Made in USA cash are drawing consideration heading into the weekend, with 5 standout tokens main the cost: EOS, ONDO, SUI, KAS, and EIGEN. EOS surged almost 7% following a controversial $3 million buy by World Liberty Monetary, whereas ONDO stays a significant RWA participant regardless of short-term volatility.

SUI continues to trip momentum from its meme coin and DEX exercise, and Kaspa (KAS) reveals robust upside potential with a potential golden cross forming. In the meantime, EigenLayer (EIGEN) is dealing with a pointy pullback however nonetheless holds bullish alerts if help ranges can maintain.

EOS

EOS is up almost 7% within the final 24 hours, sparked by World Liberty Monetary’s shock $3 million buy of the token. The transfer has stirred controversy throughout the crypto group, particularly given WLFI’s latest $125 million loss from allegedly promoting ETH at an area backside.

Whereas some have raised issues about potential market manipulation, there’s at the moment no onerous proof of foul play. EOS, which has spent a lot of the previous yr buying and selling under $0.50, briefly surged over 9% following the information, reigniting curiosity in a undertaking many thought of dormant.

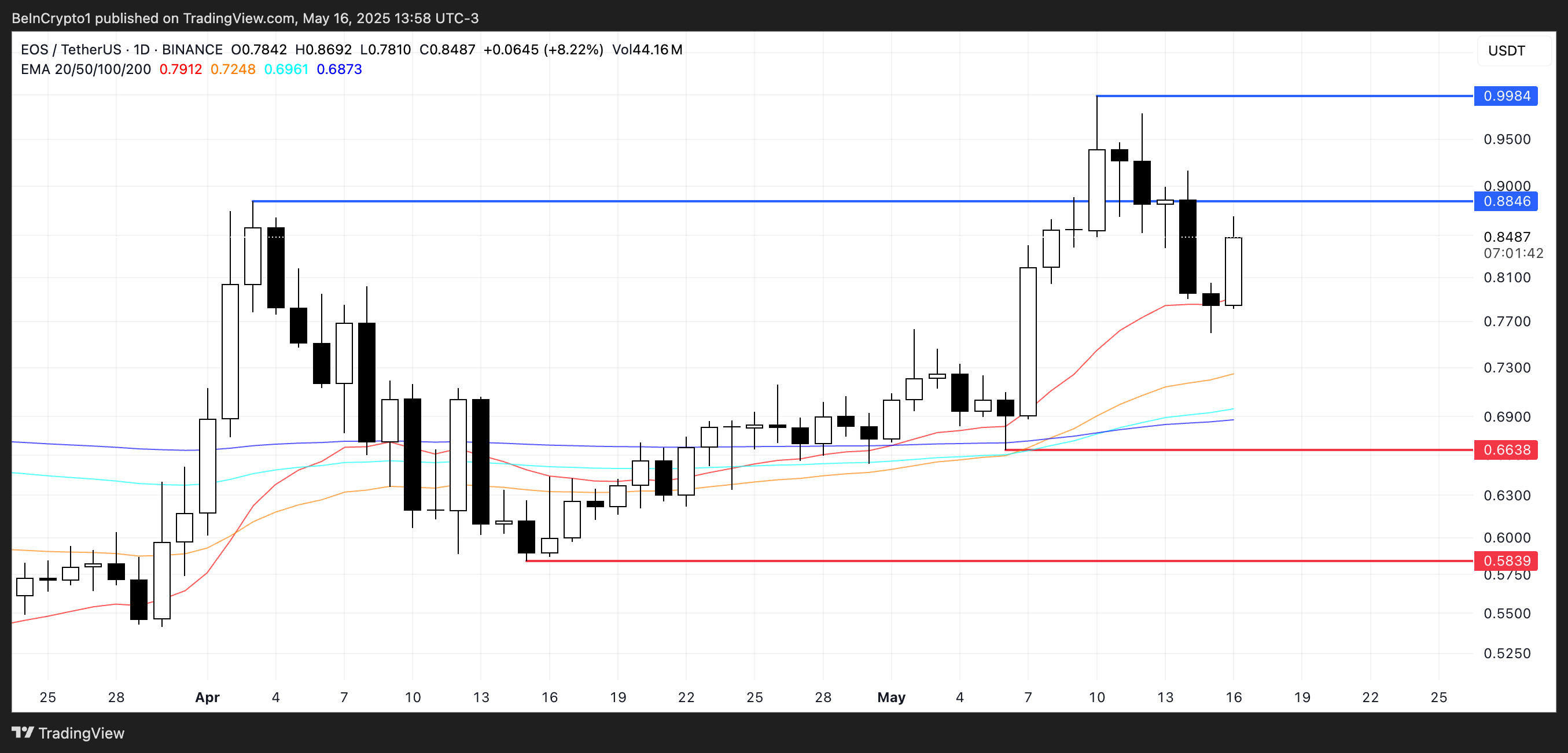

Technically, if bullish momentum persists, EOS may break above the important thing resistance degree at $0.88. A transparent breakout there might open the door for a run towards the psychological $1 mark.

Nonetheless, if sentiment shifts and the rally fades, EOS may retest help at $0.663. A break under that may probably set off additional draw back, probably dragging the token again towards the $0.58 area.

