- Trump instructed traders on April 9 it was “a good time to purchase” — the S&P 500 has rallied 14% since.

- He doubled down once more on Might 8 and reiterated at this time that the market “goes to go rather a lot increased.”

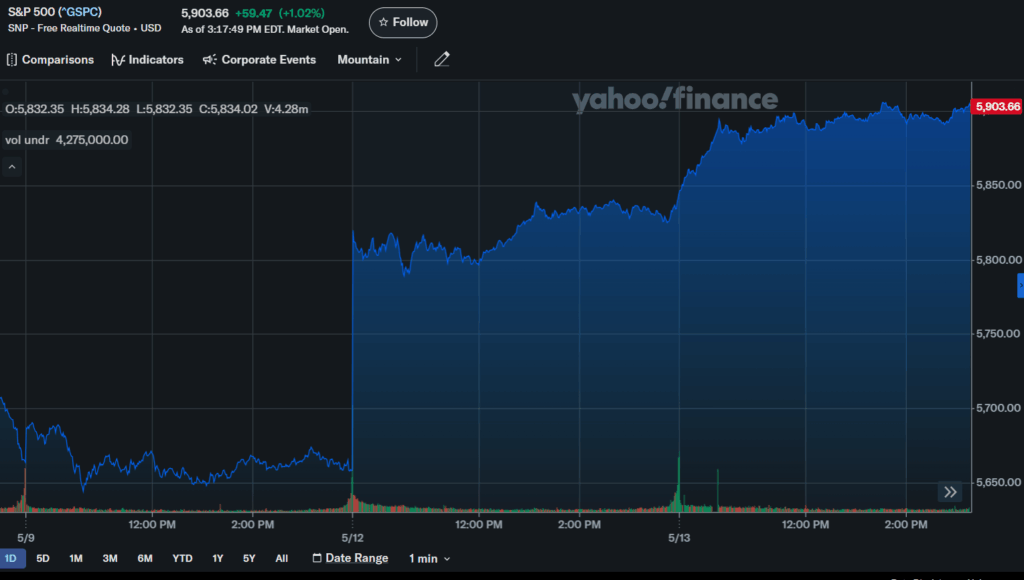

- A 90-day tariff reprieve and easing U.S.-China tensions fueled what analysts are calling the most important Trump-era rally.

President Donald Trump is as soon as once more linking his instincts to market momentum — and this time, he may need nailed the underside. After telling People it was “a good time to purchase” on April 9, the S&P 500 has rallied 14% — its strongest 21-day acquire throughout each of Trump’s phrases, excluding pandemic-era rebounds.

Now, he’s doubling down. Talking earlier at this time, Trump mentioned,

“Rising market will do. Oh, it’s going to get rather a lot increased… I instructed folks 5 weeks in the past. It’s a good time to purchase. I received criticized for that. Now they don’t criticize me anymore… It’s an explosion of funding and jobs and nice firms are coming in. By no means seen something prefer it.”

Market Backside Coincides with Tariff Reprieve

On April 8, the S&P 500 had simply plunged 12% over fears of a worldwide commerce battle after Trump’s “Liberation Day” tariff announcement. The subsequent day, Trump posted that it was a good time to purchase — then paused the harshest commerce levies with a 90-day reprieve.

Markets cherished it. The S&P 500 jumped almost 10% that day, its largest single-day acquire since 2008. Nasdaq futures adopted with a 4.2% rally. Strategists have identified that this habits, harking back to Trump’s first time period, suggests a “Trump put” could also be again in play — markets rising in anticipation of favorable White Home pivots.

The Trump Impact: Tweets, Timing, and Commerce

This isn’t the primary time traders have seen Trump attempt to speak markets into confidence. Throughout his first time period, his tweets typically signaled key strikes: sanctions, tariff threats, or sudden detentes. However what’s uncommon this cycle is the timing — his market calls at the moment are touchdown simply forward of actual coverage modifications.

On Might 8, Trump once more instructed reporters that “it’s time to purchase” — days earlier than a shock U.S.-China announcement that each nations would slash tariffs for 90 days. The S&P and Nasdaq rallied onerous once more, reinforcing the sense that Trump’s feedback are extra than simply noise.

Analysts Warn: Don’t Wager the Farm

Whereas the rally has been explosive, some market watchers are cautious. “It’s clear the Trump put is again in play,” mentioned Arun Sai of Pictet Asset Administration. “However we wouldn’t learn an excessive amount of into it… it’s simply the market pricing in a form of backstop from the White Home.”

Others level out that the 90-day tariff pauses are simply that — momentary. The structural tensions between the U.S. and China haven’t gone away, and markets may reverse if talks break down or inflation reignites.

Conclusion

Whether or not by intuition or technique, Trump’s timing has delivered one of many strongest market rebounds in years. His April and Might calls to “purchase shares” — as soon as mocked — now look prescient. And if at this time’s assertion is to be believed, he’s not executed but. With tariffs paused, China tensions cooling, and investor confidence surging, the Trump rally could have room to run — however as all the time, the ground beneath it stays political.