BTCS, a blockchain infrastructure expertise agency, introduced that it plans to amass $57.8 million value of Ethereum (ETH). It intends to leverage its elevated ETH holdings to increase its node deployment, increase staking rewards, and optimize block manufacturing economics.

The corporate seeks to boost the required funds for this buy by issuing convertible notes beneath an settlement with funding supervisor ATW Companions.

BTCS Makes Daring $57.8 Million Ethereum Wager

Within the newest press launch, BTCS revealed that it had issued the primary batch (or tranche) of convertible notes value $7.8 million. There may be additionally scope for issuing extra notes as much as an extra $50 million.

Nonetheless, this requires mutual approval from BTCS and ATW Companions. The notes are convertible into frequent inventory at a worth of $5.85 per share, a 194% premium to BTCS’s inventory worth of $1.99 on Might 13.

They’ve a two-year maturity, with a 5% low cost on the unique difficulty and a 6% annual rate of interest. Buyers additionally obtained warrants for the acquisition of almost 1.9 million shares of frequent inventory at $2.75 per share.

BTCS CEO Charles Allen contributed $95,000 to the preliminary providing, with an extra $200,000 offered by a belief from which he advantages.

“Just like how MicroStrategy leveraged its stability sheet to build up Bitcoin, we’re executing a disciplined technique to extend our Ethereum publicity and drive recurring income via staking and our block constructing operations—whereas positioning BTCS for significant appreciation ought to ETH proceed to rise in worth,” Allen mentioned.

He believes this determination to amass ETH comes at an important second within the altcoin’s progress. BeInCrypto reported that the latest Pectra improve implementation boosted the Ethereum community, catalyzing a rise within the variety of lively addresses and the burn price.

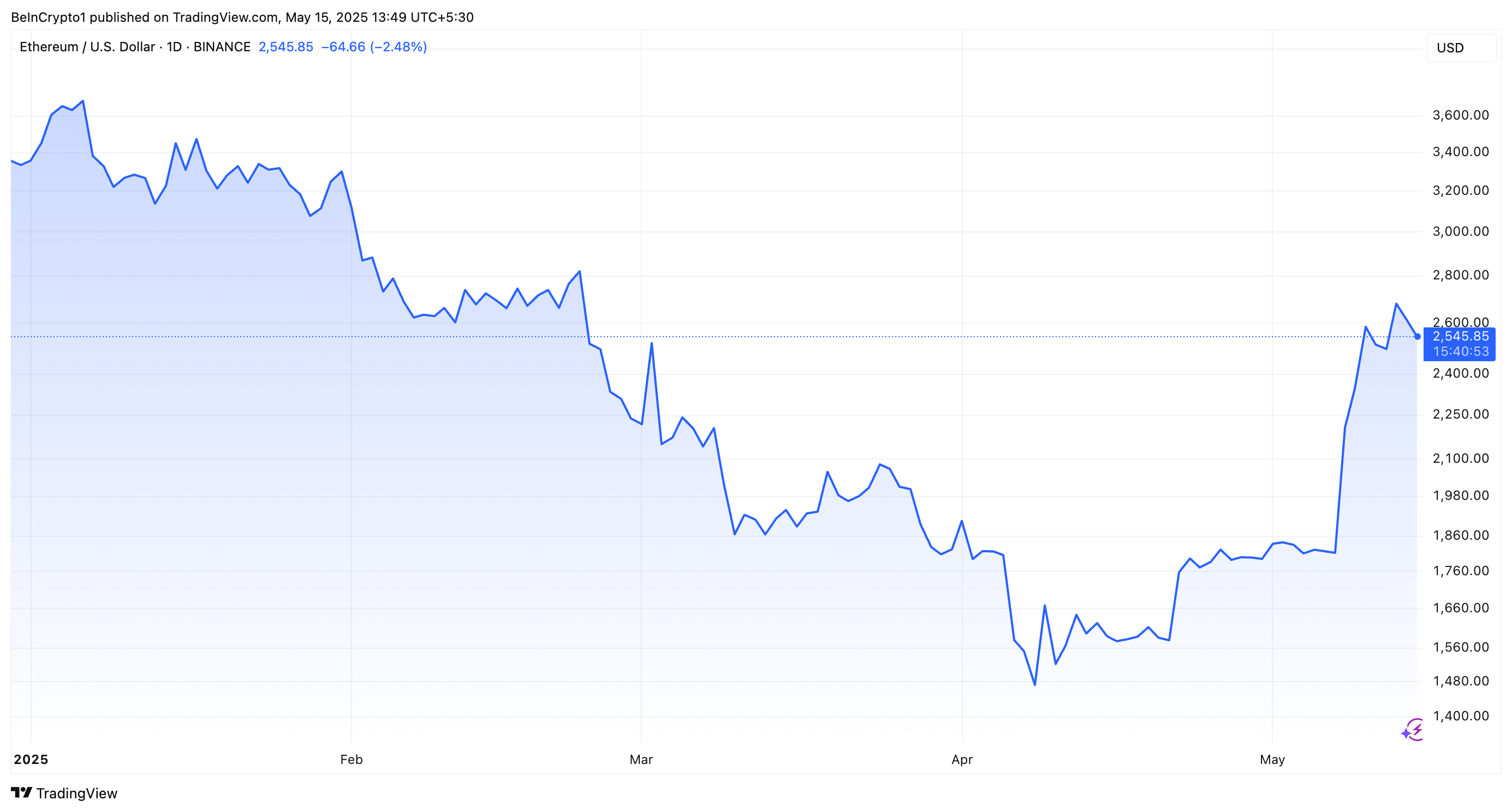

Furthermore, the worth additionally jumped to two-month highs, however a modest correction adopted. In response to BeInCrypto knowledge, over the previous day, ETH has dipped by 3.8%. On the time of writing, it traded at $2,545.