Ondo Finance (ONDO)

Actual-world asset (RWA) tokenization is gaining critical momentum. The sector reached an all-time excessive of $22.5 billion, up 5.87% within the final 30 days.

Personal credit score accounts for $13.1 billion of the full, highlighting rising institutional curiosity in bridging TradFi with blockchain infrastructure.

Amid this surge, ONDO has emerged as one of many largest gamers within the RWA house, regardless of its token value slipping over 3% prior to now 24 hours. Nonetheless, ONDO is up 16.2% during the last month, reflecting sustained investor confidence within the narrative.

Trying forward, if bullish sentiment returns, ONDO may take a look at resistance at $1.04. A breakout above that degree might push the worth towards $1.20.

Nonetheless, if the correction deepens, the token faces key help ranges at $0.86 and $0.819.

Ought to the downtrend speed up, ONDO might fall additional to $0.73 and even $0.663, making short-term value motion closely depending on whether or not the broader hype round RWA and Made in USA cash continues or fades.

SUI

SUI has been gaining traction in latest months because of its rising meme coin ecosystem and increasing DEX infrastructure.

Whereas its DEX quantity surged 36.7% over the previous week, it recorded the smallest enhance among the many prime eight chains and at the moment ranks sixth in complete DEX quantity.

Regardless of this, market curiosity stays robust, with SUI up 83% within the final 30 days—although it has cooled barely, slipping 1.25% over the previous week.

