Hyperliquid (HYPE) continues to be probably the most dominant gamers in crypto, accounting for 65% of each day perpetuals market quantity and producing $15.58 million in charges over the previous seven days. The surge in exercise has pushed HYPE to a 3-month excessive, however technical indicators now recommend the rally could also be shedding steam.

Momentum indicators like DMI and RSI level to cooling power, whereas value motion hovers close to a key help degree. Whether or not HYPE breaks above resistance or slips right into a deeper pullback might outline its subsequent main transfer.

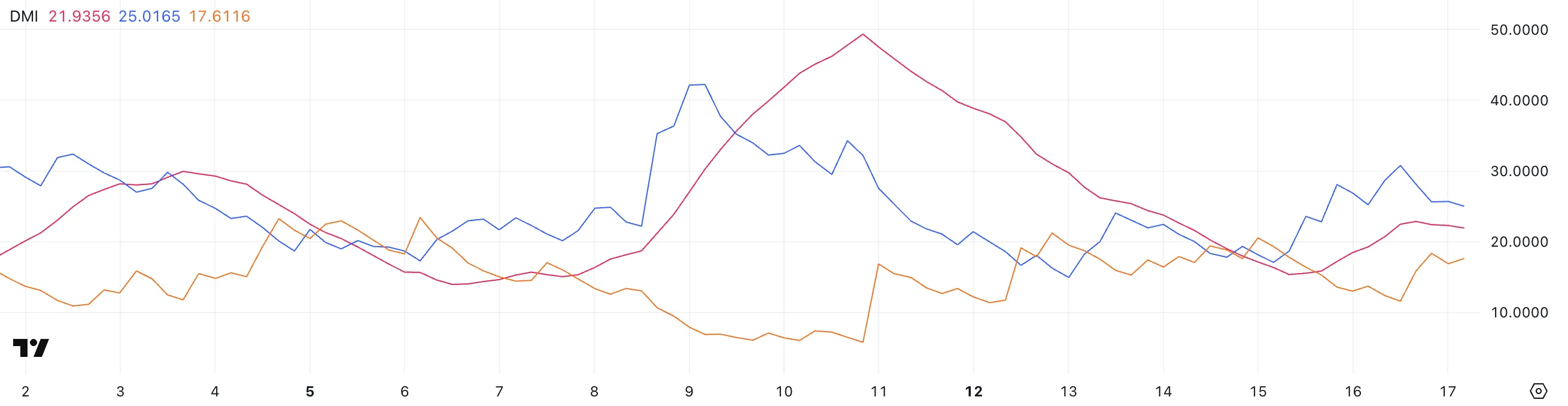

HYPE DMI Alerts Fading Bullish Momentum as ADX Hovers Close to Key Stage

HYPE’s Directional Motion Index (DMI) reveals blended indicators, with its ADX at the moment at 21.93.

That’s a slight drop from 22.85 yesterday and 24.39 4 days in the past, however nonetheless increased than the 15.34 recorded two days in the past.

The ADX measures pattern power, not course, and readings above 20 point out a possible pattern is forming, whereas values beneath 20 recommend a weak or ranging market.

The +DI, which measures bullish strain, is now at 25—up from 17 two days in the past however down from a robust 30.78 yesterday. In the meantime, the -DI, which tracks bearish strain, has risen to 17.61 from 11.57.

This implies that though bullish momentum continues to be stronger than bearish, it’s beginning to weaken, whereas promoting strain is slowly rising.

If this pattern continues, it might sign a lack of upside power and a potential shift towards consolidation or short-term correction.

Hyperliquid RSI Drops Under 60, Signaling Cooling Momentum

Hyperliquid’s RSI has dropped to 55.15, down from 68.76 yesterday, after rising from 45.82 simply two days in the past. The Relative Power Index (RSI) is a momentum oscillator that tracks the velocity and magnitude of value actions on a scale from 0 to 100.

RSI values above 70 recommend an asset could also be overbought and due for a correction, whereas values beneath 30 point out oversold situations and the potential for a bounce.

Ranges between 50 and 60 typically mirror a impartial or barely bullish stance, relying on pattern context.

The sharp drop in RSI means that HYPE’s current bullish momentum is fading. Whereas 55.15 nonetheless sits in a impartial zone, the reversal from near-overbought situations could sign purchaser exhaustion.

If follow-through shopping for doesn’t return, this might result in a cooling-off section or short-term consolidation.

If RSI stabilizes above 50, it could mirror a wholesome reset inside a broader uptrend, however additional decline might open the door for a deeper pullback.

HYPE Holds Key Help at $26.41 With Eyes on $30 Breakout

HYPE is at the moment hovering simply above a key help degree at $26.41, a zone that would resolve its subsequent main transfer.

The EMA construction stays bullish, with short-term averages nonetheless positioned above long-term ones, suggesting the broader pattern is undamaged.

Nonetheless, if this help fails below strain, Hyperliquid might drop towards $23.28, with a deeper decline probably extending to $19.55 in a robust downtrend.

On the flip aspect, if the $26.41 help holds and consumers step in, the following key check lies on the $28.43 resistance. A profitable breakout above that degree would open the door for a push towards $30—territory not seen since December 2024.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.