- First Plutus V3 dApp on Cardano – VyFinance is getting ready to ship the community’s inaugural Plutus V3 contract, setting a brand new technical benchmark.

- Secure Swap (true on-chain OTC) – peer-to-peer swaps that skip liquidity swimming pools, trimming slippage and payment drag.

- Customizable, widget-based UI – merchants can construct dashboards that floor precisely the information they care about.

VyFinance (ticker VYFI) is a Cardano-native DeFi suite that already provides an AMM DEX, neural-net yield aggregation, and NFT-gated vaults. Its acknowledged mission is to make advanced yield methods as simple as a single click on whereas conserving custody within the consumer’s pockets. The protocol’s subsequent milestone—the V3 DEX improve—folds these current items right into a cleaner interface and layers on a handful of latest toys designed for merchants who stay on-chain.

Upcoming V3 Characteristic Pack

After practically a 12 months within the code mines, the VyFi crew is rolling out the next (all gadgets are queued for main-net launch):

After the brief intro paragraph beneath, each heading retains the precise bullet construction you requested for.

This launch consists of a number of user-facing updates alongside the preliminary Secure Swap (OTC) launch. A deep-dive on validator logic will comply with as soon as it’s stay.

Customizable Dashboard

Create your ideally suited DeFi cockpit with modular widgets.

- Widgets — combine, match, and rearrange the instruments you want:

- Add Liquidity — prep orders quick

- CNT Showcase — pin your favourite Cardano tokens

- Governance — comply with proposals with out leaving the display screen

- Pool & Consumer Orders — real-time exercise

- Commerce — instantaneous swap panel

- Your Positions — top-down view of belongings

- Prime Quantity Swimming pools — right this moment’s scorching pairs

- Pool Tracker — watch lists

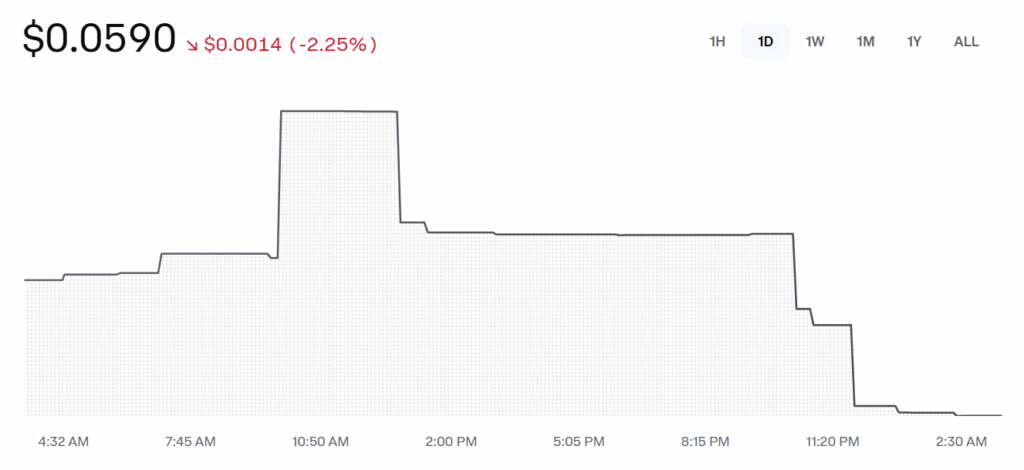

- Chart — value motion in-line

- Information — VyFi bulletins

- Bar Lottery — OG nostalgia nook

- Web Value — pockets snapshot

- Holdings — pie-chart view

- Lottery — jackpot tracker

- Bar — redistribution stats

- Farms — harvest panel

- Prime Vaults — greatest performers

- Swimming pools — basic listing view

- Market Depth Chart — stay order guide heatmap

Three default dashboards (House, Portfolio, Commerce) are all the time one click on away and absolutely tweakable.

New Pages & Options

- Portfolio Web page — native PnL and place monitoring

- Market Web page — chain-wide token screener

- Shareable Dashboards — export your format

- PnL Estimation — LP well being examine

- Tradable Charts

- Commerce-Historical past Dots — each fill, plotted

- Commerce-On-Chart — click on to create an order

- Restrict Orders — dotted-line previews

Secure Swap (OTC Buying and selling, Redefined)

- On-Chain OTC — no third-party escrow

- Public or Personal — drop a hyperlink or preserve it hush

- CNT-to-CNT — any Cardano token pair

- Mass Distribution — airdrop at scale with one tx

- Bulk Import — CSV add for giant lists

- Customized Charge Break up — sender pays, receiver pays, or break up

- TX Cart — batch a number of actions into one submission

Consumer-Interface Upgrades

- DEX Web page overhaul – cleaner tables, richer pair information

- Vaults, Governance, and Footer redesigns

- Smoother modal animations plus mobile-first tweaks

- Constant colours, tooltips, and rounded corners

Backend & Efficiency Highlights

- First V3 validator hitting Cardano main-net

- Explorer integration for simpler traceability

- Sooner information fetches and trimmed tx charges when bundling actions (Secure Swaps first)

That is solely the floor—dozens of minor fixes ship with the identical push.

Why the Market Cares

- Cheaper, sooner trades – Plutus V3 scripting slashes reminiscence and CPU prices, slicing charges for end-users whereas eradicating friction that retains many swing-traders on centralized exchanges.

- True OTC on-chain – Secure Swap plugs a long-standing gap in Cardano DeFi: massive holders can now negotiate privately, settle trustlessly, and keep away from pool slippage—all whereas staying seen to explorers for auditability.

- Dashboard modularity – Energy customers don’t desire a one-size-fits-all interface. By letting merchants pin solely what issues to them, VyFi reduces cognitive load and retains engagement excessive—metrics that are likely to correlate with TVL progress.

- Sticky token economics – Each batched swap and each farm interplay runs by way of VyFi’s payment engine. Extra quantity equals extra buy-pressure on the VYFI token and richer vault rewards, a suggestions loop that would tighten provide simply as Cardano liquidity is broadening.

- First-mover benefit – Being first with a Plutus V3 product provides VyFinance bragging rights and a technical moat. If the improve works as marketed, different dApps could combine VyFi’s validator or at the least benchmark in opposition to it—funneling dev mindshare towards the ecosystem.

Our take: We’ve been round since SundaeSwap launch week, and payment drag has all the time scared off high-frequency methods on Cardano. If these enhancements slice even 30 – 40 % off the price of a multi-hop commerce, refined bots will comply with the spark. Extra bots imply tighter spreads, higher depth, and a more healthy DEX general. That’s the form of flywheel buyers dream about.

Ultimate Ideas

VyFinance isn’t simply patching the roof—it’s switching out the inspiration for one thing sturdier, sooner, and extra user-friendly. With Plutus V3 good contracts below the hood and a dashboard that behaves extra like a Bloomberg terminal than a hobbyist web-app, the upcoming V3 launch places VyFi on a collision course with severe liquidity. If execution matches the roadmap, calling the replace “bullish” may be an understatement.