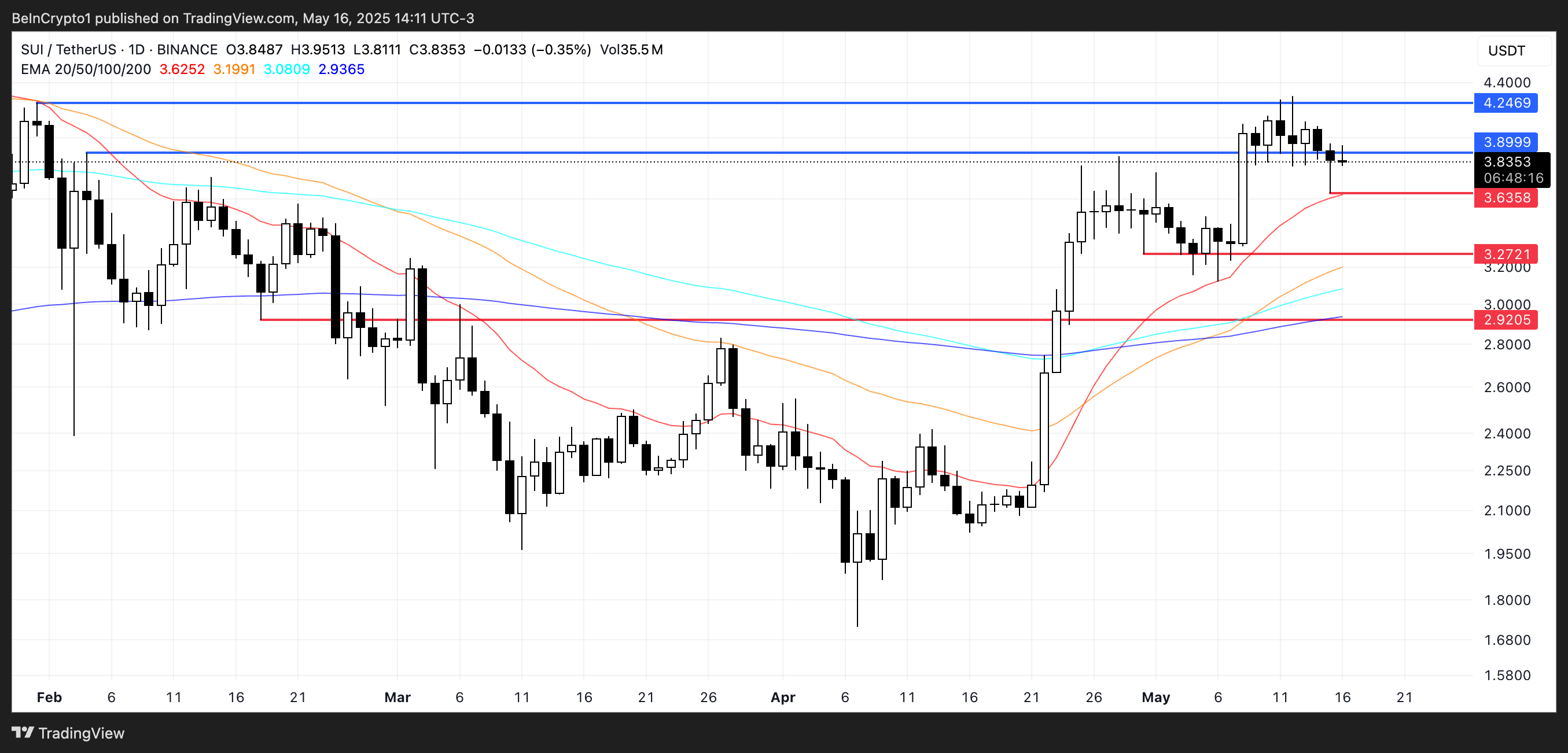

Technically, SUI’s EMA strains nonetheless point out bullish momentum.

If consumers regain management, the token may take a look at resistance at $3.89, and a breakout there might open the trail towards $4.24.

On the draw back, if SUI fails to carry help at $3.63, the following targets are $3.27 and probably $2.92 within the occasion of additional promoting stress.

Kaspa (KAS)

Kaspa (KAS) has delivered robust efficiency lately, climbing 18.5% within the final seven days and 56.7% over the previous month. Its market cap now stands at $3.17 billion, at the same time as 24-hour buying and selling quantity has dipped by 20% to $99.38 million.

EMA indicators recommend a possible golden cross formation, which may sign additional upside. If momentum continues, KAS might take a look at resistance at $0.155, and a profitable breakout may push the worth towards $0.188, making it one of the vital attention-grabbing Made in USA cash for the weekend.

Nonetheless, if the pattern weakens, key help ranges lie at $0.114 and $0.103. Shedding these may set off a deeper correction, with draw back targets as little as $0.082.

Eigenlayer (EIGEN)

EigenLayer (EIGEN) has seen combined value motion this week—up 16% over the previous seven days, however down 11% within the final 24 hours alone.

The latest drop pushed its value under $1.40 and dragged its market cap underneath the $400 million mark, signaling a possible cooldown after final week’s rally.

