Metaplanet, a Japan-based funding agency, has acquired 1,241 Bitcoin (BTC) for about $126.7 million.

With this newest buy, Metaplanet has surpassed El Salvador in whole Bitcoin holdings, strengthening its place as one of many largest institutional holders of the asset.

In accordance with an organization disclosure issued right now, the agency acquired extra Bitcoin at a median worth of roughly $102,119 (14,848,061 yen) per coin. This brings its whole holdings to six,796 BTC—up from 5,555 BTC simply final week.

Metaplanet, which started buying Bitcoin in April 2024, now holds greater than El Salvador’s nationwide reserves. In accordance with knowledge from El Salvador’s Bitcoin Workplace, the nation, a distinguished state-level adopter since 2021, has 6,174 BTC, trailing Metaplanet by 622 BTC.

“Metaplanet now holds extra Bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re simply getting began,” Metaplanet CEO Simon Gerovich wrote in a submit.

In one other submit on X (previously Twitter), Gerovich highlighted the corporate’s rising dedication to Bitcoin, revealing a cumulative funding of roughly $608.2 million. On the present BTC worth of $104,003, Metaplanet’s holdings are actually price round $706.8 million, representing a 16.2% unrealized revenue.

Furthermore, the agency has achieved a BTC Yield of 170.0% year-to-date (YTD) in 2025, a metric that tracks the expansion in Bitcoin holdings per totally diluted share. For the present quarter alone—April 1 to Could 12, 2025—the BTC Yield stands at 38.0%, reflecting continued shareholder worth creation by way of its treasury technique.

The corporate’s inventory can also be benefiting from its Bitcoin pivot. Following right now’s announcement, Metaplanet shares (3350.T) rose 3.8% in Monday buying and selling.

Moreover, BeInCrypto reported that the inventory’s worth has surged 15x because it started accumulating BTC. This signaled investor confidence within the agency’s Bitcoin-focused technique.

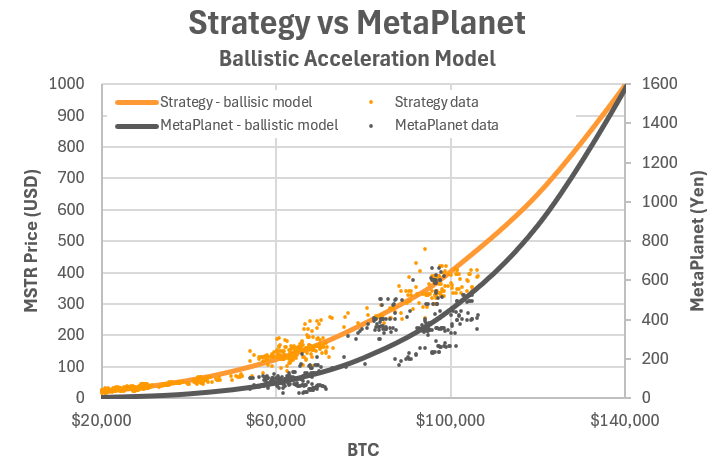

Metaplanet’s strategy mirrors that of US-based Technique (previously MicroStrategy)—a primary mover in company Bitcoin accumulation. Nonetheless, an analyst just lately advised that Metaplanet could supply even larger upside relative to Bitcoin’s worth progress.

In a ballistic acceleration mannequin, the analyst projected that at a $120,000 BTC worth, Metaplanet inventory may double (2.0x), whereas Technique’s may rise 1.6x. At $150,000, Metaplanet may see a 4.5x surge in comparison with Technique’s 3.0x acquire.

Because the analyst described, this “uneven upside” highlights how Metaplanet—nonetheless within the early phases of its Bitcoin technique—may ship outsized fairness returns relative to its threat, positioning itself as a high-beta proxy for Bitcoin publicity.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.