Technical analyst CRYPTOWZRD shared his newest tackle Chainlink (LINK)’s worth motion in a current put up on X, declaring that the asset ended the day with a impartial, indecisive shut. Whereas the session lacked a transparent directional push, he famous that this sort of pause typically precedes a sharper transfer.

CRYPTOWZRD plans to watch the intraday chart tomorrow for a possible reversal setup above the $15.85 mark, which he views as the primary signal of bullish intent. Nonetheless, a sustained transfer above $16.80 would provide a extra confirmed breakout and a stronger lengthy alternative, indicating consumers are starting to take management.

Can Chainlink Break Free From Present Stagnation?

In his newest evaluation, CRYPTOWZRD identified that LINK and LINKBTC closed at this time’s session indecisively, with each day candles reflecting weak point within the worth motion. Whereas the shortage of a transparent course is notable, each belongings might want to see a surge in shopping for strain from these ranges in an effort to set up a brand new bullish pattern.

Notably for LINKBTC, CRYPTOWZRD prompt {that a} potential push greater may materialize as Bitcoin dominance nears its resistance goal. This rise in Bitcoin dominance may present the required tailwind for LINK to achieve momentum and transition right into a bullish part in tandem with broader market motion.

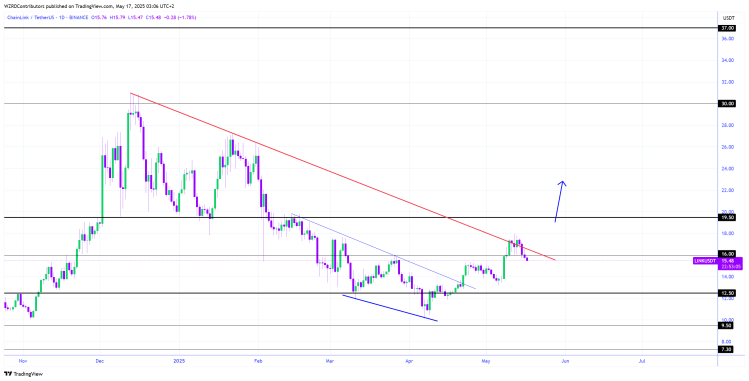

For LINK, the $16 stage has grow to be an essential assist zone as a bullish reversal from this space would add impulsive worth motion, probably driving Chainlink towards the $19.50 resistance goal within the close to time period.

If Chainlink breaks decisively above $19.50, CRYPTOWZRD anticipates a extra substantial rally that might propel the asset in the direction of the $30 resistance stage. Nonetheless, these bullish outcomes hinge on a constant upside strain and a wholesome worth construction to assist the transfer.

At this juncture, the market is ready for the formation of the following commerce setup, whether or not it’s a powerful reversal off assist or a clear breakout above resistance, to supply momentum for the following vital transfer.

Watch For Breakout Or Consolidation

In conclusion, the analyst noticed that at this time’s intraday chart was characterised by uneven and gradual worth motion, with no clear course established. Given the shortage of momentum, the expectation is heightened volatility because the market works by these ranges. Nonetheless, the worth wants to interrupt decisively above the $16.80 intraday resistance stage to set off a stable lengthy entry.

That mentioned, there may be additionally the likelihood that worth might transfer sideways within the close to time period, consolidating inside a variety. If that happens, $15.85 will act as the important thing intraday assist goal, the place the market may discover momentary stability earlier than deciding its subsequent transfer. With the present indecisiveness available in the market, one of the best plan of action is to attend for a well-formed chart sample or a transparent setup that gives a high-probability commerce entry.