Bitcoin’s (BTC) climb above $100,000 has strengthened confidence in predictions that it’ll set a brand new all-time excessive (ATH) quickly.

Primarily based on on-chain knowledge, accumulation developments, and market sentiment, there are a number of compelling causes to imagine Bitcoin might attain a brand new peak. This text analyzes 5 key causes supporting that prediction.

5 Causes Driving Bitcoin Towards a New ATH in Might

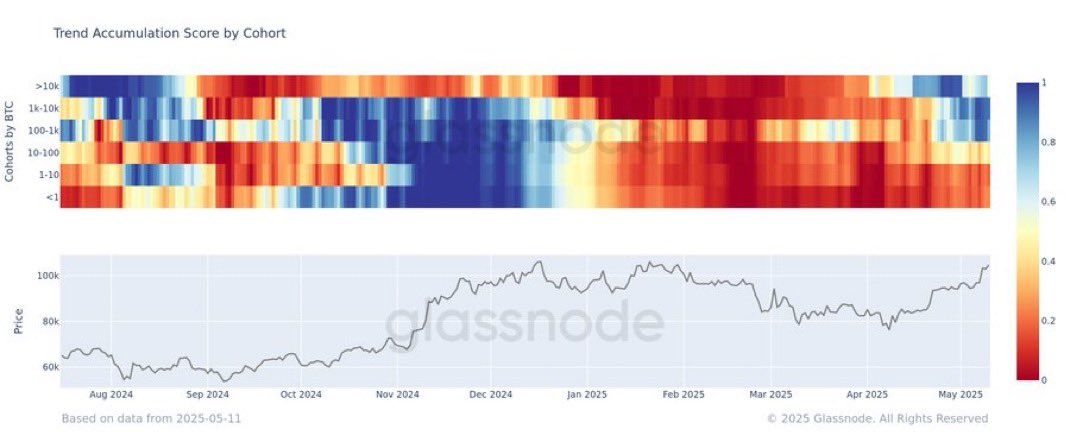

The primary cause is the buildup of whales throughout Might. Knowledge from Glassnode reveals that wallets of all sizes are actively accumulating BTC. Glassnode’s “Pattern Accumulation Rating by Cohort” chart illustrates this pattern.

In early April, accumulation was primarily restricted to giant whale wallets holding over 10,000 BTC. However by Might, the buildup pattern had unfold to smaller wallets holding between 100 and 1,000 BTC. In the meantime, wallets holding lower than 100 BTC additionally confirmed growing accumulation exercise, mirrored within the fading pink colours on the chart all through Might.

Moreover, Santiment experiences that previously 30 days, whale wallets have amassed one other 83,105 BTC. This accumulation has helped flip the Spot Quantity Delta into optimistic territory, giving Bitcoin momentum to push increased.

“The aggressive accumulation from these giant wallets— it could be a matter of time till Bitcoin’s coveted $110,000 all-time excessive stage is breached, significantly after the US & China tariff pause,” Santiment predicted.

