Pi Community (PI) is below mounting strain as technical indicators and group sentiment turn into more and more bearish. Regardless of a 23% achieve over the previous week, PI has plunged 44% in simply 4 days, falling beneath the $1 mark following backlash over its $100 million fund launch.

Indicators just like the Ichimoku Cloud and BBTrend present fading momentum, with no indicators of a reversal. PI might stay susceptible to additional draw back if key resistance ranges are reclaimed and shopping for strain returns.

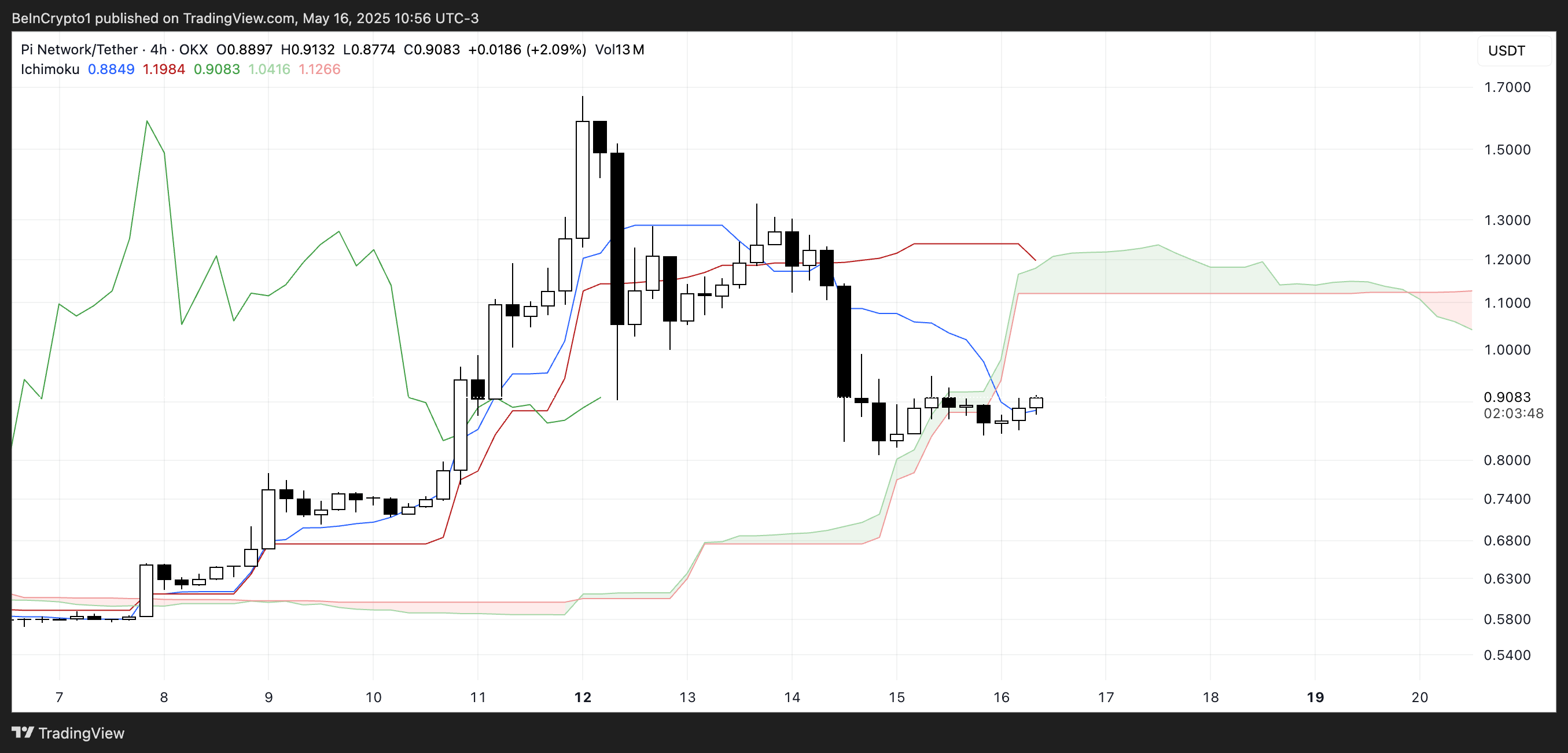

PI Struggles Under Cloud as Bearish Momentum Persists

The Ichimoku Cloud chart for Pi Community (PI) reveals indicators of ongoing weak spot following a pointy decline. Value motion is beneath the Kijun-sen (pink line) and near the Tenkan-sen (blue line), indicating that short-term momentum stays bearish.

