- Huge DOGE Switch Amid Bullish Sentiment: A switch of 793 million DOGE (price $153 million) between unknown wallets coincides with a 12.16% value rally to $0.2062, elevating hypothesis of potential whale strikes.

- On-Chain and Derivatives Exercise: Whereas sentiment indicators present optimism, on-chain exercise stays subdued with Each day Lively Addresses at 70,913 and Transaction Rely at 52,071. In the meantime, derivatives quantity surged 126.06% to $6.2 billion, indicating heightened speculative exercise.

- Technical Evaluation – Subsequent Goal $0.286: DOGE broke out of a consolidation zone close to $0.203, with RSI now at 70.57 (overbought) and Parabolic SAR remaining under the worth, suggesting continued bullish momentum towards the $0.286 resistance degree.

A whopping 793 million Dogecoin (price over $153 million) simply moved between two unknown wallets, grabbing the market’s consideration. The timing? Proper in the midst of a contemporary 12.16% rally that’s pushed DOGE to $0.2062 as of immediately. Whereas large transfers like this usually trace at whale strikes, sentiment indicators are out of the blue leaning bullish too.

Sentiment Turns Constructive, However On-Chain Knowledge Stays Subdued

Market Prophit exhibits each crowd and good cash sentiment scoring above 1.3, suggesting confidence from each retail and institutional gamers. But, on-chain exercise isn’t precisely screaming bullish simply but.

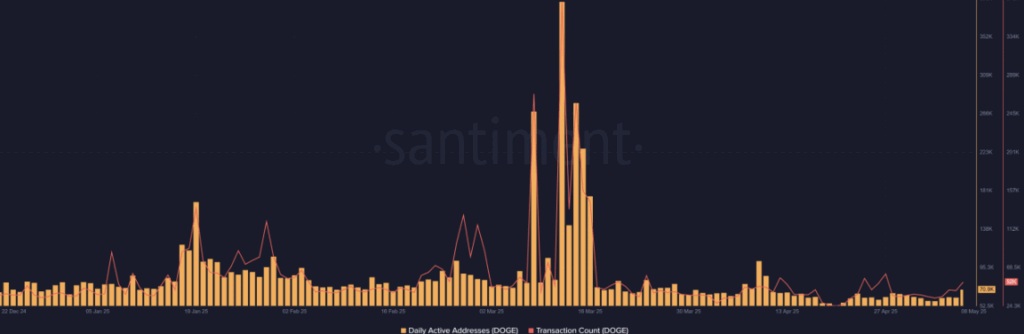

Each day Lively Addresses sit at 70,913, and Transaction Rely is hovering round 52,071. Sure, these numbers are up barely from April’s lows, however they’re nonetheless far under March peaks, the place each metrics topped 300,000. So, whereas the temper is lifting, DOGE’s on-chain exercise is extra of a cautious rebound than a confirmed uptrend.

Valuation Evaluation – What’s Driving This Rally?

From a valuation perspective, DOGE nonetheless appears to be like prefer it’s in favorable territory. The MVRV Z-Rating is sitting at 0.70, indicating that the majority holders aren’t in important revenue, limiting the chance of mass sell-offs. However there’s a twist — the Inventory-to-Circulation Ratio has dropped to zero. That’s proper. Zero.

This sharp decline would possibly trace at mining stagnation or a brief provide freeze, which might introduce shortage dynamics. If DOGE provide stays tight and demand stays robust, it might create upward value stress, particularly throughout speculative runs.

Derivatives and Market Sentiment – Repositioning or Breakout?

Hypothesis within the derivatives market is heating up. Buying and selling quantity surged 126.06% to $6.2 billion, and Open Curiosity jumped 17.10% to $2.2 billion. However there’s a catch. Choices Quantity rose 55.13%, whereas Choices Open Curiosity dropped 53.96%. That implies short-term repositioning, not long-term conviction.

In the meantime, Santiment’s Weighted Sentiment indicator climbed to +0.59, indicating that bullish commentary is gaining traction. Traditionally, this sort of shift usually precedes main value motion, reinforcing the potential for additional beneficial properties.

Technical Evaluation – Eyes on $0.286

DOGE just lately broke out of a multi-week consolidation zone close to $0.203, forming a double-bottom sample round $0.144. With the neckline now performing as help, momentum indicators are pointing larger.

The RSI is as much as 70.57 — technically overbought, but in addition an indication of robust bullish stress. In the meantime, the Parabolic SAR continues to print under the worth, suggesting the uptrend is unbroken.

If bulls keep management, the subsequent large resistance degree to observe is $0.286. A clear break above that zone might open the door for much more upside, doubtlessly solidifying DOGE’s present rally right into a broader uptrend.