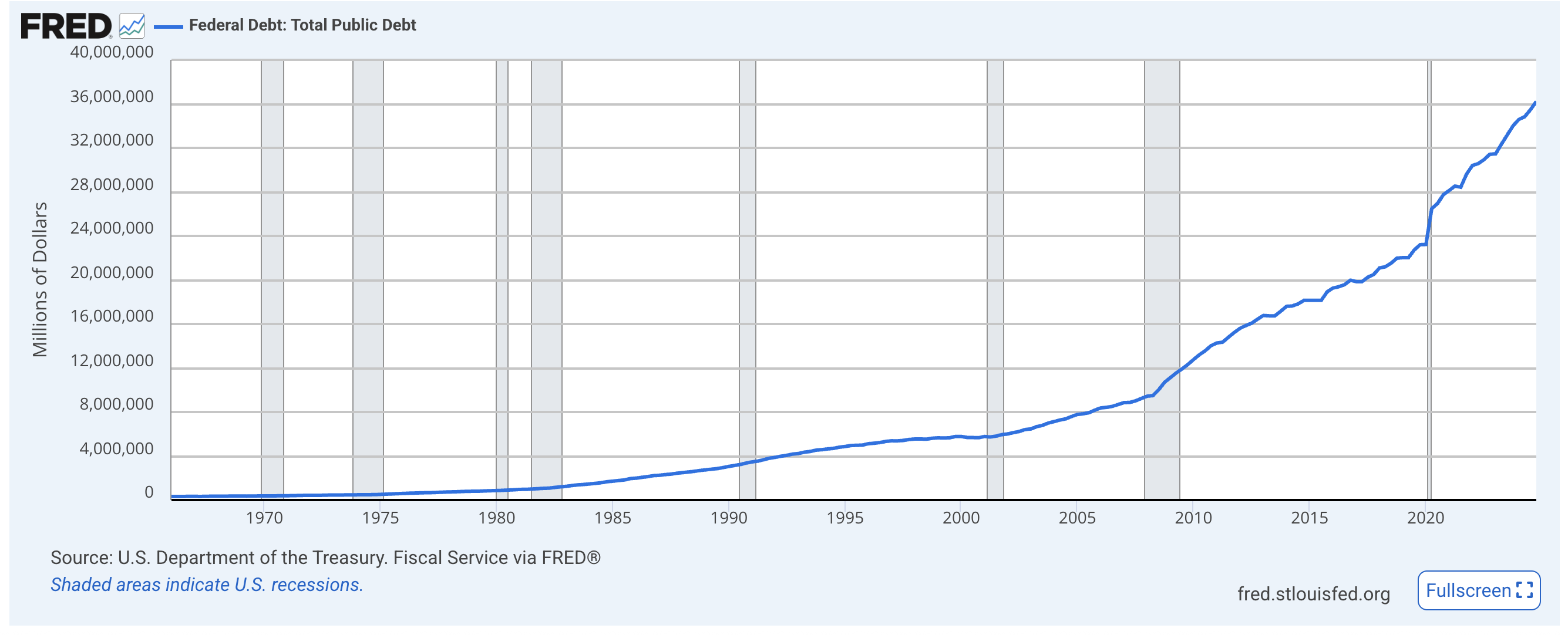

Bitcoin (BTC) is going through a mixture of bullish alerts and short-term uncertainty. Moody’s current downgrade of the US credit standing has heightened long-term bullish sentiment round BTC, reinforcing its position as a hedge towards rising debt and monetary uncertainty.

