- Diverging Market Sentiment: Binance Coin (BNB) barely moved over the previous 24 hours, however spot merchants are accumulating whereas futures merchants stay bearish. Spot merchants pulled $31.28 million price of BNB off exchanges this week, indicating long-term confidence.

- Futures Market Weak point: Regardless of spot accumulation, the Taker Purchase/Promote Ratio is at 0.955, exhibiting increased promoting strain. Open Curiosity has dropped to $789.9 million, signaling decreased conviction amongst futures merchants.

- Growth Exercise Declines: BNB Good Chain’s improvement exercise is slowing, with sensible contract deployments down 34.77% and verified contracts falling 22.69% in 24 hours, doubtlessly impacting BNB’s value motion.

Binance Coin (BNB) barely moved over the previous 24 hours, gaining simply 0.10%. However whereas the floor seems calm, the undercurrents inform a extra complicated story – one in every of combined market sentiment and diverging dealer conduct.

Spot and Futures Merchants Take Reverse Sides

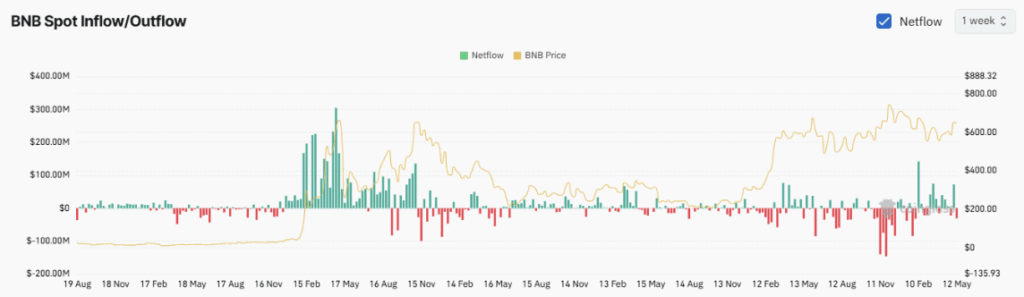

Spot merchants have taken a decidedly bullish stance. Over the previous day, $8.34 million price of BNB flowed out of exchanges, including to a weekly web outflow of $31.28 million. That type of motion often means merchants are scooping up BNB and shifting it to personal wallets, a basic signal of long-term confidence.

Nevertheless, within the futures market, the temper is noticeably totally different. In line with CoinGlass, Binance’s largest futures merchants are literally extra bearish than bullish. The Taker Purchase/Promote Ratio presently sits at 0.955, suggesting promoting strain is barely outweighing shopping for strain. The broader market ratio is even decrease at 0.9139, indicating weak shopping for curiosity general.

Open Curiosity Falls as Conviction Wanes

Open Curiosity (OI) – a measure of unsettled contracts within the futures market – has additionally taken a success. It’s fallen from $855.2 million in early Might to $789.9 million now. That type of drop factors to fading momentum and fewer dealer conviction.

Curiously, brief sellers took heavier losses within the final 24 hours, dropping $102,560, in comparison with $2,140 in losses for longs. That tilt may imply the market is beginning to flip in opposition to shorts, giving the sting to the bulls – but it surely’s nonetheless too early to name.

Growth Exercise Slows on BNB Good Chain

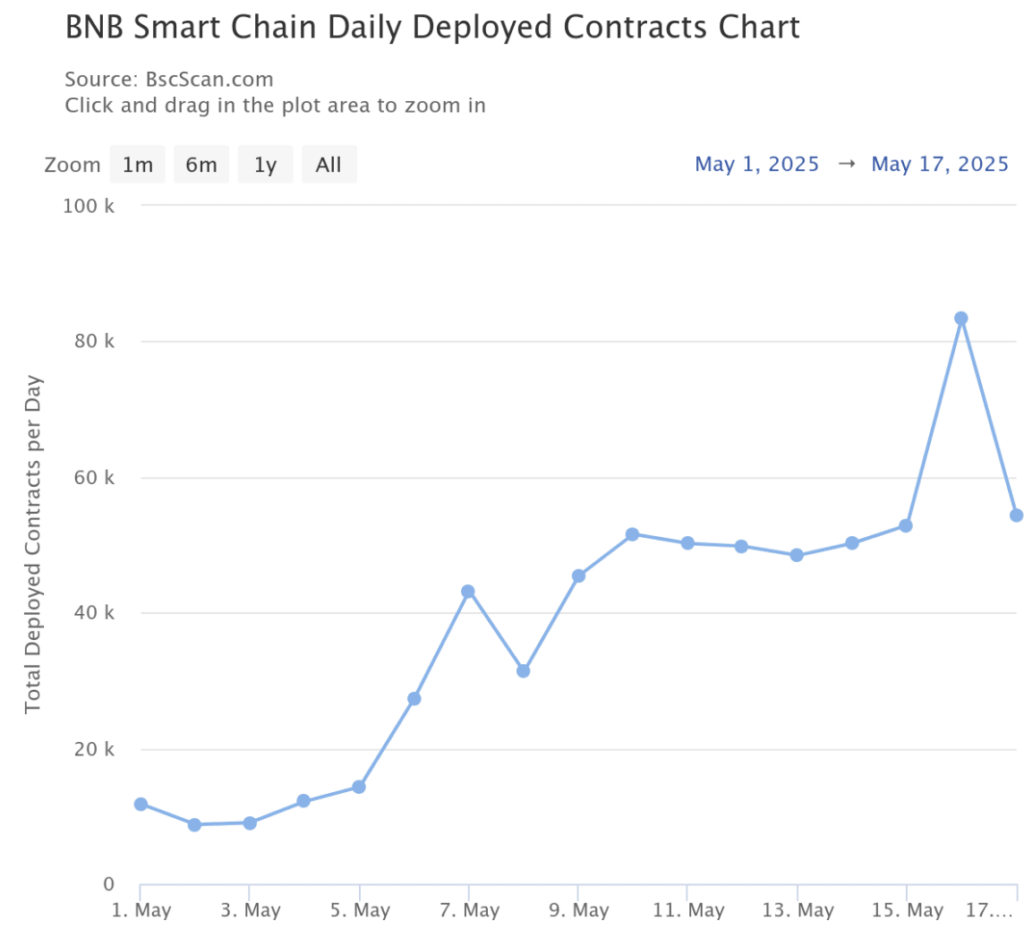

In the meantime, the BNB Good Chain can be sending combined indicators. After a stable run of exercise earlier this month, sensible contract deployment has fallen off a cliff. In line with BscScan, every day contract deployments dropped 34.77% in 24 hours, touchdown at 54,369 contracts.

Verified contracts additionally slid by 22.69% to 259, suggesting decrease community utilization and doubtlessly much less on-chain demand for BNB.

What’s Subsequent for BNB?

Proper now, the BNB market is caught in a push-pull between bullish spot merchants and bearish futures gamers. If improvement exercise continues to say no and adverse sentiment round BNB persists, the coin may face additional draw back. But when on-chain exercise picks up and spot merchants preserve accumulating, a rally may not be off the desk simply but.