On Thursday, institutional buyers continued to pour capital into US-listed spot Bitcoin ETFs, signaling persistent curiosity in crypto publicity amongst institutional buyers.

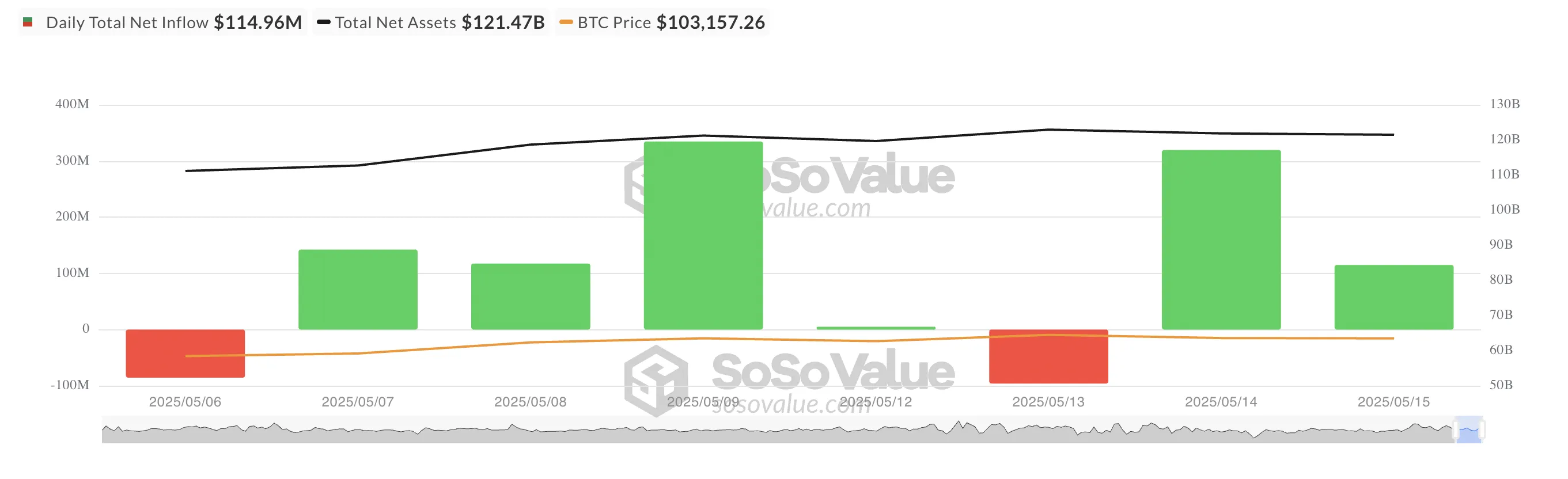

Whole web inflows throughout all US-listed Bitcoin ETFs amounted to roughly $115 million, reflecting sustained bullish sentiment regardless of short-term market volatility.

Institutional Urge for food Holds as BTC ETFs See $115 Million Inflows

On Thursday, web inflows into BTC ETFs totaled $114.96 million, down 64% from Wednesday’s $319.56 million. Whereas this marked sustained institutional curiosity in these funds, yesterday’s determine marked a steep decline from Wednesday’s inflows, suggesting a brief cooldown in momentum.

BlackRock’s IBIT ETF as soon as once more led the pack, recording the very best web every day inflows amongst its friends. The fund noticed a every day web influx of $409.72 million on Thursday, bringing its whole historic web influx to $45.42 billion.

In the meantime, ARK 21Shares Bitcoin ETF (ARKB) had the very best web outflow amongst all issuers on Thursday, with $132.05 million exiting the fund. ARKB’s whole historic web inflows stay at $2.57 billion as of this writing.