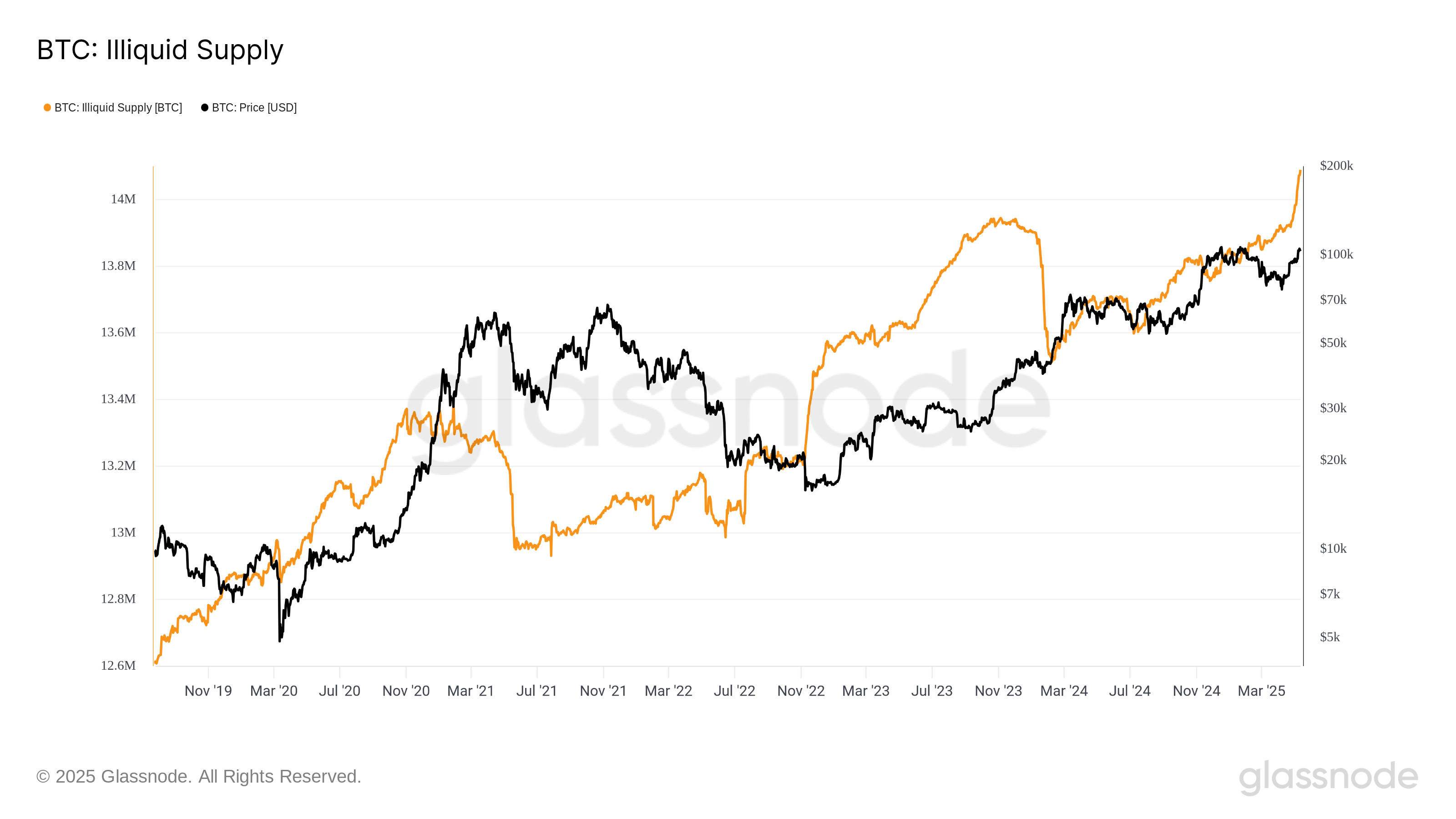

The second cause is that Bitcoin’s illiquid provide has reached a document excessive of 14 million BTC, which is value over $1.4 billion.

The rise in illiquid provide signifies that long-term buyers (HODLers) are holding tightly to their Bitcoin. They don’t have any intention of promoting within the brief time period. Consequently, this reduces the circulating provide, and as demand rises, Bitcoin’s value can get away extra simply.

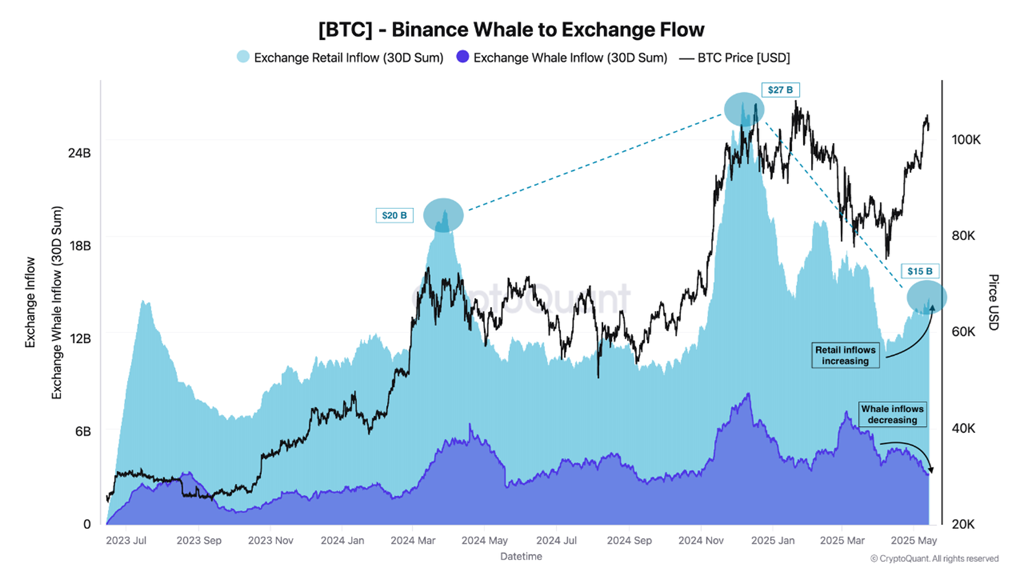

The third cause comes from small buyers. Though a brand new wave of retail buyers has but to emerge absolutely, CryptoQuant experiences that retail buying and selling quantity on Binance—the world’s largest crypto change—has began to rebound after a interval of decline.

