Solana (SOL) is up 28.4% over the previous month, however its momentum has slowed. After briefly touching $184, it has gained simply 0.78% within the final seven days. Regardless of this, Solana continues to dominate DEX metrics, main all chains with $27.9 billion in weekly quantity.

The broader ecosystem stays energetic, with a number of Solana-based apps among the many prime price mills. Nevertheless, technical indicators reminiscent of RSI, Ichimoku Cloud, and EMA strains counsel the rally could also be dropping steam, signaling a possible interval of consolidation or correction forward.

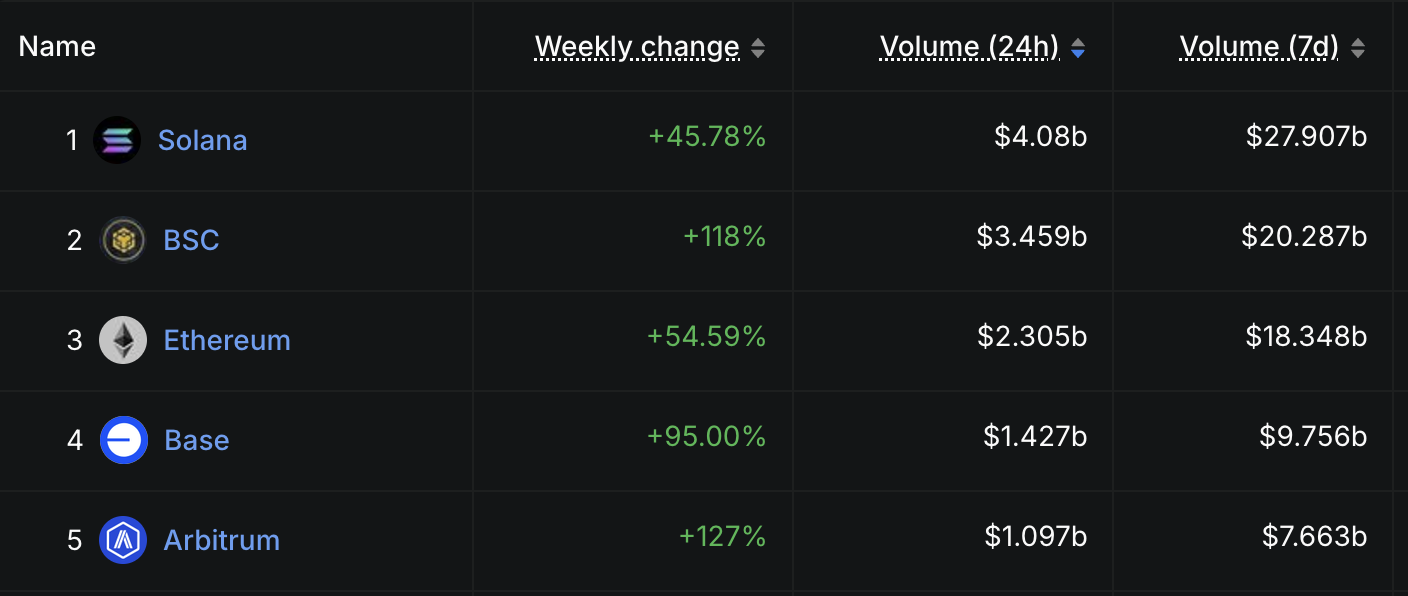

Solana Leads DEX Market With $27.9 Billion Weekly Quantity and Surging App Exercise

Solana continues to say its dominance within the decentralized trade (DEX) ecosystem, main all chains in buying and selling quantity for the fourth consecutive week.

Over the previous seven days alone, Solana recorded $27.9 billion in DEX quantity—surpassing BNB Chain, Ethereum, Base, and Arbitrum.

The weekly DEX quantity for Solana surged by 45.78%, signaling a robust resurgence in on-chain exercise after reducing exercise between March and April.

This rise is a spike and a part of a broader pattern, with volumes persistently staying above the $20 billion mark over the previous month.

Including to its momentum, Solana is dwelling to 4 of the previous week’s ten highest fee-generating apps and chains. This contains acquainted platforms and newcomers, exhibiting a wholesome variety within the ecosystem.

Imagine App, a newly launched Solana-based launchpad, stands out within the current surge. Within the final 24 hours alone, it generated $3.68 million in charges—surpassing well-established platforms like PancakeSwap, Uniswap, and Tron.

