Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

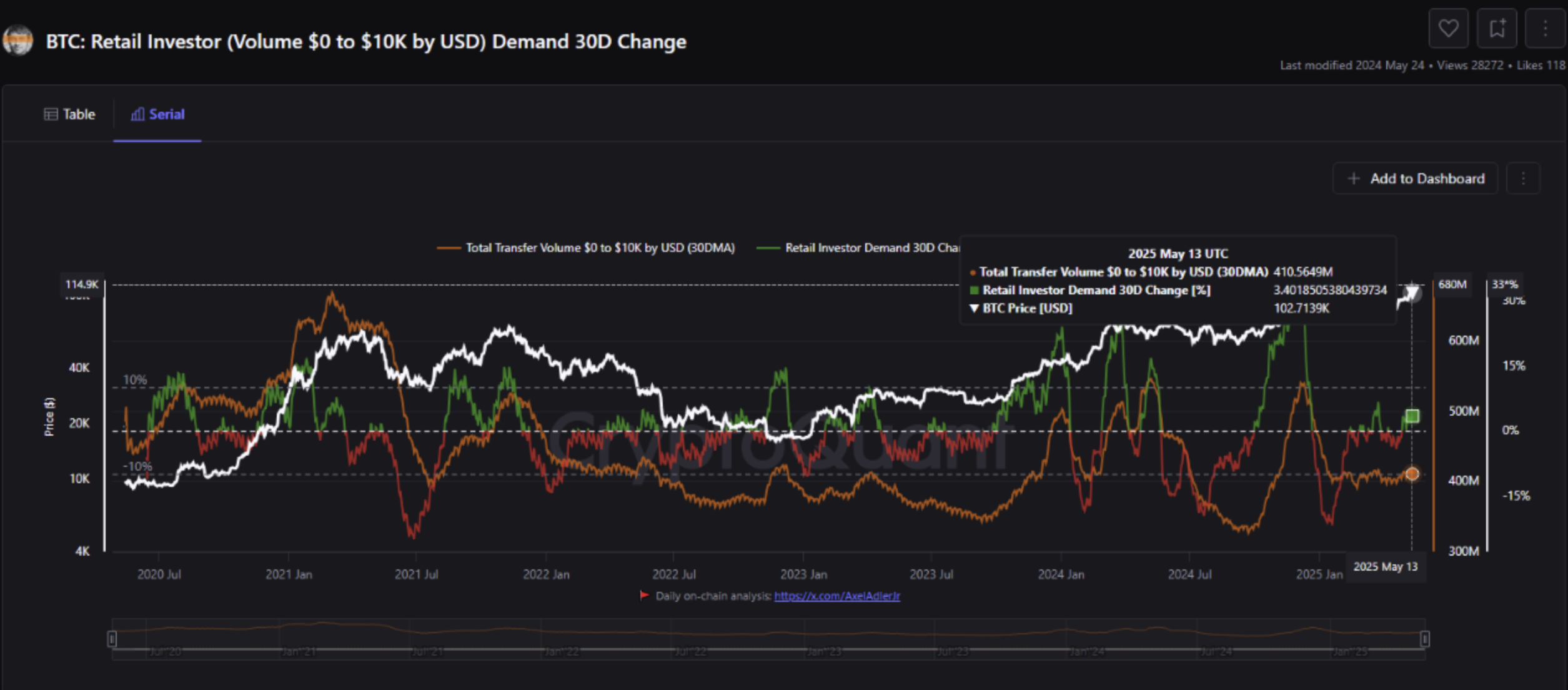

Retail participation within the Bitcoin (BTC) market is on the rise, as on-chain information signifies that smaller buyers are progressively re-entering the house. This renewed exercise is commonly an indication of rising confidence within the asset and might act as a catalyst for the following leg up in worth.

Bitcoin Witnesses Rise In Retail Participation

In keeping with a current CryptoQuant Quicktake publish by on-chain analyst Carmelo Aleman, retail buyers – outlined as wallets holding lower than $10,000 price of BTC – are steadily returning to the market. These contributors are sometimes probably the most reactive to market actions.

Associated Studying

Aleman famous that whereas retail buyers could not at all times time the market as successfully as institutional gamers, their conduct stays a key barometer of broader market sentiment. As extra retail buyers be part of, they have a tendency to create a optimistic suggestions loop, reinforcing bullish narratives and driving elevated shopping for stress, which might appeal to much more contributors.

The BTC: Retail Investor 30-Day Change indicator displays this development. Since turning optimistic on April 28, the indicator has proven a 3.4% enhance in retail shopping for by Could 13, signalling a powerful resurgence in small-investor exercise.

Aleman added that if Bitcoin maintains its upward momentum, the broader crypto market may benefit, as retail buyers could start diversifying into different property looking for greater returns. He wrote:

This might profit the whole crypto house, as small buyers are prone to diversify into different tasks, together with DeFi, staking, futures, and different devices. All indicators level to this shift in retail conduct being the beginning of a brand new wave of mass adoption within the cryptocurrency market.

Aleman additionally emphasised monitoring different on-chain indicators comparable to lively addresses, unspent transaction output (UTXO) depend, new addresses, and switch quantity, which regularly rise in tandem with rising retail exercise.

A Few Warning Indicators For BTC

Whereas rising retail curiosity is encouraging, a couple of pink flags recommend warning. Notably, the Change Stablecoins Ratio (USD) lately surged to five.3 throughout Bitcoin’s rally to $104,000. This means that BTC reserves on exchanges now exceed stablecoin balances – a sign that promoting stress could possibly be constructing.

Associated Studying

In keeping with CryptoQuant contributor EgyHash, a studying above 5.0 is traditionally important. An identical spike to six.1 in January was adopted by a pointy worth correction, indicating that buyers could also be rotating from BTC again into money.

Regardless of some cautionary indicators, Bitcoin continues to exhibit bullish momentum. The Stochastic RSI is displaying renewed power, and different technical indicators recommend the rally might proceed. At press time, BTC trades at $103,993, up 0.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and Tradingview.com