Moreover, Carmelo Alemán, an analyst at CryptoQuant, additionally noticed that whereas retail quantity hasn’t spiked but, it has proven optimistic indicators.

“Within the coming months, as retail participation will increase, we will count on to see progress in Energetic Addresses, UTXO Depend, and metrics like New Addresses and Switch Quantity, reflecting the sustained growth of the crypto ecosystem,” Alemán predicted.

The fourth cause analysts are carefully watching is the correlation between Bitcoin’s value and the worldwide M2 cash provide.

In accordance with crypto knowledgeable Colin Talks Crypto, the expansion in M2— a measure of the cash provide from central banks just like the Fed, ECB, and BoJ—has precisely predicted Bitcoin’s rise from $76,000 to $105,000 since April 8. Primarily based on this pattern, Colin forecasts Bitcoin may attain $120,000 in Might.

“Bitcoin continues to be proper on observe with World M2. $120,000+ by the top of Might?” Colin stated.

This correlation isn’t new. Traditionally, Bitcoin tends to learn and rise sharply when international liquidity will increase. Given the present macroeconomic situations, increasing the cash provide might proceed to gasoline Bitcoin’s progress.

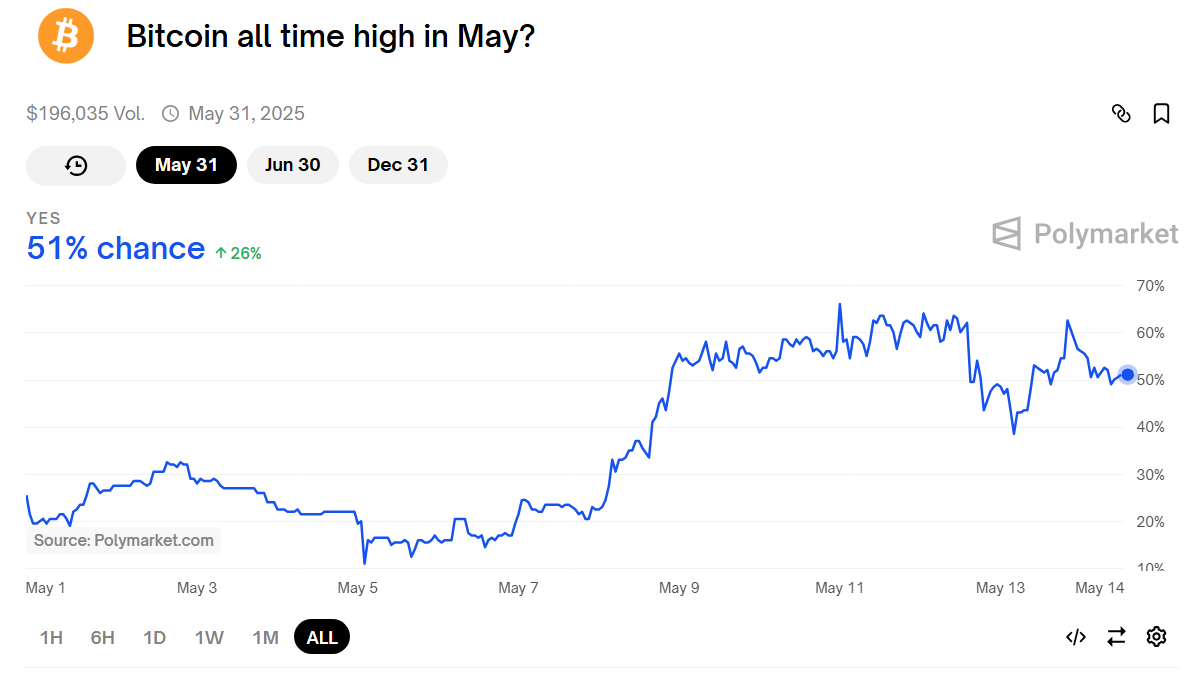

Lastly, prediction market Polymarket reveals that the chance of Bitcoin reaching a brand new ATH in Might has risen from 11% to 60%, at present at 51%. Polymarket permits customers to guess on future occasions, and this shift displays rising optimism locally.

As confidence in Bitcoin’s upward potential grows, it may set off a FOMO (concern of lacking out) impact. This may increasingly entice extra buyers and push costs even increased.

Actually, Bitcoin has already hit new ATHs in nations like Turkey and Argentina, the place native currencies have depreciated sharply. Specialists like billionaire Tim Draper predict Bitcoin will hit $250,000 by the top of 2025. Apart from, Customary Chartered forecasts Bitcoin may attain $120,000 in Q2.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.