The latest candles additionally work together with the decrease boundary of the Kumo Cloud (inexperienced/pink shaded space), exhibiting hesitation in regaining upward traction.

The Chikou Span (inexperienced lagging line) is now positioned beneath the worth candles, additional reinforcing a bearish outlook.

Regardless of the present consolidation close to the cloud’s edge, there’s no sturdy sign but of a reversal. The main span strains that type the Kumo forward are flat and barely downward-sloping, suggesting restricted bullish assist within the close to time period.

For sentiment to shift, PI should break decisively above each the Kijun-sen and the cloud, confirming a possible pattern reversal.

Till then, the chart favors warning, with bears nonetheless holding the higher hand.

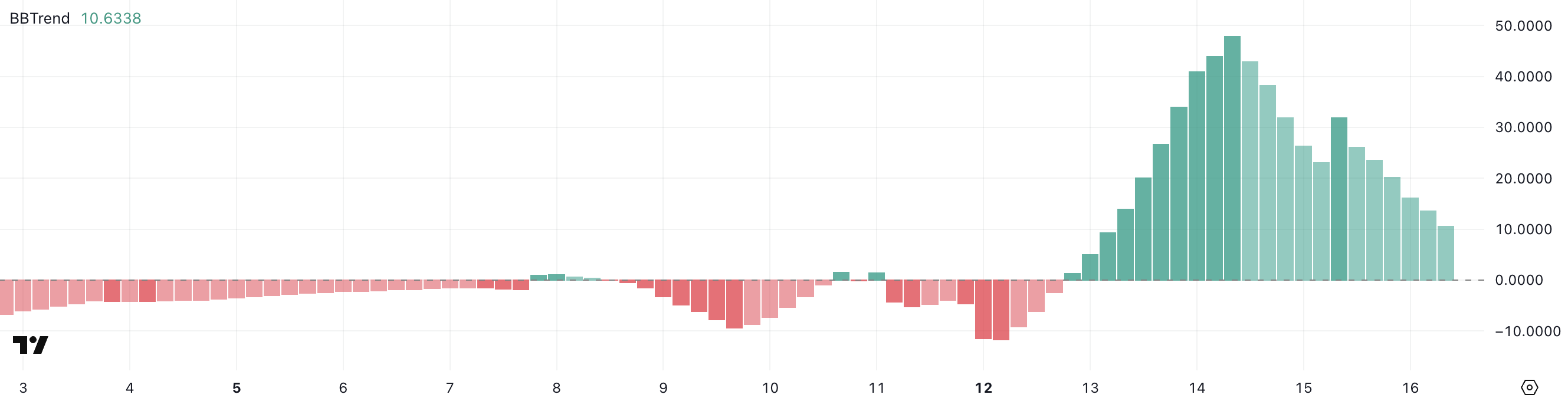

Pi Community Pattern Power Collapses as BBTrend Falls to 10.63

Pi Community’s BBTrend indicator has sharply declined to 10.63, after peaking close to 48 simply two days in the past and dropping to 32 yesterday.

This steep fall displays a major weakening in pattern power over a brief interval, suggesting that the latest bullish momentum is fading shortly.

The fast loss in pattern depth might point out a transition towards consolidation or perhaps a potential reversal if no new shopping for strain emerges.

The BBTrend (Bollinger Band Pattern) measures the power of a value pattern by evaluating the width of Bollinger Bands to cost volatility.

Larger values usually replicate sturdy trending habits—both bullish or bearish—whereas decrease values recommend sideways motion or weakening momentum.

At 10.63, Pi’s BBTrend suggests the asset might enter a impartial part, the place volatility contracts and value may vary with out clear route except a brand new breakout or breakdown develops.

Following the announcement of its $100 million Pi Community Ventures fund, Pi Community is dealing with rising strain from each its group and the market.

Regardless of launching the initiative to spice up ecosystem development and real-world adoption, critics argue that the venture has didn’t ship on key guarantees—akin to launching 100 decentralized apps (DApps), well timed KYC processes, and referral rewards.

Many Pioneers see the fund as a distraction from unresolved points, particularly since purposes are collected through a easy Google Kind. Market sentiment mirrored this frustration, with PI’s value dropping beneath $1 and falling 44% during the last 4 days.