Momentum Cools for SOL as Indicators Flip Impartial

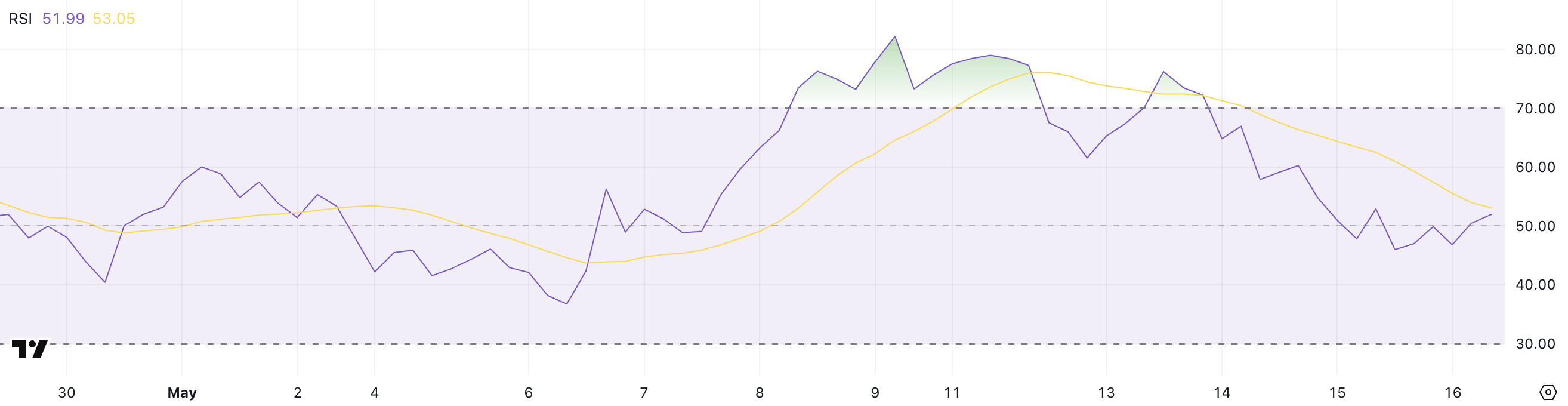

Solana’s Relative Power Index (RSI) has dropped to 51.99, down from 66.5 simply three days in the past, signaling a transparent lack of bullish momentum.

Over the previous few days, the RSI has hovered between 44 and 50, reflecting a extra impartial market sentiment after beforehand nearing overbought circumstances.

This shift means that merchants are extra cautious, and up to date good points could also be cooling off.

The RSI is a momentum indicator that ranges from 0 to 100, with values above 70 indicating overbought circumstances and under 30 signaling oversold territory. At 51.99, Solana sits within the impartial zone, which usually suggests a interval of consolidation or indecision.

If the RSI rises above 60 once more, it might level to renewed bullish energy; if it dips under 45, additional draw back stress might observe.