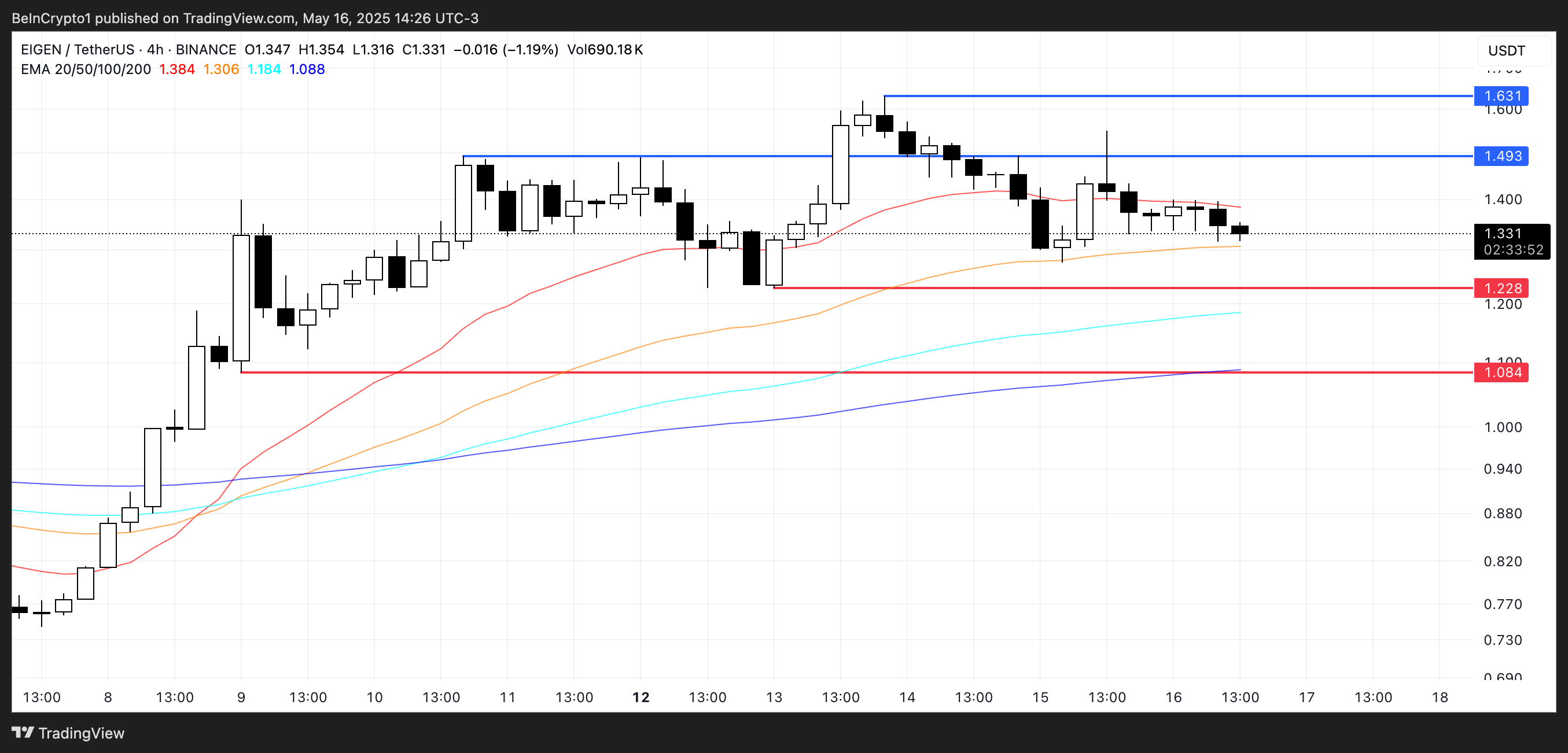

Regardless of the pullback, EIGEN’s EMA strains stay in a bullish formation. If the downtrend continues, the token might take a look at key help at $1.22, with additional draw back potential towards $1.084 if that degree fails.

Nonetheless, if EigenLayer regains its prior momentum, it may retest resistance at $1.49, and a breakout there might pave the way in which for a transfer towards $1.63.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.