Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

XRP is popping heads once more following a formidable present of resilience in latest days, bouncing from lows of $2.08 earlier this week to reclaim $2.4 on the time of writing. This upward momentum, now clocking over 15% features from its check of the $2 assist, has introduced with it an fascinating historic sample on XRP’s each day chart.

A comparability of XRP’s present value construction with its 2017 trajectory exhibits {that a} uncommon setup could also be indicating an enormous breakout is on the horizon, with a value goal as excessive as $9.

Associated Studying: 3.5 Million TRUMP Tokens On The Transfer—Trump Crew Makes A Huge Play

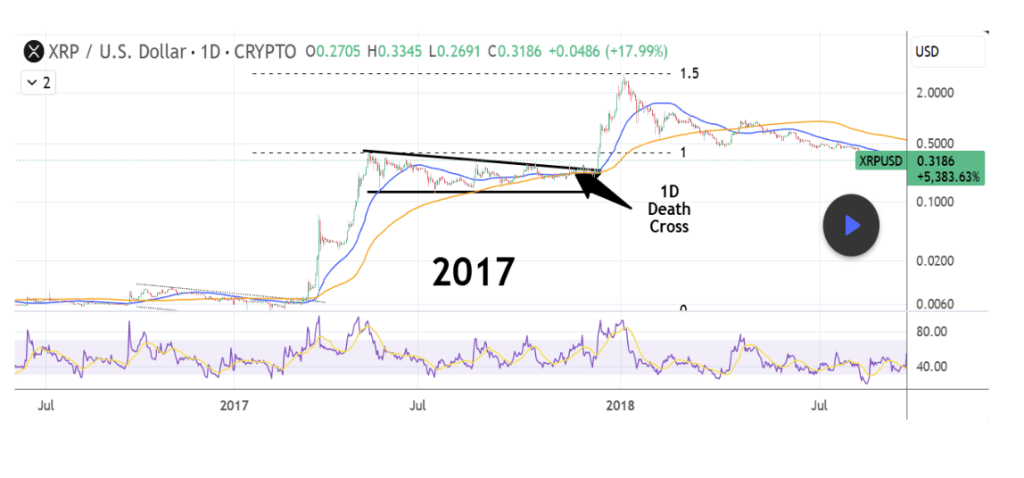

XRP Worth Flashes 1D Loss of life Cross Sign, However Worth Historical past Suggests A Twist

On the floor, a dying cross has appeared on the XRP each day candlestick timeframe chart. This type of cross happens when the 50-day shifting common crosses under the 200-day shifting common, and would sometimes be interpreted as a bearish signal. Nevertheless, in accordance with a crypto analyst on the TradingView platform, this may not be the case for XRP.

A more in-depth take a look at historic precedent from 2017 means that this technical sign will not be as dangerous for XRP because it sounds. Again then, XRP exhibited almost similar habits of buying and selling inside a descending triangle simply earlier than the dying cross occurred. That second marked a misleading shift, as XRP’s value motion rapidly flipped path and exploded to the upside. Inside weeks of the 2017 dying cross, XRP went on to hit the 1.5 Fibonacci extension zone, delivering returns in extra of 1,350% from its pre-breakout degree of $0.23 up till its present all-time excessive of $3.4.

XRP has once more spent months consolidating inside a good descending triangle within the 2025 setup main as much as the present dying cross which is the primary in over a 12 months. Regardless of the bearish implications of the dying cross, the parallels in chart construction with the 2017 sample and timing have made this formation a bullish wildcard.

An identical playout of the 2017 dying cross rally would ship the XRP value to new all-time highs on the 1.5 Fibonacci extension. When it comes to a value goal, the analyst famous that the 1.5 Fibonacci extension for this 12 months aligns close to the $9.00 value degree, which might symbolize a 325% rally from XRP’s present value.

Indicators Keep Impartial However Optimistic

Notably, the XRP value has a impartial however promising technical outlook throughout larger timeframes. XRP holds a Relative Energy Index (RSI) of 54.799 on the weekly timeframe. That is mid-range and exhibits there’s nonetheless loads of room to climb earlier than XRP turns into overbought. The MACD studying at 0.197 signifies gentle upward strain, whereas the ADX is at 30.423.

Associated Studying

On the time of writing, XRP is buying and selling at $2.38. The analyst’s bullish state of affairs relies upon considerably on whether or not institutional curiosity aligns with the technical breakout.

Featured picture from Unsplash, chart from TradingView