Welcome to the US Crypto Information Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso to grasp why the share value of Cantor Fairness Companions Inc. (CEP) is seeing draw back stress whereas the share value of Technique’s inventory (MSTR) is rising. CEP is the corporate behind 21 Capital, a newly established agency imitating Technique’s Bitcoin mannequin.

Crypto Information of the Day: Max Keiser Points 21 Capital Warning as CEP Shares Sink

Twenty One Capital’s ambitions to grow to be the subsequent main company Bitcoin participant are beneath fireplace. The share value of its holding firm, Cantor Fairness Companions Inc., is bearing the brunt of overhead stress.

The CEP inventory value is down by over 6% within the final 5 buying and selling days. In the meantime, the share value of its market rival, Technique (previously MicroStrategy), is up by over 7%.

It comes barely three weeks after CEP’s Twenty One Capital launched, following a $3 billion funding from Tether, Softbank, Bitfinex, and Cantor Fitzgerald.

Headed by James Mallers, Twenty One Capital offered as Technique’s inadvertent market rival, or peer. It launched BTC-native metrics like Bitcoin Per Share (BPS), successfully difficult Technique’s mannequin, the place buyers have oblique publicity to Bitcoin by MSTR inventory.

In a latest US Crypto Information publication, Bitcoin pioneer Max Keiser stated establishments should “Saylorize” or die. Nonetheless, regardless of Twenty One Capital extending the “Saylorization” pattern, the CEP inventory value continues to endure downward stress whereas Technique’s inventory value is gaining.

In opposition to this backdrop, buyers hoped that hype round Cantor Fairness Companions Inc.’s deliberate SPAC merger might reverse the pattern, however this seems to be false hope. Notably, the merger would see CEP inventory listed beneath the brand new ticker XXI.

“Cantor Fairness Companions (CEP) introduced a merger with bitcoin treasury firm Twenty One Capital in a $3.6 billion merger,” reviews indicated.

The announcement propelled shares of the SPAC automobile, Cantor Fairness Companions (CEP), sharply larger, however now momentum is fading.

Traders who hoped for a post-merger rally have watched the inventory drift downward towards the mid-$20s over the previous 5 days.

BeInCrypto contacted Max Keiser for insights into why that is taking place, with the Bitcoin maxi blaming it on Twenty One Capital’s mannequin mimicking Technique.

Mimicking Technique Might Be Detrimental, Max Keiser Says

In accordance with Max Keiser, Twenty One Capital’s try and mimic Technique might show far riskier and fewer efficient.

“There’s an enormous distinction between an organization with a Bitcoin treasury technique and a Bitcoin technique firm,” Keiser advised BeInCrypto.

Keiser says Technique is leveraging its heft as an organization with a lot of Bitcoin, harnessing volatility to purchase extra BTC. Nevertheless, Cantor Fairness Companions Inc. or Twenty One Capital doesn’t meet that normal.

“CEP is an organization that’s seeking to purchase a lot of Bitcoin, which may be very unstable. I query if they will successfully harness that volatility like Technique does,” he added.

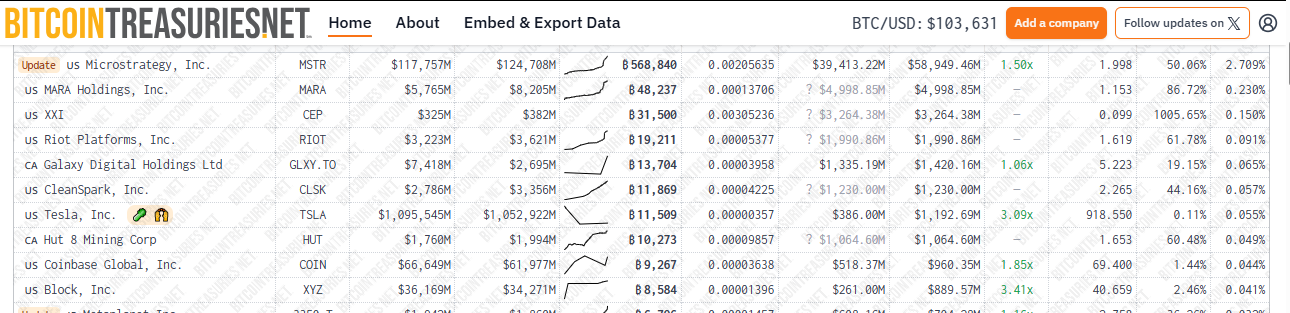

Twenty One Capital is the third-largest company Bitcoin holder after Technique and Bitcoin mining agency MARA Holdings. Knowledge on Bitcoin Treasuries reveals Technique holds 568,840 BTC, whereas MARA holds 48,237 Bitcoin tokens.

In the meantime, after Tether acquired 4,812.2 Bitcoin (now held in an escrow pockets as Twenty One Capital prepares to finish a SPAC merger with Cantor Fairness Companions), Twenty One Capital holds 36,312 Bitcoin tokens.

Within the interview with BeInCrypto, Keiser articulated that attempting to repeat Technique’s mannequin with out the infrastructure, self-discipline, or scale places 21 Capital in a precarious place.

“A Bitcoin technique firm is inherently riskier, with no clear path to be as aggressive as Technique in leveraging market volatility to seize extra Bitcoin,” he acknowledged.

Additional, regardless of the surge in curiosity from buyers hoping to leap on what gave the impression to be the “subsequent large BTC play, Keiser believes the long-term winner is already clear.

“Finally, the large winner will proceed to be Technique, with dozens of knock-offs attempting to catch them, failing to generate the identical returns, however rising demand for Bitcoin considerably. That finally ends up benefiting STRATEGY proportionately greater than the knock-offs, with much less danger,” he concluded.

This aligns with a sentiment from Steven Lubka, the Head of Swan Non-public Wealth. As BeInCrypto famous in one of many US Crypto Information publications, Lubka stated the inadvertent competitors between Twenty One Capital and Technique will finally bode nicely for Technique.

“Paradoxically, somebody throwing the gauntlet at Microstrategy, ‘we need to grow to be essentially the most profitable firm in Bitcoin, ‘ Solely makes Microstrategy extra useful,” Lubka remarked.

Charts of the Day

This chart reveals Technique Inc.’s inventory value rose by $28.61 or 7.28% over the previous 5 days, closing at $421.61 on Might 14.

This chart reveals a 5-day decline in Cantor Fairness Companions Inc.’s inventory value, down by 6.22% since Might 7. CEP closed at $29.84 on Tuesday and is making an attempt a slight pre-market restoration.

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to comply with in the present day:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of Might 13 | Pre-Market Overview |

| Technique (MSTR) | $421.61 | $418.65 (-0.70%) |

| Coinbase World (COIN) | $256.90 | $258.33 (+0.56%) |

| Galaxy Digital Holdings (GLXY.TO) | $29.39 | $30.43 (+3.52%) |

| MARA Holdings (MARA) | $16.37 | $16.32 (-0.31%) |

| Riot Platforms (RIOT) | $9.06 | $9.04 (-0.23%) |

| Core Scientific (CORZ) | $10.24 | $10.30 (+0.59%) |

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.