Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin’s value motion up to now 24 hours has seen it slowly retracing from the $104,000 zone it began the week at. This vary has turn into notably vital as Bitcoin continues to flirt with ranges final seen throughout its latest push towards new all-time highs. Bitcoin’s value actions over the previous two days have tightened, and the candlestick habits on the weekly chart has led to a doji formation on the weekly candlestick timeframe, an indicator of indecision.

Apparently, a technical evaluation from crypto analyst Tony “The Bull” Severino has highlighted essential ranges to look at that may decide whether or not the Bitcoin value is turning bearish or nonetheless bullish.

Combined Alerts: Why the Present Resistance Zone Is Important

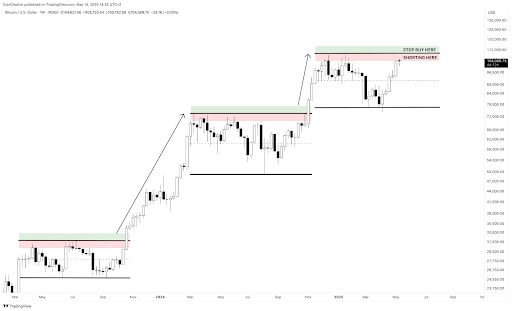

Crypto analyst Tony “The Bull” Severino shared a chart and in-depth breakdown on the social media platform X, pointing to horizontal assist and resistance ranges as crucial technical indicators in his view. As proven on his Bitcoin weekly chart, the main cryptocurrency is now urgent towards a well-defined resistance zone slightly below its all-time excessive, marked clearly in pink. The proximity of this degree to its all-time excessive means it might act as a ceiling, making it an necessary space to look at for both a breakout or a reversal.

Associated Studying

Tony outlines three doable interpretations for the present market construction across the $108,000 resistance degree. The bullish case hinges on Bitcoin consolidating beneath resistance, a sample typically adopted by upward continuation. The impartial case is that Bitcoin may very well be forming a broad buying and selling vary, wherein case it is smart to brief the market at resistance whereas shopping for close to assist. On the bearish aspect, the presence of a doji candlestick at this key degree could also be an indication of fading momentum and an early sign of a value reversal.

His buying and selling technique displays this uncertainty. He has positioned brief positions inside the pink resistance zone, with a cease loss simply above the all-time excessive. On the similar time, he has set a cease purchase order within the inexperienced breakout zone above the all-time excessive, prepared to modify lengthy ought to the Bitcoin value convincingly break by means of resistance.

Situations For A Bullish Breakout Are Not But Fulfilled

Though Tony famous that the broader funding market, together with altcoins and the inventory market, appears to be like sturdy, he cautioned that this doesn’t assure a bullish breakout for Bitcoin. For affirmation, a bullish breakout have to be preceded by aligning varied technical indicators. These embody a breakout with substantial buying and selling quantity, an RSI studying above 70 on the weekly chart, and a weekly shut above the higher Bollinger Band.

Associated Studying

For the time being, nonetheless, the Bitcoin CME Futures chart has failed to maneuver previous 70 on the every day RSI twice, and buying and selling quantity is in decline. In line with CoinMarketCap, the buying and selling quantity of Bitcoin is $44.33 billion up to now 24 hours, a 11.40% discount from the earlier 24 hours. These are early warning indicators {that a} breakout try might lack the energy wanted for sustainability.

Nonetheless, the circumstances are nonetheless very combined and beginning to lean extra bullish than bearish. On the time of writing, Bitcoin is buying and selling at $102,352, down by 1.31% up to now 24 hours.

Featured picture from Pixabay, chart from Tradingview.com