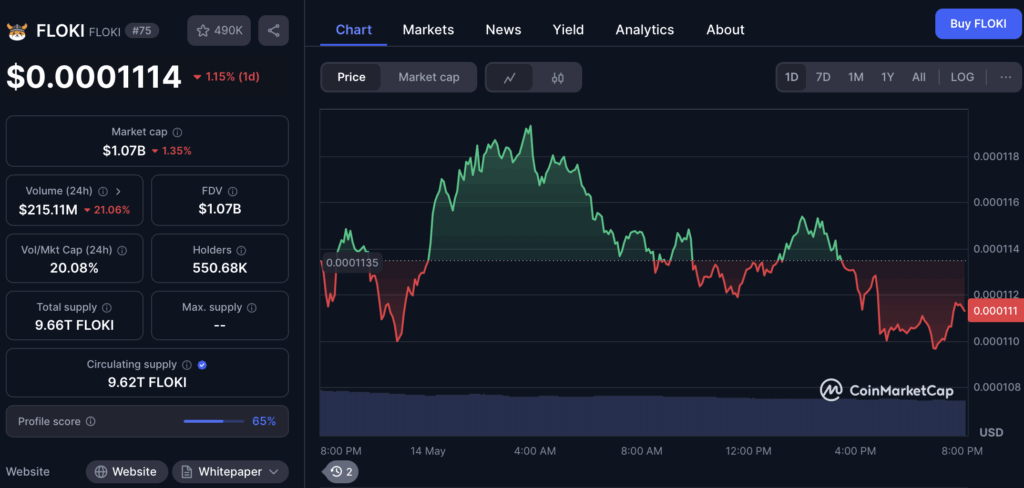

- FLOKI Bounces Again: FLOKI surged 107% in day by day buying and selling quantity in Could, spiking practically 17% to $0.000123 earlier than correcting to $0.000109. Regardless of the short-term pullback, the broader development reveals bullish momentum constructing as FLOKI breaks out of its months-long downtrend.

- Key Ranges and Technicals: The $0.0000695 degree, beforehand a bearish order block, has flipped to a bullish breaker block. Indicators like OBV and CMF sign sturdy shopping for strain, with Fibonacci ranges pointing to a 22% upside goal between $0.000135 and $0.00014.

- Bitcoin’s Influence and Liquidity Zones: FLOKI’s subsequent transfer could hinge on Bitcoin’s efficiency, with the $0.0001 and $0.000092–$0.000095 zones performing as key assist. If these ranges maintain and Bitcoin stays sturdy, FLOKI may prolong its rally towards the $0.00014 goal.

FLOKI’s again within the sport. After months of being caught within the mud, the meme coin surged in Could, catching merchants’ consideration with a 107% soar in day by day buying and selling quantity. At its peak, FLOKI shot up practically 17% to hit $0.000123 however has since pulled again round 10%, now hovering close to $0.000109. However regardless of the rollercoaster journey, the larger image reveals momentum is constructing, and key technical zones are coming into play.

Breaking the Downtrend – FLOKI Reverses Course

FLOKI had been caught in a transparent downtrend since mid-December 2024. That modified in April when it blasted by the $0.0000695 degree, flipping what was as soon as a bearish order block right into a bullish breaker block. That transfer? It’s a traditional signal of a possible reversal and will set the stage for extra upside.

Technicals Paint a Bullish Image

The indications are backing up the bullish case. On-Steadiness Quantity (OBV) has popped above its February highs – a degree it couldn’t break in April. That’s an indication of sturdy shopping for strain. In the meantime, the Chaikin Cash Move (CMF) is solidly in optimistic territory at +0.05, signaling constant capital inflows.

Fibonacci retracement ranges are additionally pointing to potential targets. The subsequent large one? The 61.8% retracement zone between $0.000135 and $0.00014. If FLOKI can maintain its present momentum, there’s a 22% upside from present ranges. Bulls are undoubtedly eyeing that zone.

Liquidity Zones to Watch

However it gained’t be a straight shot to increased costs. Current liquidity knowledge reveals that the $0.000107 area has been a hotbed for liquidation exercise, with a ton of positions getting worn out over the past three months. That’s partly why we noticed the current surge and pullback.

A have a look at the 1-week liquidation heatmap reveals extra hassle spots – the $0.0001 mark and the $0.000092–$0.000095 vary are filled with liquidation clusters. If worth dips again into these zones, it may shake out some weak arms earlier than making one other transfer increased.

The Bitcoin Impact – FLOKI’s Destiny Tied to BTC

Let’s not overlook the elephant within the room – Bitcoin. FLOKI’s subsequent transfer is probably going tied to what BTC does subsequent. If Bitcoin retains climbing, it may give FLOKI the gas to push towards that $0.00014 goal. But when Bitcoin stumbles, FLOKI may get dragged down with it, particularly if confidence throughout the crypto market takes a success.

The Backside Line – Is FLOKI Able to Fly?

For now, the important thing assist zones to look at are $0.0001 and $0.000092–$0.000095. If these ranges maintain and the bullish construction stays intact, FLOKI might be gearing up for one more 22% run to the $0.000135–$0.00014 vary. However with liquidity clusters looming and Bitcoin performing as a wild card, merchants ought to keep nimble – as a result of within the wild world of crypto, something can occur subsequent.