- Solana Surges 17% Amid Institutional Inflows: Solana (SOL) climbed to $173 on Might 9, fueled by elevated institutional investments and an increase in memecoin exercise, pushing the community’s complete worth locked (TVL) to over $8.7 billion.

- Quick Squeeze Potential as Liquidations Mount: Solana’s leveraged market noticed $31 million in internet liquidations, whereas on-chain liquidations hit $47 million, elevating the percentages of a brief squeeze that might drive SOL greater.

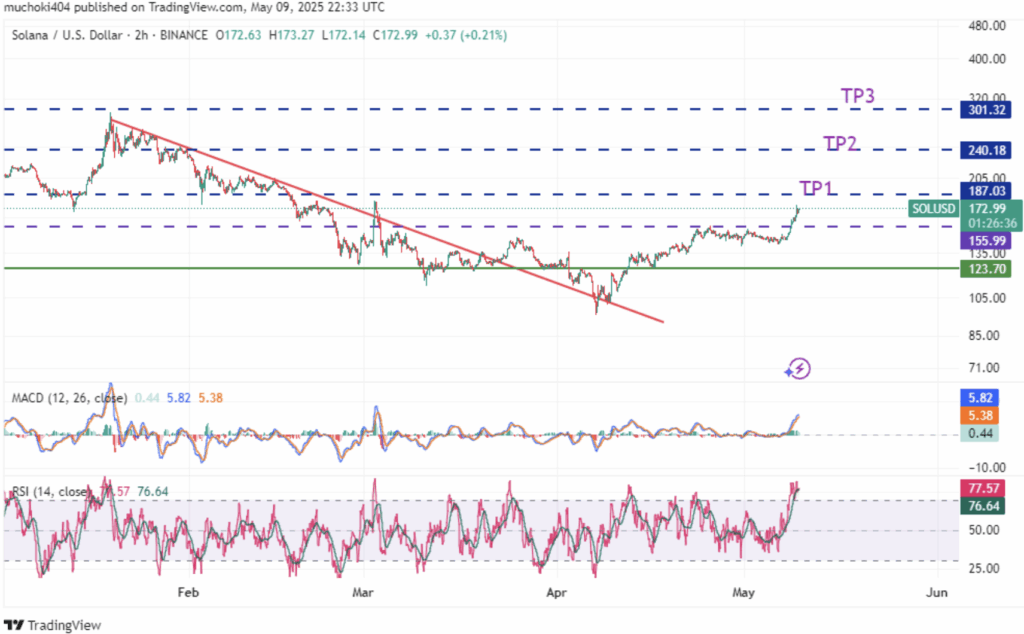

- Bullish Targets at $187 and $240: On the 2-hour chart, SOL’s MACD crossed above zero, and RSI pushed previous 70, indicating bullish momentum, with key resistance at $187 and $240 if the 200-day SMA is cleared.

Solana (SOL) has been using the wave alongside Bitcoin and Ethereum, gaining 17% over the previous week to hit $173 on Might 9 in the course of the late North American buying and selling session. The big-cap altcoin, with a completely diluted valuation close to $89.8 billion and a 24-hour buying and selling quantity of round $8.8 billion, is catching eyes as volatility ramps up.

Quick Squeeze Potential as Liquidations Spike

With the current worth surge, Solana’s leveraged market noticed a internet liquidation of $31 million prior to now 24 hours. In the meantime, native perpetual exchanges on Solana recorded over $47 million in on-chain liquidations, rising the probabilities of a brief squeeze. If bearish merchants get caught offside, a sudden spike may push SOL greater within the close to time period.

Institutional Money Inflows Increase Solana Community

It’s not simply retail merchants fueling Solana’s rise. Institutional traders have been pouring money into the community, led by Sol Methods, which has been aggressively rising its SOL holdings over the previous few quarters. The memecoin craze inside the Solana ecosystem has additionally helped pump the community’s complete worth locked (TVL) to over $8.7 billion.

In the meantime, the U.S. SEC underneath the Trump administration has taken a extra crypto-friendly stance than in earlier years, fast-tracking spot Solana ETF functions. If these ETFs get the inexperienced gentle, extra institutional cash may movement into Solana, additional boosting its worth motion.

Technical Evaluation – Eyeing $187 and $240

From a technical perspective, SOL is flashing bullish indicators. On the 2-hour chart, SOL efficiently rebounded from a falling logarithmic trendline, with the MACD line crossing above the zero mark and the RSI climbing over 70 — each basic bullish indicators.

With momentum constructing, the following key targets are $187 and $240. Nevertheless, the larger macro-bullish setup gained’t be totally confirmed till SOL clears the 200-day Easy Shifting Common (SMA), a degree that might act as a launchpad for additional good points.

For now, all eyes are on institutional flows and the potential for a brief squeeze to see if Solana can keep its upward trajectory.