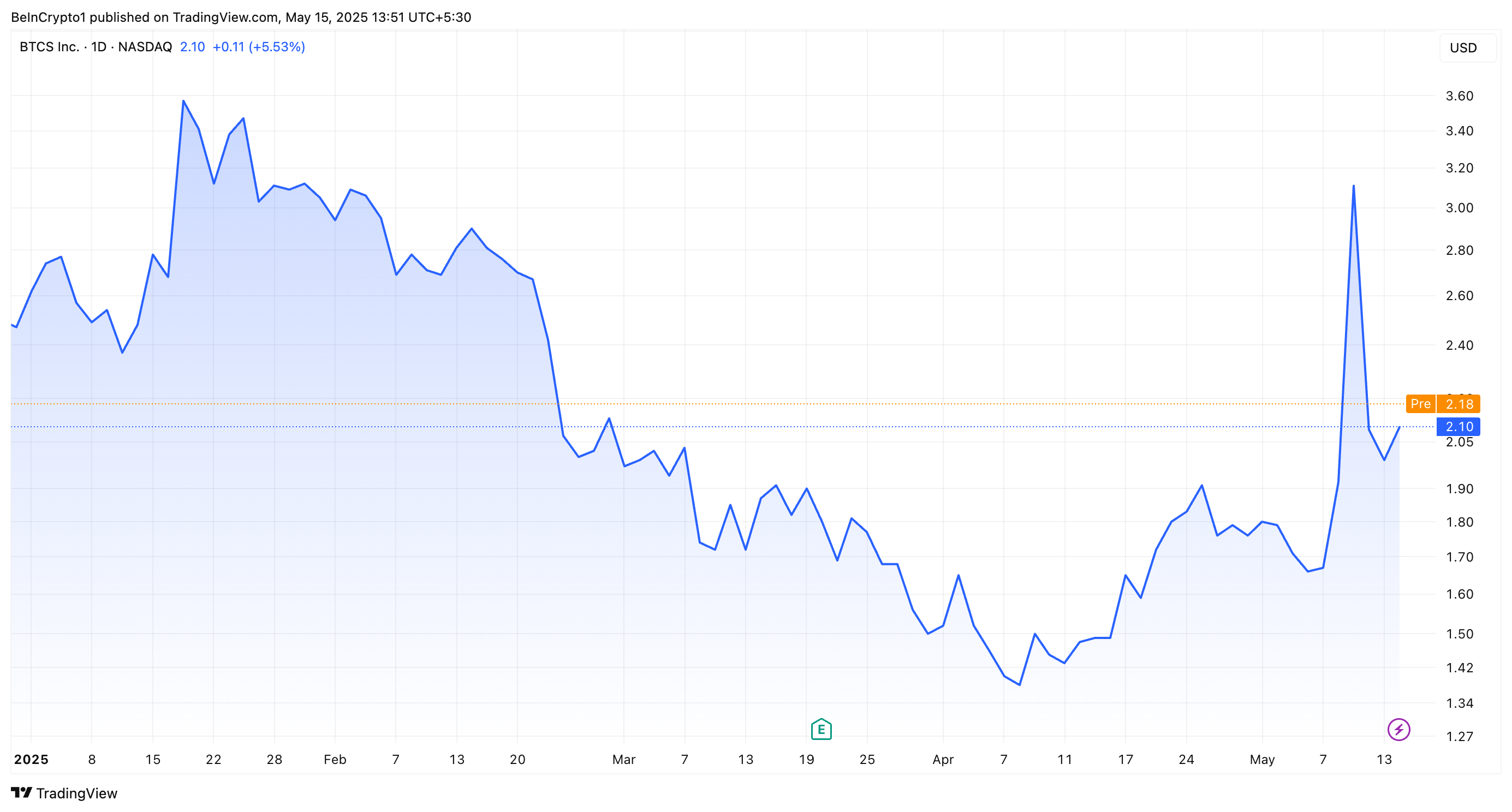

Whereas Ethereum didn’t profit from BTCS’ information, its personal inventory did. This mirrored investor confidence within the firm’s strategic pivot.

Google Finance knowledge confirmed that the inventory worth jumped 5.5%. Nevertheless, year-to-date, its worth has declined by 14.9%.

In the meantime, the announcement comes amid a broader pattern of publicly traded corporations diversifying their stability sheets with digital property. Nevertheless, BTCS’s strategy positions it as a contrarian participant within the area, diverging from the Bitcoin (BTC)-focused methods adopted by corporations like Technique (previously MicroStrategy), Metaplanet, and 21 Capital.

Whereas these corporations have benefited from BTC holdings, BTCS’s initiative, if profitable, might affect different corporations to discover different digital property past Bitcoin. This might doubtlessly reshape company treasury methods.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.