Japanese agency Metaplanet has introduced that it’s issuing $15 million in strange bonds, with funds devoted to buying Bitcoin (BTC).

The choice indicators its intention to double down on its accumulation technique, shrugging off BTC’s newest worth dip from its multi-month excessive of $105,000.

In line with the official disclosure, the bonds carry a 0% rate of interest and are set to mature on November 12. They’re valued at $375,000. Metaplanet’s newest bond issuance goals to push its holdings nearer to its goal of 10,000 Bitcoins by the top of 2025.

If the agency raises the complete $15 million, it might purchase roughly 147 BTC at present costs. This transfer follows its acquisition of 1,241 Bitcoin yesterday, valued at $126.7 million, bringing its whole holdings to six,796 BTC.

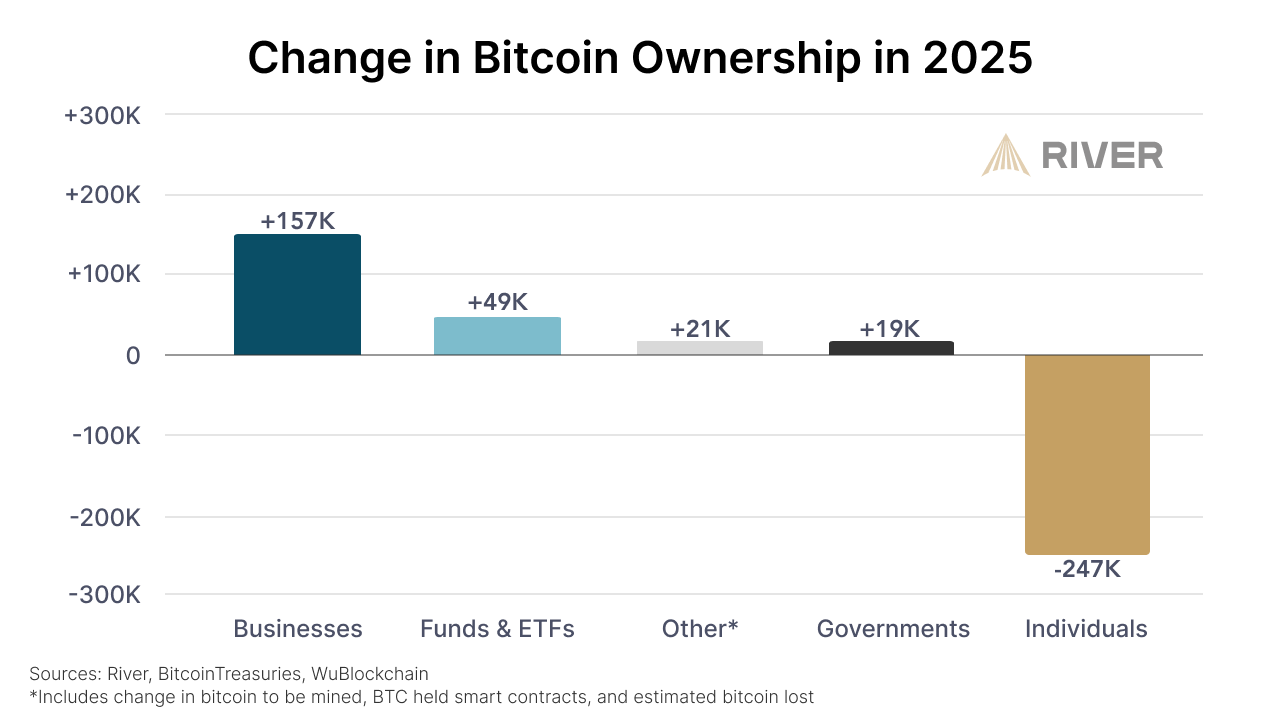

This technique aligns with a broader development in 2025: a shift in Bitcoin possession from particular person buyers to establishments and governments. In line with knowledge from River, companies at the moment are the main patrons of Bitcoin, even outpacing governments and exchange-traded funds (ETFs).

“Companies are the biggest internet purchaser of bitcoin thus far this yr, lead by Technique which makes up 77% of the expansion,” the publish learn.

Technique — beforehand referred to as MicroStrategy — continues to spearhead this development. The corporate disclosed on Might 12 that it had acquired 13,390 BTC for $1.34 billion. The cash had been bought at a mean worth of $99,856 per coin.

This addition elevated Technique’s whole Bitcoin holdings to 568,840 BTC, acquired at a mean price of $69,287 per coin.

Nonetheless, not everybody views this plan as sustainable. Economist and Bitcoin critic Peter Schiff took to X to warning towards the potential fallout.

“You subsequent purchase will possible push your common price above $70,000,” Schiff wrote.

He burdened that if Bitcoin’s worth falls once more, it might dip beneath Technique’s common buy worth for his or her cash. Since Technique borrowed cash to fund these acquisitions, a worth drop might be problematic.

If compelled to promote their holdings to repay debt, the losses would change into “actual” as a substitute of simply theoretical. This magnifies the chance of leveraging Bitcoin, particularly when the market is risky.

This warning comes amid BTC’s newest dip. On Might 12, the value pumped to highs final seen on January 31 after the US and China agreed on a 90-day tariff deal.

However, after peaking at $105,705, Bitcoin tumbled. It shortly shed 3.7% of its good points to commerce at $101,725 at press time. Regardless of this, analysts stay optimistic that the present rally nonetheless has room to develop and will propel BTC to all-time highs.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.