- American Bitcoin Merges with Gryphon, Eyes Nasdaq Itemizing: Trump-backed American Bitcoin will go public underneath the ticker “ABTC” after merging with Gryphon Digital Mining, aiming to broaden Bitcoin mining infrastructure throughout the U.S. whereas scaling its accumulation technique.

- Hut 8 Retains Management as Infrastructure Associate: Regardless of the merger, Hut 8 will preserve its infrastructure and operations function, securing ongoing income streams and retaining 80% fairness within the newly fashioned entity.

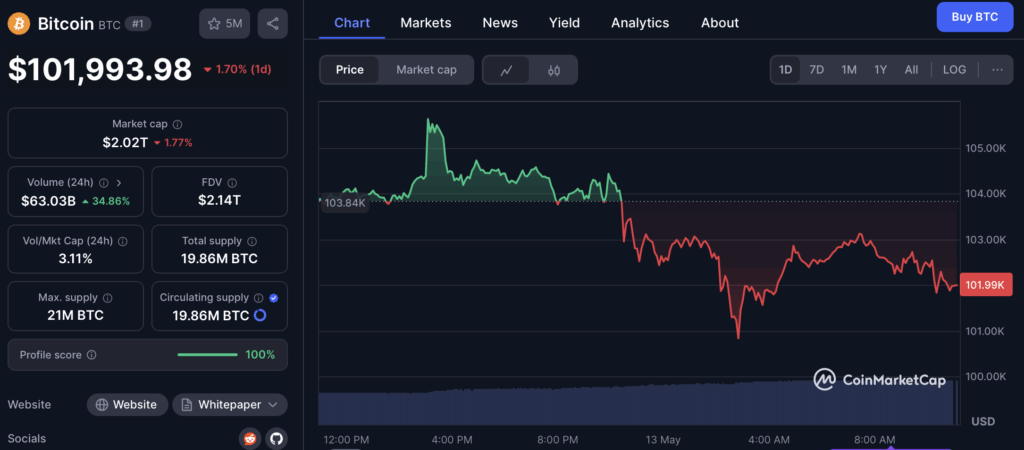

- Bitcoin Faces Revenue-Taking Amid Merger Information: Bitcoin briefly hit $105,800 earlier than pulling again to $101,809 as merchants locked in income, although regular purchase orders at $101K recommend ongoing help regardless of elevated market volatility.

Trump-backed American Bitcoin is taking a giant leap ahead, merging with Nasdaq-listed Gryphon Digital Mining to go public underneath the ticker “ABTC.” The all-stock deal, introduced Monday, goals to supercharge the corporate’s Bitcoin accumulation technique whereas scaling its mining infrastructure throughout the U.S. The merger is slated to shut in Q3 2025, pending regulatory inexperienced lights.

“This transaction marks the subsequent step in scaling American Bitcoin as a purpose-built automobile for low-cost Bitcoin accumulation at scale,” stated Hut 8 CEO Asher Genoot.

Underneath the phrases, American Bitcoin shareholders will maintain onto 98% of the merged entity, with Hut 8 staying within the driver’s seat as the bulk shareholder.

Hut 8 Retains Management as Infrastructure Associate

Even after the merger, Hut 8 will preserve its grip because the unique infrastructure and operations companion for American Bitcoin. The deal secures business agreements that assure ongoing income streams by its energy and digital property divisions.

This isn’t Hut 8’s first transfer to consolidate its place. Again in March, it fashioned American Bitcoin by a merger with American Knowledge Facilities (ADC), a enterprise led by Eric Trump and Donald Trump Jr.

Eric Trump is about to affix the brand new entity’s management workforce, alongside Mike Ho, Justin Mateen, and Michael Broukhim. The mixed operation is advertising and marketing itself as a low-cost Bitcoin accumulator, leveraging public capital markets to gas its development.

What’s Subsequent for American Bitcoin?

The Nasdaq itemizing provides American Bitcoin entry to U.S. capital markets, positioning it as a key participant within the Bitcoin mining and infrastructure area. With Hut 8 holding over 10,000 BTC and retaining 80% fairness within the merged agency, it retains a strong footing within the Bitcoin market whereas minimizing stability sheet publicity.

Bitcoin Worth Motion — Revenue Taking or Only a Pause?

In the meantime, Bitcoin hit an intraday excessive of $105,800 on Binance earlier than pulling again to $101,809 — down 3% on the day. The retreat suggests some profit-taking after final week’s rally, however regular purchase orders across the $101K stage point out underlying help stays robust.

Volatility stays elevated, with structural shifts within the mining sector and recent capital flows including to the combination. Merchants are conserving an in depth watch because the market digests the American Bitcoin merger information and broader macroeconomic alerts