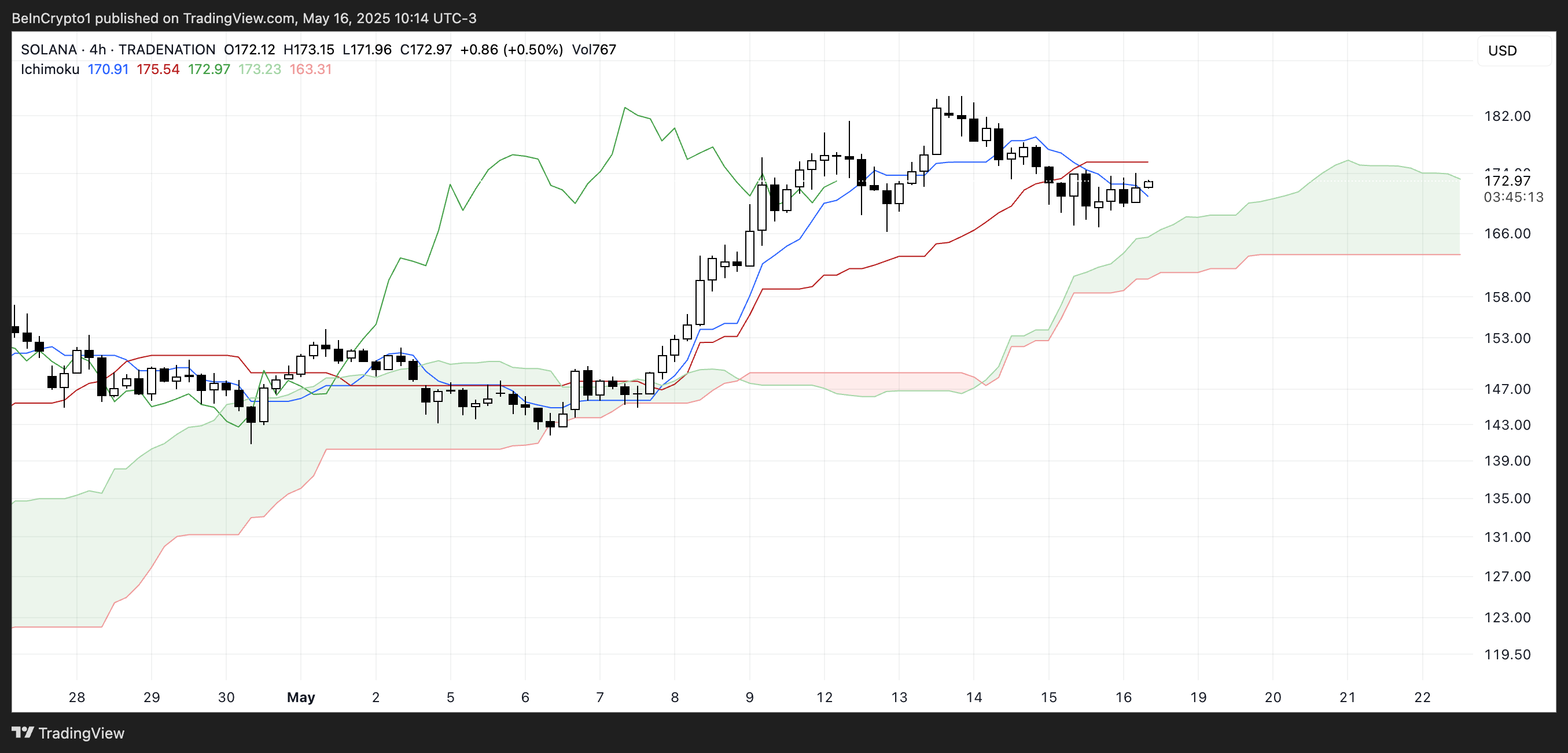

Solana’s Ichimoku Cloud chart exhibits a interval of consolidation following a robust uptrend, with key indicators now suggesting indecision.

The worth is hovering close to the Kijun-sen (purple line) and Tenkan-sen (blue line), each of which have began to flatten—indicating a slowdown in momentum.

The Chikou Span (inexperienced lagging line) stays above the candles, suggesting that the broader pattern nonetheless has a bullish bias. Nevertheless, the dearth of distance between it and the present worth motion displays weakening energy.

The Kumo Cloud (inexperienced and purple shaded space) forward remains to be bullish, with the main span strains unfold aside, offering assist beneath the present worth.

Nevertheless, with candles now carefully interacting with the Kijun-sen and failing to strongly break above the Tenkan-sen, the short-term sentiment seems cautious.

If the worth can push decisively above the blue line, momentum might return, however any drift into the cloud might sign the beginning of a extra extended consolidation section or potential pattern reversal.

Solana’s Bullish EMA Construction Faces Momentum Slowdown

Solana’s EMA strains stay bullish, with the short-term transferring averages positioned above the longer-term ones. Nevertheless, the hole between these strains is narrowing, suggesting that upward momentum is weakening.

Solana worth not too long ago failed to interrupt previous a key resistance stage, and though a retest might open the trail towards reclaiming the $200 zone, the dearth of sturdy follow-through raises questions concerning the pattern’s energy.

Complementing this cautious outlook, the Ichimoku Cloud and RSI indicators level to a possible cooldown. Solana not too long ago held above an necessary assist stage however stays susceptible—if that assist breaks, additional draw back might observe.

The broader construction nonetheless leans bullish, however the market seems to be at a crossroads. The following transfer doubtless will depend on whether or not consumers can reclaim initiative or sellers push via key decrease ranges.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.