The value motion of Bitcoin over the previous week was largely redemptive, because the premier cryptocurrency reclaimed its place above the psychological $100,000 mark. This current burst of bullish momentum mirrors a healthily rising sentiment amongst traders.

On Friday, Might 15, the Bitcoin value reached as excessive as $103,800 — its highest stage since January. Nevertheless, the newest on-chain information exhibits the absence of investor exercise within the derivatives market, usually seen when BTC’s worth hits this stage.

BTC Value Rally About To Hit A Roadblock?

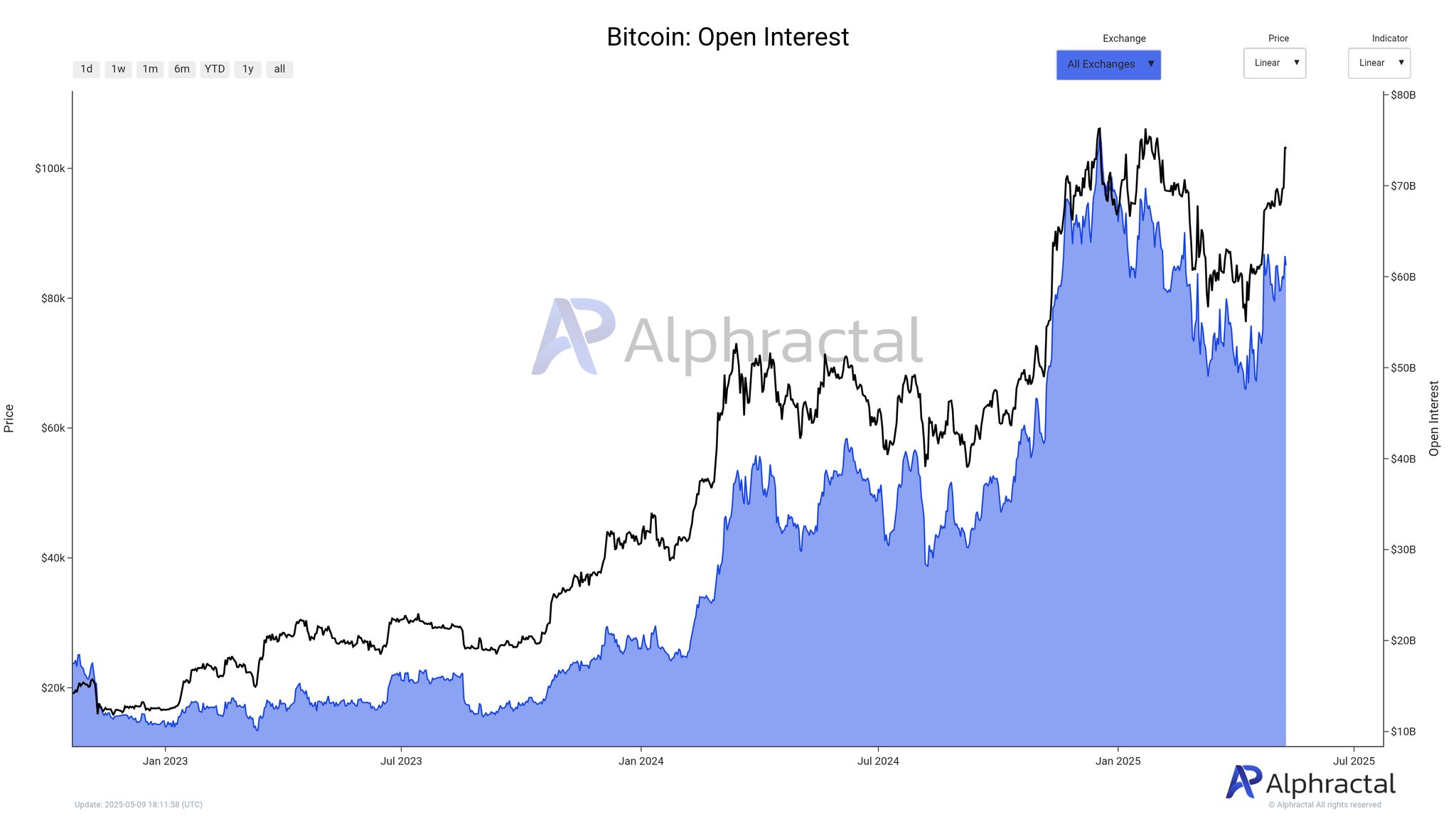

In a current publish on the social media platform X, crypto analytics platform Alphractal shared that the open curiosity (OI) has not fairly moved in tandem with the Bitcoin value over the previous few days. The open curiosity metric measures the overall amount of cash flowing into BTC derivatives at any given time.

Rising open curiosity is usually thought-about a bullish sign for the premier cryptocurrency, particularly because it suggests contemporary capital inflow into the market. In the end, this pattern suggests bettering investor sentiment and surging dealer confidence.

In response to information from Alphractal, the present aggregated OI for Bitcoin (valued at round $103,000) stands at an estimated $61.3 billion. The final time BTC was at this monumental value, the open curiosity was greater than $68 billion.

Supply: @Alphractal on X

With the present Bitcoin open curiosity lower than the OI the final time value was at $103,000, Alphractal famous that this pattern suggests decrease leverage and lowered exercise in crypto’s largest market. The analytics agency additional defined that this phenomenon could possibly be attributable to both current waves of liquidations or place closures.

Within the publish on X, Alphractal revealed different the reason why the flagship cryptocurrency’s value is likely to be vulnerable to a short-term correctional motion. The related on-chain metric backing this bearish projection is the Whale Place Sentiment.

The Whale Place Sentiment metric tracks each the directional bias and buying and selling habits of enormous holders. It usually displays the web positioning of whales, their market sentiment, and likewise modifications in open positions.

Chart displaying a decline within the Whale Place Sentiment from 1 to round 0.7 | Supply: @Alphractal on X

Alphractal concluded that the drop within the Whale Place Sentiment displays massive traders’ curiosity in closing lengthy positions, thereby shifting market sentiment. If the metric continues to drop, the on-chain analytics agency inferred that it might result in value stagnation, or worse, a correction.

Bitcoin Value At A Look

As of this writing, the value of BTC stands at $103,035, reflecting no important motion within the 24 hours. Whereas the current bullish momentum means that the premier cryptocurrency might hit a brand new all-time excessive within the coming days, traders may need to train warning, contemplating current on-chain observations

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.