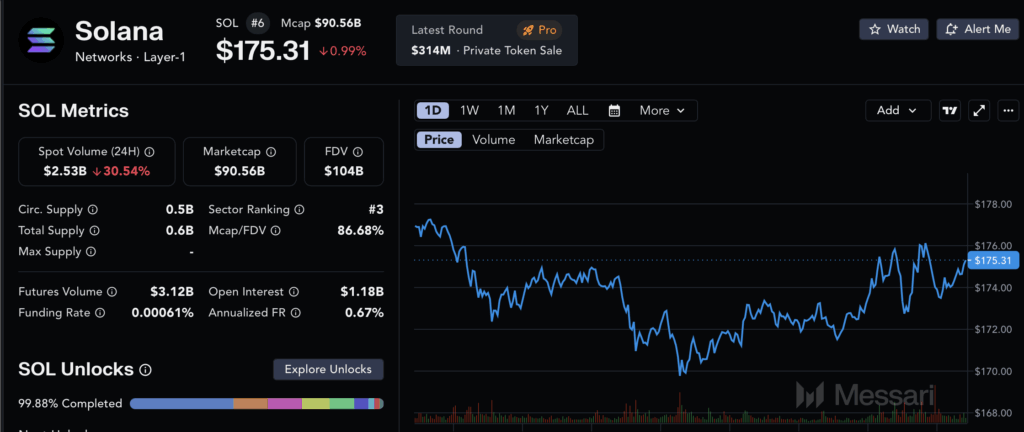

- Solana Soars 56% Amid Market Rally: Solana (SOL) jumped 56% previously 30 days, driving the broader crypto market rally fueled by a serious U.S.-UK commerce deal and Bitcoin’s surge previous $101,000.

- Potential Targets – $150 or $200?: Whereas SOL is eyeing $200, which aligns with the 0.382 Fibonacci retracement degree, a noticeable hole between transferring averages and RSI suggests potential consolidation or a pullback to $150.

- Key Ranges to Watch: If SOL maintains momentum, the following upside goal is $190, but when patrons fail to carry present ranges, a dip to $150 might present a reset earlier than the following large transfer.

The primary 4 months of the 12 months had been tough for U.S. markets, particularly crypto. However final week, issues took a pointy flip. Solana (SOL) was one of many largest winners, leaping 56% because the market rallied. Now, with SOL eyeing $200, the query is — can it maintain climbing?

Market Enhance from U.S.-UK Commerce Deal

Thursday introduced some much-needed optimism. The U.S. and UK introduced a serious commerce deal, easing some geopolitical stress. Bitcoin received a ton of consideration for blasting previous $101,000, however Solana was proper there with it, driving the wave and racking up spectacular positive factors.

In keeping with CoinMarketCap, SOL spiked over 56% in 30 days, pushing it nearer to the $200 mark. And that degree isn’t only a random quantity — it aligns with the 0.382 Fibonacci retracement degree, making it a key goal for bulls.

Solana’s Present Place — $150 or $200?

Solana kicked off the 12 months as one of the vital hyped belongings within the crypto area, aiming to affix the ranks of Bitcoin and Ethereum as a top-tier funding. Now, with the current rally, it’s at a vital juncture.

One analyst means that if SOL can maintain the momentum going, the following goal is $190, simply shy of $200. However there’s a catch. There’s nonetheless a noticeable hole between Solana’s transferring averages and the Relative Power Index (RSI). That hole suggests a possible consolidation — or perhaps a correction.

If the rally stalls, a drop to $150 might be on the desk. But when patrons maintain piling in, $200 won’t be too far off. The subsequent few days will probably be key in figuring out which path SOL takes.

What’s Subsequent for Solana?

For now, the market stays optimistic. SOL is buying and selling at a vital degree, and with Bitcoin pushing greater, the broader market sentiment is leaning bullish. Nonetheless, with such a giant hole between key indicators, merchants ought to brace for potential volatility.

If Solana can push by $190, the $200 mark might be subsequent in line. In any other case, a pullback to $150 would possibly give patrons an opportunity to regroup earlier than the following large transfer.