Futures Curiosity in BTC Rises Barely

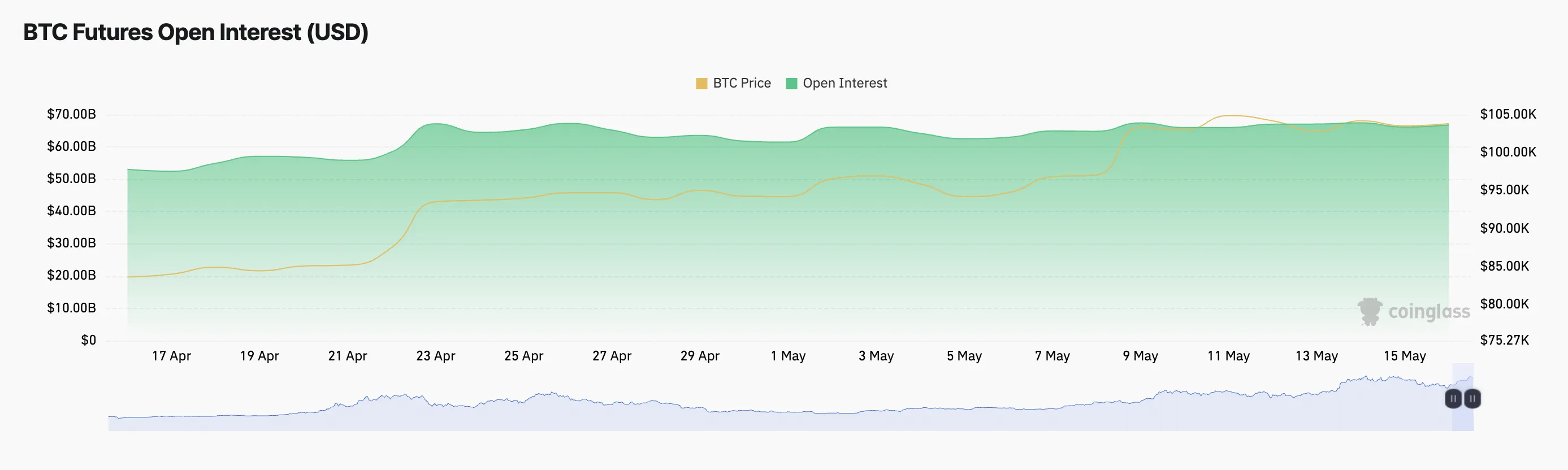

At press time, the main coin trades at $104,007, recording a 2% value surge amid a broader market rally over the previous day. Throughout the evaluate interval, the coin’s futures open curiosity (OI) has risen by a modest 1%, signaling a slight uptick in leveraged positions.

Open curiosity refers back to the whole variety of excellent futures contracts that haven’t but been settled. When OI will increase alongside rising costs, it signifies recent capital getting into the market and a strengthening of the present development.

With BTC, the modest rise in its OI means that market contributors stay considerably cautious whereas bullish momentum is constructing. The small uptick factors to restricted conviction amongst merchants, with many nonetheless adopting a “wait and see” strategy.

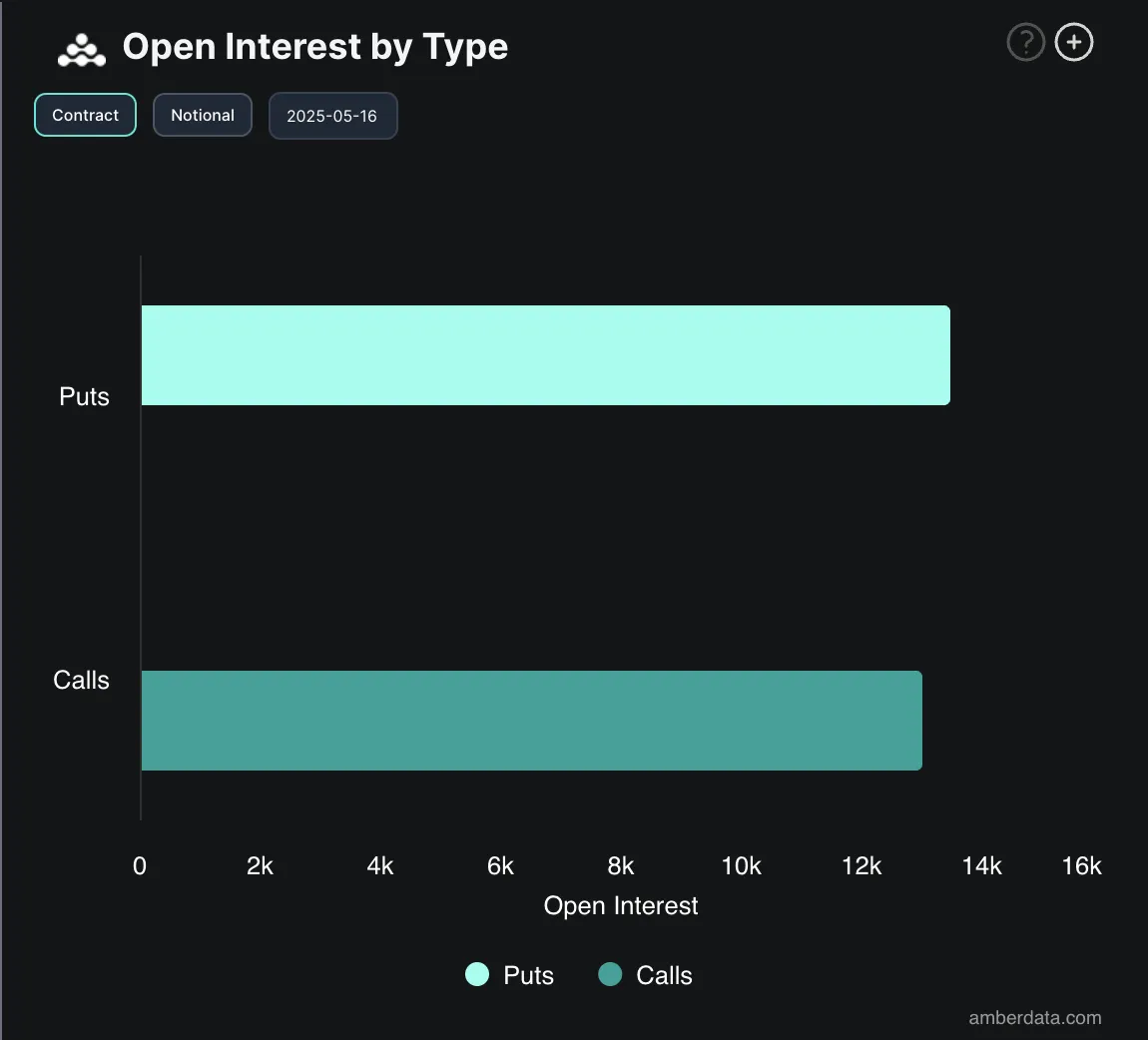

Furthermore, within the coin’s choices market, there’s an uptick in demand for put contracts at present.

This means rising hedging exercise and lingering bearish sentiment, which indicators a scarcity of optimism amongst BTC choices merchants.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.