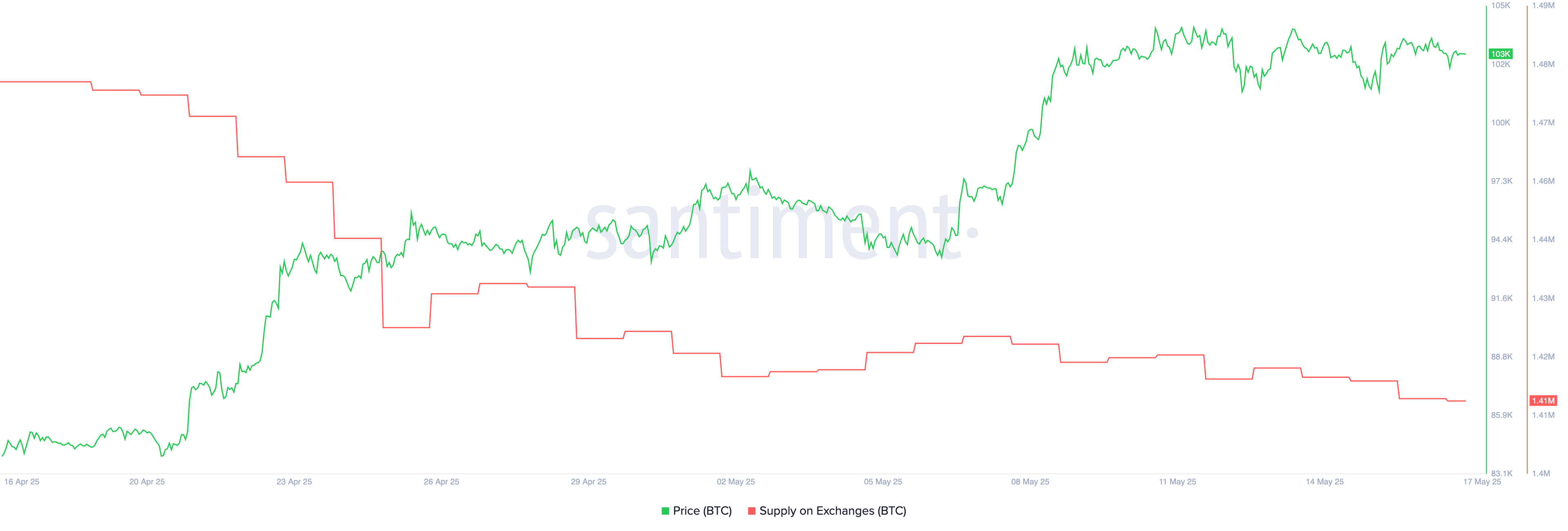

In the meantime, on-chain knowledge reveals a declining provide of Bitcoin on exchanges, suggesting buyers are leaning towards holding somewhat than promoting. Regardless of these bullish fundamentals, BTC stays in a short-term consolidation section, with value motion needing recent momentum to interrupt increased.

Moody’s Downgrade Ends US Century-Lengthy Excellent Credit score Ranking Streak

Moody’s has downgraded the US credit standing from Aaa to Aa1, eradicating the nation’s final excellent rating amongst main credit score businesses.

It’s the primary time in over a century that the US lacks a top-tier ranking from all three, following downgrades by S&P in 2011 and Fitch in 2023. Rising deficits, mounting curiosity prices, and the absence of credible fiscal reforms drove the choice.

Markets reacted shortly—Treasury yields climbed, and fairness futures slipped. The White Home dismissed the downgrade as politically pushed, with lawmakers nonetheless negotiating a $3.8 trillion tax and spending bundle.

Moody’s additionally warned that extending Trump-era tax cuts might deepen deficits, pushing them towards 9% of GDP by 2035—a situation that will strengthen the enchantment of crypto, particularly Bitcoin, as a hedge towards long-term fiscal instability.