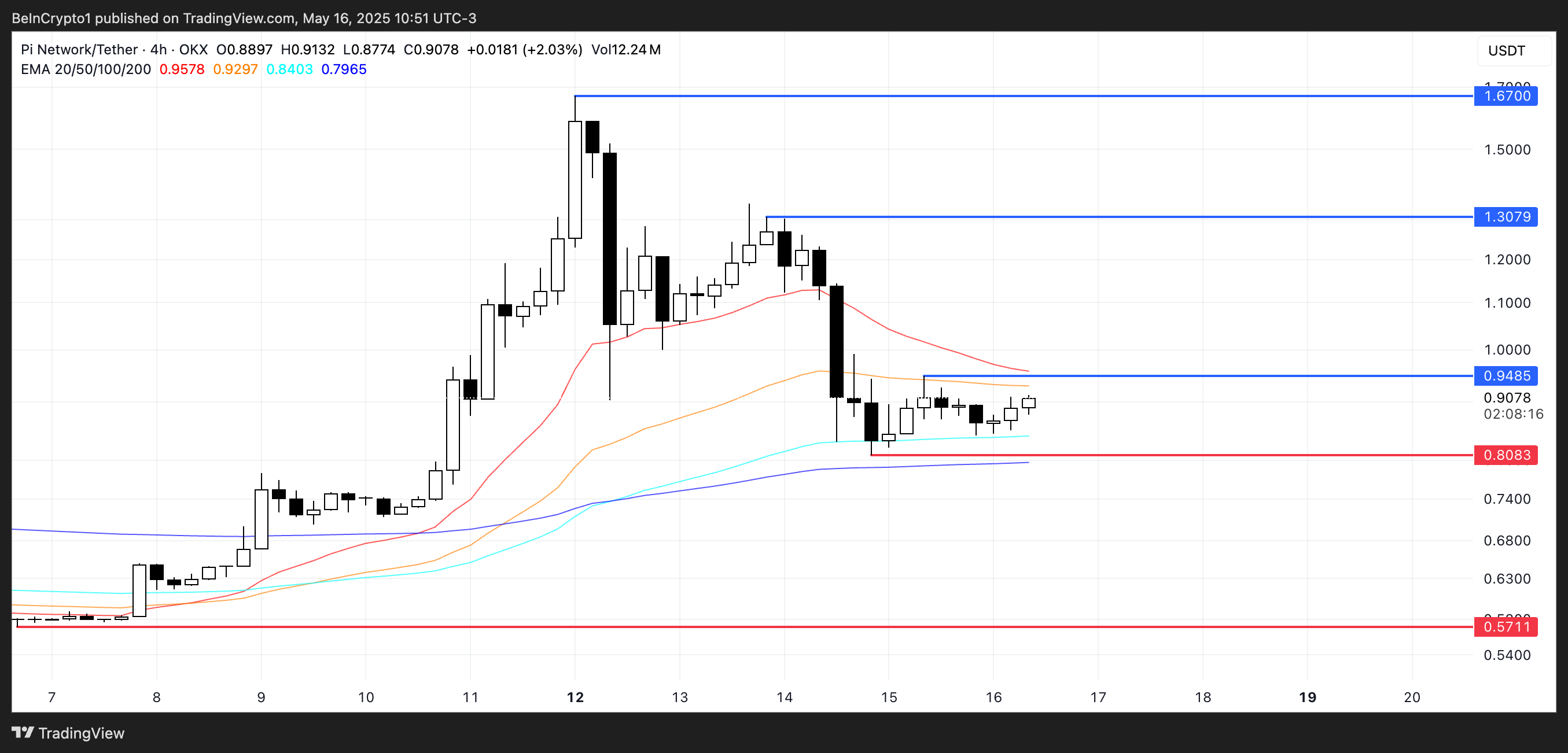

Technically, PI’s indicators assist the bearish outlook. Momentum alerts just like the DMI and CMF present declining power and elevated distribution, whereas the EMA strains are tightening and hinting at attainable dying crosses.

Though PI has been up 23% during the last seven days, the latest value motion suggests a lack of confidence and potential for additional draw back.

If the token fails to carry the important thing $0.80 assist stage, it may decline towards $0.57—but when momentum returns, a breakout above $0.94 may open the trail to $1.30 and even $1.67.

Disclaimer

In step with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.