- Peter Schiff Acknowledges Bitcoin Use Case: Bitcoin critic Peter Schiff surprisingly pointed to Jim Chanos utilizing Bitcoin to hedge towards his brief place in MicroStrategy (MSTR), suggesting BTC might need a ‘actual use case’ as a hedge towards Saylor’s Bitcoin-heavy technique.

- Chanos Calls Out MSTR’s Valuation: Chanos argued that MSTR inventory is buying and selling at a hefty premium to its precise Bitcoin holdings, stating, “Traders are paying $3 of inventory value to achieve $1 of Bitcoin publicity,” highlighting the perceived overvaluation.

- Bitcoin Consolidation and MSTR’s Danger: Whereas MSTR inventory is up 40% in 2025, Schiff warns that its features are extra tied to Bitcoin’s value motion than actual enterprise progress, cautioning {that a} BTC drop may spell hassle for MSTR – a sentiment echoed by some as BTC consolidates between $100,678 and $105,700.

Peter Schiff, the gold man who’s all the time trashed Bitcoin, simply admitted there would possibly – simply would possibly – be a use case for BTC. Yeah, you heard that proper. Schiff, who’s by no means missed an opportunity to slam crypto, pointed to a method by funding supervisor Jim Chanos as a potential ‘actual use case’ for Bitcoin. But it surely’s not what Bitcoin followers would count on.

Chanos Makes use of Bitcoin to Hedge Towards MicroStrategy

In response to Schiff’s put up on X, Bitcoin’s use case isn’t what the crypto crowd’s been touting. He highlighted how Chanos, a widely known short-seller, purchased Bitcoin to hedge towards his brief place in MicroStrategy (MSTR). Why? As a result of MSTR, led by Michael Saylor, retains piling on Bitcoin – they’re sitting on almost 570,000 BTC now – and it’s made the inventory virtually a proxy for Bitcoin with additional company threat.

Schiff sarcastically mentioned Saylor has ‘by chance created an actual use case for Bitcoin,’ suggesting traders like Chanos are utilizing BTC to guard themselves from MSTR’s risky, Bitcoin-heavy technique.

Chanos Calls Out MicroStrategy’s Valuation

Chanos isn’t mincing phrases. In one other put up, he argued that MSTR’s inventory is buying and selling at a premium that’s means out of whack with the precise worth of its Bitcoin holdings. He put it bluntly: ‘Traders are paying $3 of inventory value to achieve $1 of Bitcoin publicity.’

By holding Bitcoin whereas shorting MSTR, Chanos is actually betting that MSTR’s inventory will drop, however Bitcoin will both maintain regular or rise – cushioning his potential losses. It’s a fairly wild technique, and it speaks to how excessive MSTR’s valuation has gotten.

Schiff Doubles Down – Is MSTR Actually a Bitcoin ETF?

Peter Schiff, by no means one to cross up an opportunity to slam Saylor, took intention at MSTR’s total enterprise mannequin, arguing that it’s extra of a Bitcoin-holding entity now than a software program firm. He mentioned, ‘If you wish to purchase Bitcoin, then purchase Bitcoin. If you wish to put money into the inventory market, purchase an organization with an precise enterprise.’

In the meantime, Michael Saylor retains doubling down on Bitcoin, just lately including 13,390 BTC for $1.34 billion. Schiff says it’s a dangerous transfer – if BTC tanks, these paper features may flip into actual monetary ache.

MSTR Inventory Surges – However Can It Final?

MSTR’s inventory is up almost 40% in 2025, mirroring Bitcoin’s surge. However Schiff’s not satisfied. He thinks the rally is tied extra to BTC value motion than any actual enterprise progress. And if Bitcoin takes a dive? MSTR’s inventory may go proper with it.

Nonetheless, some see Saylor’s technique as visionary. Professional-XRP lawyer John Deaton in contrast Saylor’s long-term Bitcoin play to Warren Buffett’s strategy with Berkshire Hathaway. In response to Deaton, Saylor may very well be aiming to regulate as much as 5% of all Bitcoin in circulation – a large guess, particularly with BTC consolidating between $100,678 and $105,700.

Bitcoin’s Large Image – Breakout or Breakdown?

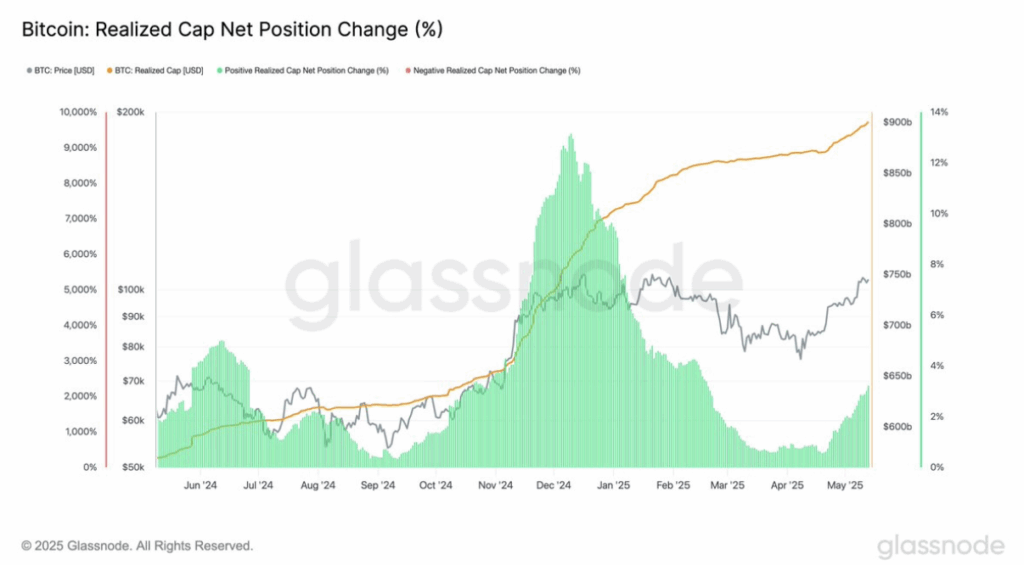

Whereas all this drama performs out with MSTR, Bitcoin itself is caught in a decent vary. Analysts are watching key ranges as BTC’s realized cap has climbed $30 billion since April 20, signaling recent cash is flowing in. If Bitcoin can maintain above present assist, a bullish breakout may very well be within the playing cards. However as all the time in crypto, nothing’s set in stone.