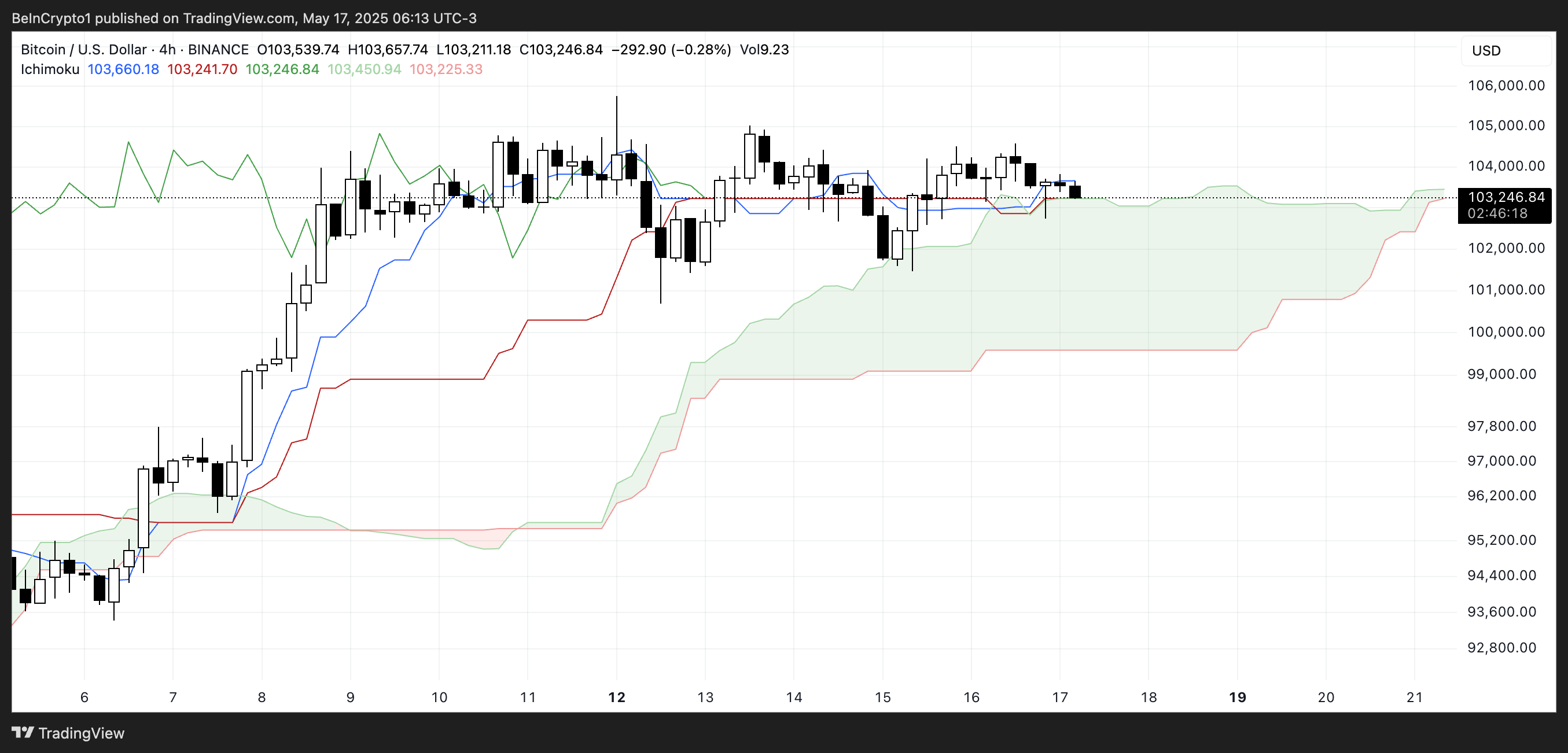

Bitcoin Consolidates: Falling Trade Provide Meets Ichimoku Indecision

After briefly rising from 1.42 million to 1.43 million between Might 2 and Might 7, Bitcoin’s provide on exchanges is falling as soon as once more.

This brief uptick adopted a extra important decline between April 17 and Might 2, when the trade provide dropped from 1.47 million to 1.42 million. Now, the metric has resumed its downward development, at present sitting at 1.41 million BTC.

The provision of Bitcoin on exchanges is a key market indicator. When extra BTC is held on exchanges, it typically alerts potential promoting stress, which will be bearish.

Conversely, a decline in trade balances suggests holders are transferring their cash to chilly storage, lowering near-term promote stress—a bullish sign. The present drop reinforces the concept that buyers could also be getting ready to carry somewhat than promote.

The Ichimoku Cloud chart for Bitcoin reveals a interval of consolidation with neutral-to-slightly-bearish alerts. The worth is at present sitting proper across the flat Kijun-sen (pink line), indicating a scarcity of sturdy momentum in both course.

The Tenkan-sen (blue line) can also be flat and carefully monitoring the worth, reinforcing this sideways motion and short-term indecision.

The Senkou Span A and B traces (which type the inexperienced cloud) are additionally comparatively flat, suggesting equilibrium available in the market. The worth is transferring close to the highest fringe of the cloud, which generally acts as help. Nonetheless, because the cloud just isn’t increasing and has a flat construction, there isn’t any sturdy development affirmation in the mean time.

The Chikou Span (inexperienced lagging line) is barely above the worth candles, hinting at gentle bullish bias, however total, the chart alerts indecision and the necessity for a breakout to substantiate the following course.

Moody’s Downgrade Strengthens Bitcoin’s Lengthy-Time period Bull Case Amid Quick-Time period Consolidation

The U.S. dropping its final excellent credit standing after Moody’s downgrade could possibly be a serious long-term catalyst for Bitcoin.

Whereas it might not set off fast value motion, the downgrade reinforces the narrative of rising fiscal instability and debt issues—situations that strengthen Bitcoin’s enchantment as a decentralized, hard-capped asset.

