Bitcoin is edging nearer to new highs, and indicators throughout the board recommend it is probably not lengthy earlier than it smashes by its earlier file.

The market’s latest momentum is backed by aggressive accumulation and a pointy drop in BTC held on exchanges — each basic indicators of brewing upward stress.

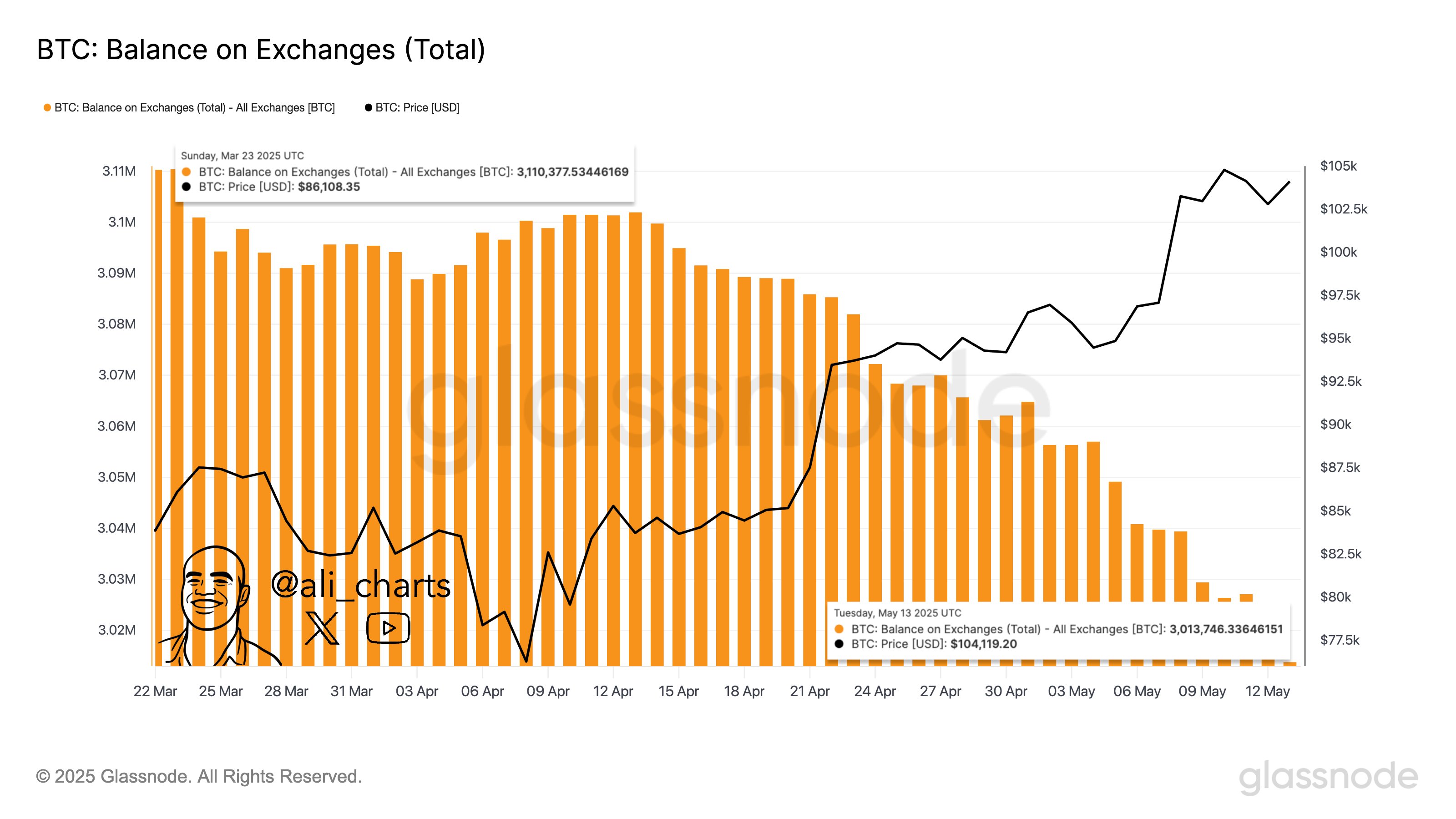

On-chain knowledge reveals that over 100,000 BTC has quietly exited buying and selling platforms in latest weeks.

The dwindling change provide displays a rising choice amongst buyers to carry fairly than promote, reinforcing Bitcoin’s shortage narrative at a time when value is flirting with its historic peak.

In the meantime, technical patterns level towards additional upside. Analysts are watching a recurring market construction — often known as the “Energy of Three” — which hints at a possible breakout above $112,000. That sample, together with bullish momentum indicators like a weekly MACD crossover, provides gasoline to an already energetic rally.

If Bitcoin clears the $105K stage, it may set off a wave of liquidations in brief positions, probably accelerating features. With confidence rising and provide thinning, the stage seems set for Bitcoin’s subsequent leap into value discovery.