XRP has been up 10% over the previous seven days however has corrected by 4.6% on Thursday, signaling a possible shift in momentum. The RSI has dropped under 50, Ichimoku indicators present worth slipping underneath key assist traces, and the EMA hole is narrowing—collectively pointing to weakening short-term energy.

Whereas XRP’s broader pattern stays technically bullish, its indicators now replicate rising vulnerability. Whether or not the latest pullback deepens or units the stage for a rebound will rely on how XRP behaves round present assist zones.

XRP Momentum Cools as RSI Slides Under 50

XRP’s Relative Energy Index (RSI) has dropped considerably, falling from 65.13 yesterday to 46.95 at this time.

This decline signifies a transparent lack of bullish momentum inside a short while body and locations XRP again within the decrease half of the impartial RSI zone.

The drop displays a shift in sentiment, as merchants could also be stepping again from aggressive shopping for following latest worth motion.

The RSI is a momentum oscillator that measures the pace and alter of worth actions on a scale from 0 to 100. Readings above 70 sometimes counsel an asset is overbought and could also be due for a correction, whereas ranges under 30 point out oversold circumstances that might precede a rebound.

XRP’s present RSI of 46.95 suggests neither excessive, however the downward pattern may sign weakening demand.

If the RSI continues falling towards 30, it could level to elevated bearish stress; nevertheless, a bounce from present ranges may assist XRP stabilize and try a restoration.

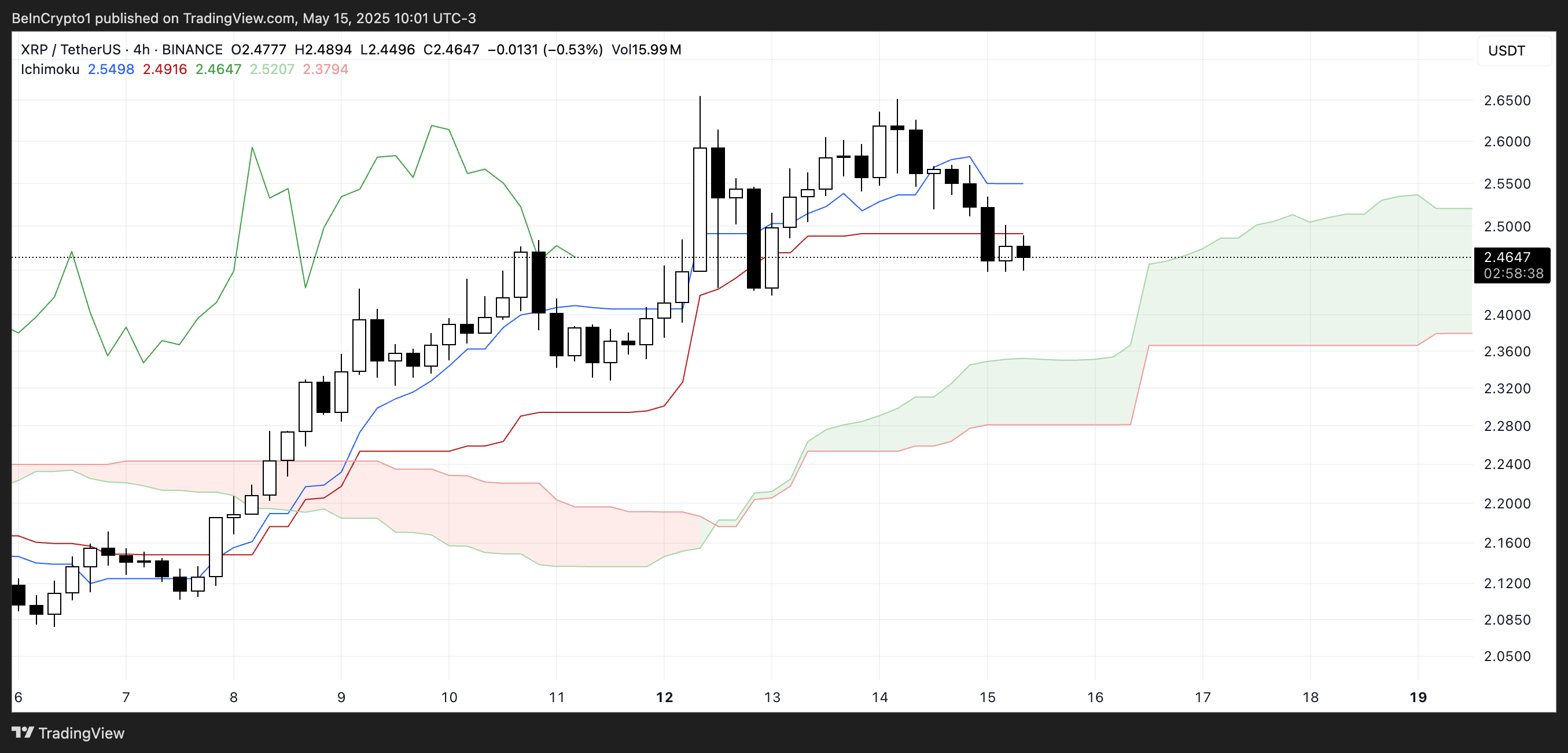

XRP Faces Strain as Worth Slips Under Ichimoku Strains

The Ichimoku Cloud chart for XRP reveals a shift in momentum as the value motion has moved under each the blue Tenkan-sen and purple Kijun-sen traces.

This crossover to the draw back is often considered as a short-term bearish sign, particularly when confirmed by the value buying and selling under the Kijun-sen.

The cloud forward (Senkou Span A and B) is at present inexperienced, indicating that the longer-term outlook nonetheless holds a bullish bias. Nevertheless, the cloud’s narrowing suggests weakening pattern energy and rising vulnerability to a potential pattern reversal.

The worth is now approaching the sting of the inexperienced cloud, which acts as a key assist zone. If this assist holds, XRP might consolidate or try a bounce.

Nevertheless, if the value breaks decisively under the cloud, it could mark a bearish shift in construction. Moreover, the Chikou Span (lagging inexperienced line) has misplaced its bullish separation from previous worth motion, suggesting that momentum is now not clearly on the bulls’ aspect.

The general setup displays a market at a crossroads—nonetheless holding structural assist, however with rising indicators of weak spot.

XRP EMA Strains Slender as Market Awaits Subsequent Transfer

XRP’s EMA traces stay bullish, with shorter-term shifting averages nonetheless positioned above the longer-term ones—a sign that the broader pattern is undamaged.

Nevertheless, the hole between these traces has narrowed, signaling a possible weakening in momentum. This compression means that bulls are shedding management, and if XRP fails to carry the close by assist at $2.42, it may open the door for a deeper correction.

In such a case, additional draw back targets embrace $2.32, adopted by $2.25 and $2.15 if bearish stress accelerates.

Regardless of this vulnerability, XRP continues to be up 11.7% over the previous week, displaying it has just lately attracted shopping for curiosity.

If optimistic momentum resumes, XRP may once more problem the $2.65 resistance.

A profitable breakout above that stage might pave the best way for a transfer above $2.70—a worth not seen since March 2.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.