentum and rising promoting stress.

With XCN’s BBTrend now deep in unfavorable territory, it means that bearish sentiment is regaining management. Until the indicator flips again to constructive quickly, the present setup implies restricted upside and the potential for additional value weak point within the close to time period.

Golden Cross Varieties on Onyxcoin: Can XCN Break By way of Resistance?

Onyxcoin (XCN) has simply fashioned a golden cross—a bullish technical sample the place the short-term transferring common crosses above the long-term transferring common.

This growth typically alerts the start of a possible uptrend. If momentum continues, XCN might quickly take a look at the resistance at $0.020.

A breakout above that stage could pave the best way for additional beneficial properties towards $0.024, and if the rally sustains, the value might climb as excessive as $0.0273. Onyxcoin has been one of many hottest altcoins of 2025, up 118% within the final 30 days.

Nevertheless, if the uptrend fails, key help ranges might come into play.

The primary space to look at is $0.0175—if that stage is damaged, XCN could decline to $0.0164.

Continued weak point might drag the value even decrease to $0.0156.

Disclaimer

In keeping with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.