Binance founder and former CEO Changpeng Zhao (CZ) not too long ago proposed a 3X or 10X discount in BSC gasoline charges. Barely 24 hours later, the Binance Good Chain slashed gasoline charges by 10X, reaching a 90% discount. The transfer helped builders and customers massively.

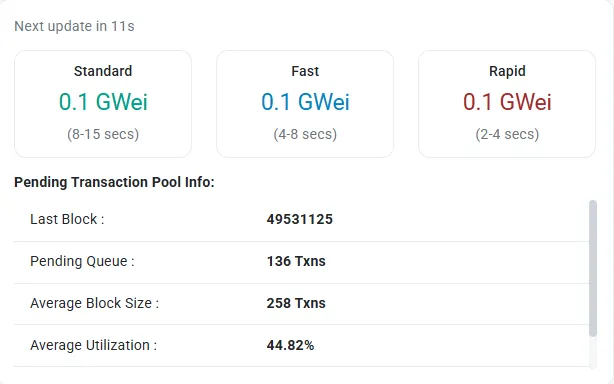

In an unique with BeInCrypto, BNB Chain’s Core Improvement staff breaks down the story behind its dramatic 90% gasoline charge minimize. Transferring from 1 Gwei to 0.1 Gwei, they make clear governance mechanics, market incentives, and the chain’s altering place within the Layer-1 vs. Layer-2 stack battle.

CZ Could Have Lit the Spark, However Validators Management the Fireplace

The narrative round Binance Good Chain’s gasoline charge plunge this Could from 1 Gwei to 0.1 Gwei was rapidly pinned to a single catalyst: a tweet from Binance founder Changpeng Zhao.

That is amidst an area usually dominated by headlines. Nevertheless, behind the scenes, one thing extra profound is unfolding.

Validator-driven recalibration of community pricing dynamics is aligned with a strategic push to entrench BNB Chain’s function in a multi-layered, scalable blockchain future.

Talking solely to BeInCrypto, a BNB Chain Core Improvement spokesperson dispelled the notion that this was a top-down decree from Changpeng Zhao.

“As a result of the minimal gasoline worth setting isn’t a part of the consensus mechanism, it’s a market dynamic as chosen by validators. The group of validators responds to calls from CZ, however finally, it’s their determination,” the spokesperson stated.

In different phrases, whereas CZ’s name sparked debate, the ultimate lever pull got here from validators. The validators comprise a distributed group balancing community demand, block area provide, and protocol economics.

Not About Rival Chains—It’s About Market Effectivity

Ethereum’s Layer-2 rollups and Solana’s charge benefits didn’t encourage the 90% discount in BSC gasoline charges. As a substitute, altering validator sentiment and consumer expectations drove this determination.

“It’s pushed by group, and a market dynamic of block area. It’s not universally enforced both. Some dApps and platforms nonetheless use increased charge settings,” the spokesperson added.

That caveat, the place gasoline charges are usually not uniformly down throughout instruments and dApps, explains why some customers could not but really feel the influence.

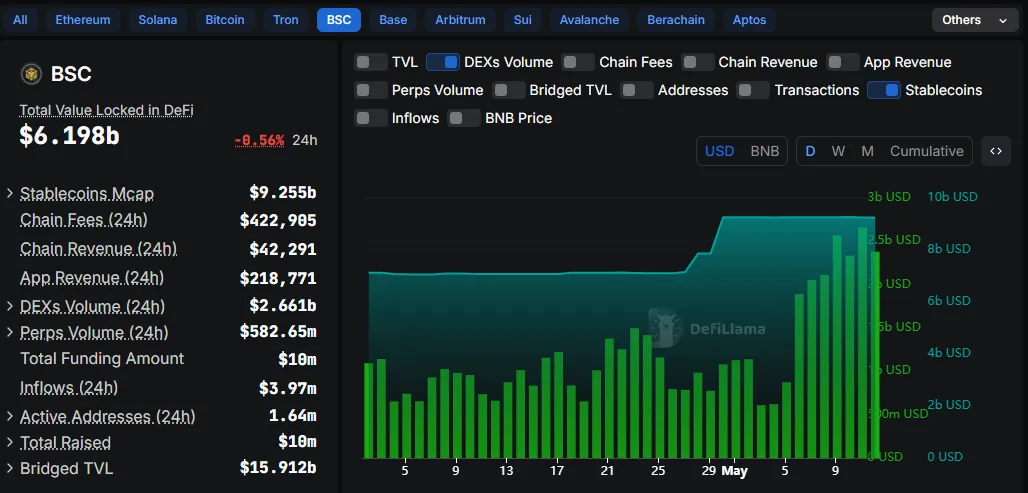

Nonetheless, metrics recommend momentum is constructing. BSC has seen latest spikes in decentralized trade (DEX) buying and selling and stablecoin transfers, impartial of the newest charge change.

BSC + opBNB: Two-Layered, One Imaginative and prescient

Whereas BSC continues to anchor the BNB ecosystem, the true masterstroke lies in its layered structure. opBNB, the community’s high-speed Layer-2, targets 10,000 transactions per second (TPS) and sub-cent prices. It units the stage for BNB Chain to straddle the L1 and L2 battlegrounds.

“The BNB Chain ecosystem is positioning itself not simply as a single aggressive L1, however as a community providing scalable options throughout completely different layers. opBNB lets us compete fiercely within the L2 area for high-volume, low-cost purposes, whereas BSC stays a strong base layer,” the staff instructed BeInCrypto.

This duality, a resilient base and scalable layer, is changing into a regular amongst main chains eyeing mass adoption. In response to the BNB Chain core improvement staff, BNB Chain is absolutely aligned with that thesis.

Sustainable or Short-term? Validators Maintain the Dial

Is 0.1 Gwei sustainable? That relies on community load and validator sentiment. With BSC averaging simply 20% capability utilization, congestion dangers seem low. Nonetheless, in line with the staff, pricing isn’t fastened however is an natural mechanism.

“The pricing is a person market alternative from validators. They need to regulate it in line with ever-changing market circumstances,” the spokesperson stated.

This market-led mannequin could possibly be BNB Chain’s secret weapon—adjustable, scalable, and community-sensitive.

What started as a viral suggestion from Binance’s founder has matured right into a community-coordinated response that displays BNB Chain’s adaptive structure and governance.

With DeFi, stablecoins, and high-volume dApps gaining traction and opBNB poised to supercharge throughput, the 90% charge slash isn’t just about value—it’s about progress.

BNB token was buying and selling for $665.49 as of this writing, up by a modest 1.48% within the final 24 hours.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.