Within the medium to long run, extra buyers might flip to BTC as a hedge towards sovereign threat and weakening belief in conventional monetary methods.

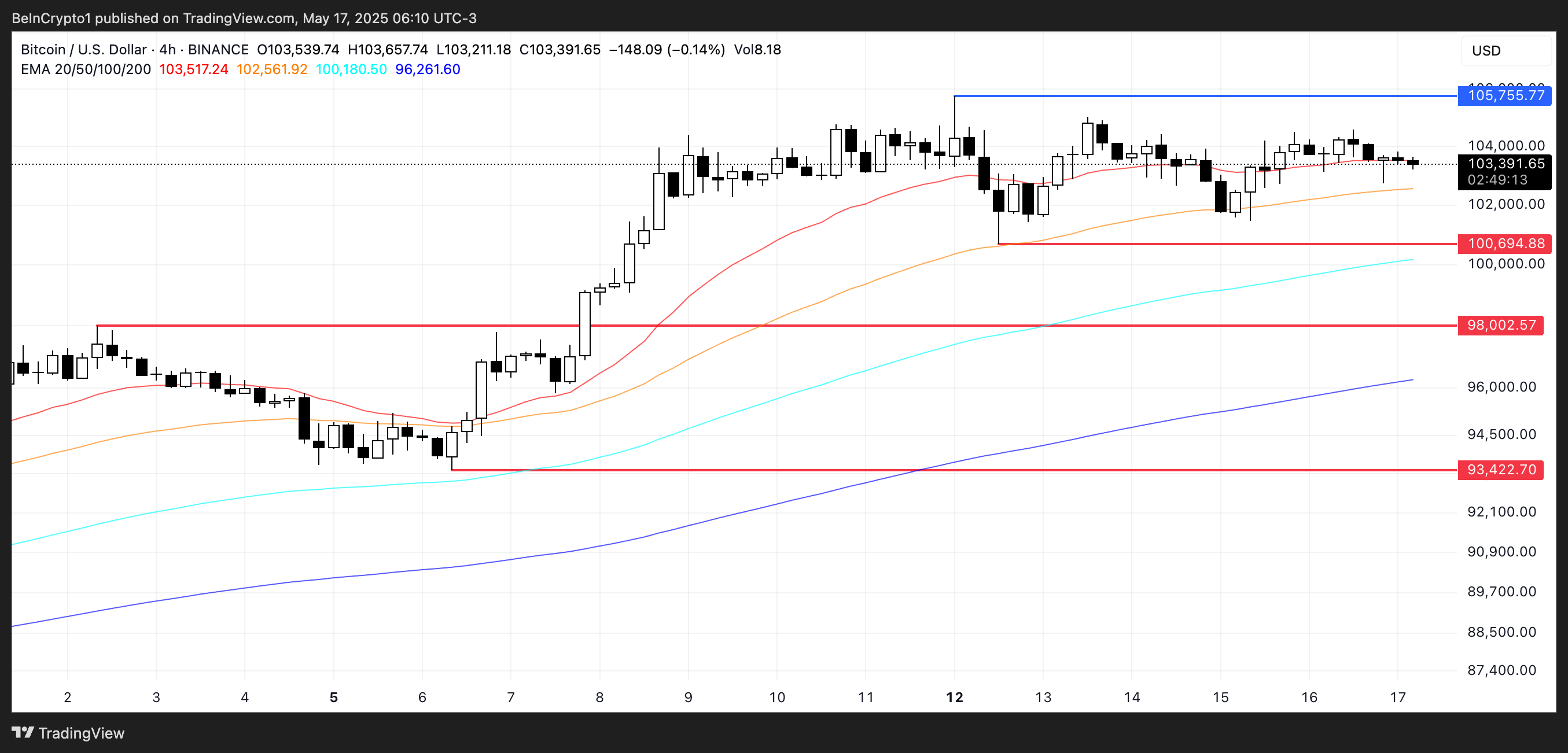

Within the brief time period, nevertheless, Bitcoin value stays in a consolidation section after breaking above $100,000. Its EMA traces are nonetheless bullish, with shorter-term averages above longer-term ones, however they’re flattening out.

For bullish momentum to renew, BTC would want to push previous the $105,755 resistance.

On the draw back, holding above the $100,694 help is essential—dropping it might open the door for declines towards $98,002 and doubtlessly $93,422.

Disclaimer

Consistent with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.