CryptoQuant’s CEO says that Bitcoin is successfully a deflationary asset now that BTC is getting quickly gathered by Michael Saylor’s Technique (MSTR).

In a put up on the social media platform X, Ki Younger Ju tells his 422,200 followers that regardless of Bitcoin’s inflation, Technique is now gobbling up cash at a faster fee than what miners can produce.

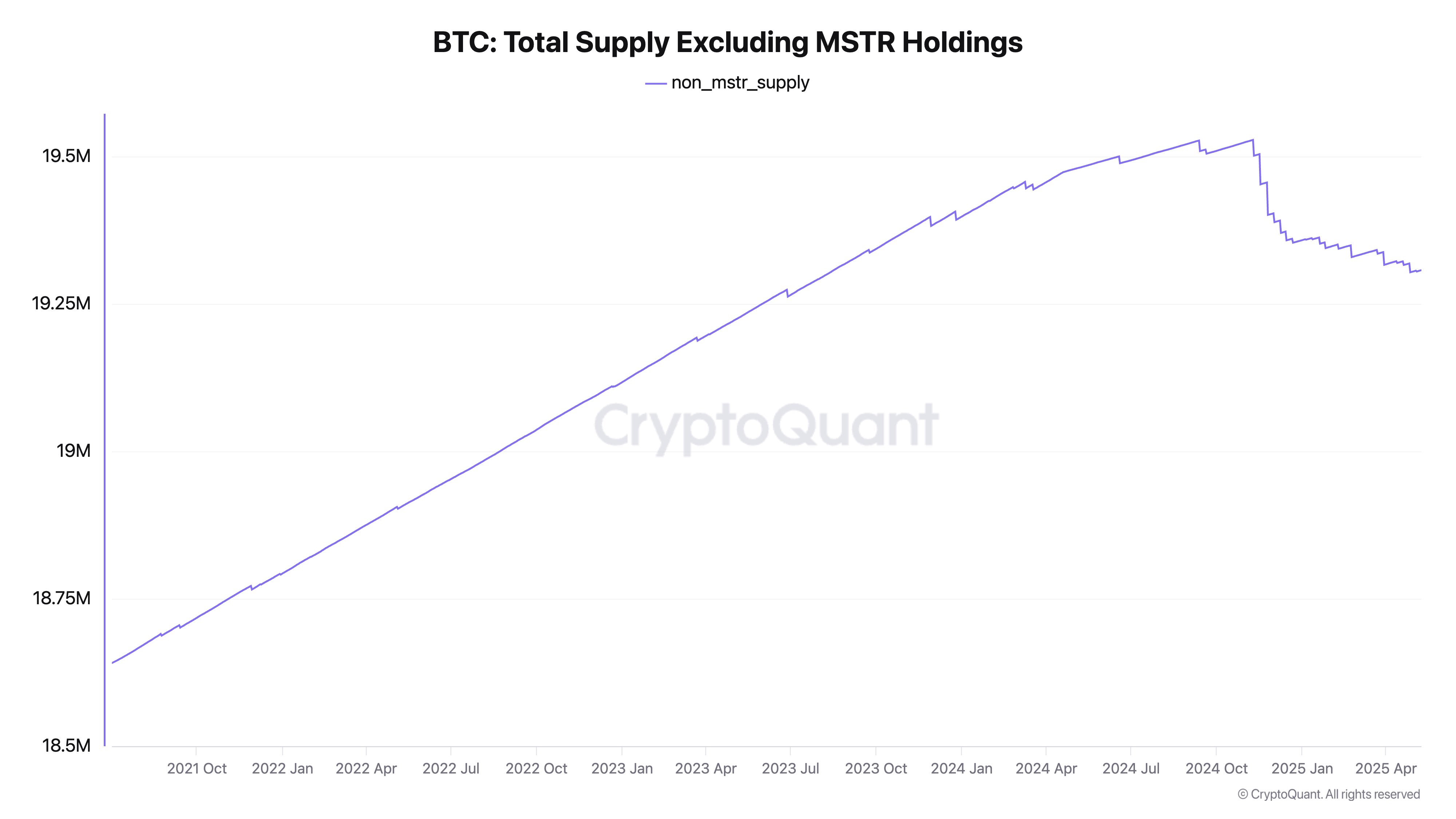

CryptoQuant’s information seems to indicate that when excluding cash held by MSTR, the availability of BTC has been happening since late final yr.

“Bitcoin is deflationary.

Technique is shopping for BTC quicker than it’s mined. Their 555,000 BTC is illiquid with no plans to promote. MSTR’s holdings alone imply a -2.23% annual deflation fee – doubtless larger with different secure institutional holders.”

In response to BitcoinTreasuries.internet, Technique has 555,450 BTC price about $58 billion, representing 2.645% of Bitcoin’s 21 million provide.

Ju lately backtracked on his earlier name that the Bitcoin bull market was over. The CEO mentioned that Bitcoin’s market construction is extra complicated now, with many alternative giant gamers, making forecasting tougher.

In response to the CryptoQuant CEO, promoting strain on BTC has eased within the face of “huge inflows” from spot exchange-traded funds (ETFs).

“Up to now, the Bitcoin market was fairly easy. The principle gamers have been previous whales, miners, and new retail buyers, mainly passing the bag to one another. When retail liquidity dried up and previous whales began cashing out, it was comparatively simple to foretell the cycle peak. It was like a sport of musical chairs – everybody tried to money out directly, and those that didn’t ended up caught with their holdings.

However now, the Bitcoin market has turn out to be rather more numerous. ETFs, MicroStrategy (MSTR), institutional buyers, and even authorities businesses are contemplating shopping for and promoting Bitcoin. Up to now, profit-taking cycles have been triggered when whales cashed out on the peak, resulting in a sequence response of sell-offs and a worth drop.”

At time of writing, Bitcoin is buying and selling for $114,112.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney