- BNB Breaks Out of Symmetrical Triangle: BNB surged previous the $644 resistance degree after breaking out of a symmetrical triangle sample, forming a double-bottom construction with a goal of $732 and potential for additional beneficial properties towards $1,000.

- Binance Chain Payment Discount Boosts Community Exercise: Binance Chain slashed gasoline charges by 90%, driving Complete Worth Locked (TVL) to over $8 billion and DEX volumes to a six-week excessive of $2.12 billion, signaling elevated consumer exercise.

- Brief Squeeze and Key Resistance Ranges: Over $3 million briefly positions have been liquidated as BNB climbed previous $600, intensifying shopping for strain. The subsequent key ranges to observe are $650 and $700, with potential for a breakout to $732 if momentum holds.

After weeks of flat, sideways buying and selling, BNB is lastly making some noise. The token simply busted by means of the higher trendline of a symmetrical triangle sample on the day by day chart, hinting at a possible breakout. And it’s not simply the technicals — on-chain knowledge and rising community exercise are all pointing in the identical route: up.

Symmetrical Triangle Breakout and Double-Backside Sample

BNB’s breakout above the triangle sample was no fluke. The transfer was adopted by a clear retest, the place the outdated resistance line flipped to assist. Now, BNB is testing the $644 resistance space, a key degree to observe.

Including to the bullish setup, a double-bottom sample has additionally emerged, with the neckline proper round $644. If BNB can clear this degree, the projected goal sits at roughly $732. A breakout there might open the door for a run towards $1,000, however that’s a giant ‘if’ for now.

Technical indicators are backing the bullish outlook. The Superior Oscillator (AO) has flipped to inexperienced bars, and the MACD is displaying rising bullish divergence — each indicators that consumers are gaining floor.

Binance Chain Payment Discount Spurs Community Exercise

In the meantime, a significant community growth can also be in play. Binance Chain simply slashed its gasoline charges from 1 gwei to 0.1 gwei — a 90% discount. This transfer, proposed by Binance founder CZ, is already shaking issues up.

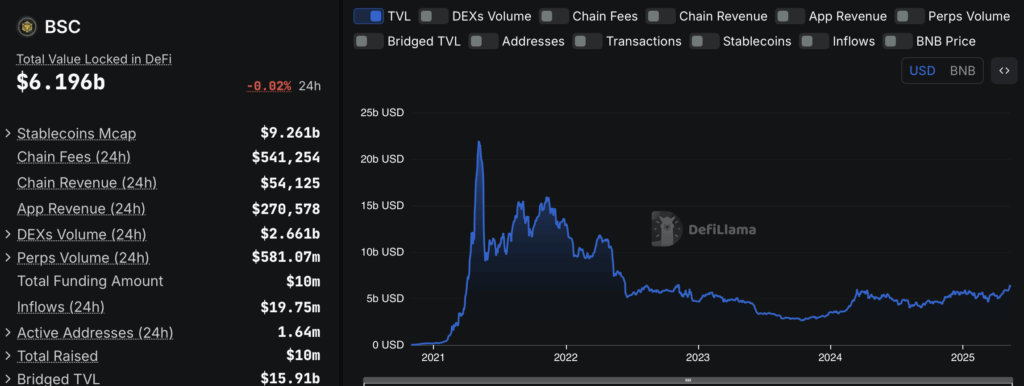

Following the payment lower, community utilization has spiked. Knowledge from BSC Scan and DeFiLlama exhibits Complete Worth Locked (TVL) on Binance Chain has surged previous $8 billion — the best since 2024. The decrease charges have made it cheaper for customers to work together with dApps, driving up exercise throughout the board.

DEX volumes are additionally climbing, hitting a six-week excessive of $2.12 billion. This uptick in buying and selling is a transparent signal that extra merchants are flocking to Binance Chain-based platforms, additional supporting BNB’s bullish pattern.

Brief Squeeze Sends Costs Increased

The rally can also be catching brief sellers off guard. In line with Coinglass, over $3 million briefly positions have been liquidated on Could 8 and 9 as BNB’s value pushed previous $600.

The squeeze has pressured many shorts to cowl, including extra shopping for strain to the market. Since mid-April, liquidation volumes have been comparatively low, suggesting that volatility is easing and market sentiment is stabilizing.

Key Resistance Ranges and Path Towards New Highs

BNB is now eyeing an important resistance degree at $650. If the value can break and maintain above this zone, the following goal is $700. Past that, the double-bottom sample factors to a goal round $732.

If the bullish construction holds and quantity continues to rise, the push to $1,000 might come into play. However for now, $650 and $700 stay the fast ranges to observe.

On the time of writing, BNB is buying and selling round $650.91, up sharply from its lows in early April. With community exercise rising and technicals leaning bullish, the stage may very well be set for a sustained rally — however provided that consumers can keep management at these key resistance ranges.