Japanese agency Metaplanet noticed its inventory worth surge to three-month highs on Monday after saying its newest Bitcoin (BTC) acquisition. The corporate added 1,004 BTC to its treasury, marking its third important buy this month.

Every week earlier, it had acquired 1,241 BTC, surpassing El Salvador’s reserves. Beforehand, on Might 7, Metaplanet made a relatively smaller buy of 555 BTC.

In keeping with the official disclosure, the most recent transaction was valued at 15.19 billion yen (roughly $104.3 million). Metaplanet’s common shopping for value was 15.13 million yen, equal to $103,873 per BTC.

“From July 1, 2024, to September 30, 2024, the Firm’s BTC Yield was 41.7%. From October 1, 2024, to December 31, 2024, the Firm’s BTC Yield was 309.8%. From January 1, 2025, to March 31, 2025, the corporate achieved a BTC Yield of 95.6%. Quarter to Date, from April 1, 2025, to Might 19, 2025, the Firm’s BTC Yield is 47.8%,” the assertion learn.

Metaplanet points zero-coupon extraordinary bonds to fund these purchases. In Might 2025, it issued bonds price $64.7 million. This consists of $24.7 million from the twelfth Collection issued on Might 2, $25 million from the thirteenth Collection authorized on Might 7, and $15 million from the fifteenth Collection issued on Might 13.

The corporate now holds a complete of seven,800 Bitcoin, with an combination funding of 105.38 billion yen, or roughly $712.5 million. The common historic buy worth throughout its Bitcoin holdings stands at 13.5 million yen per BTC, roughly $91,343 per coin.

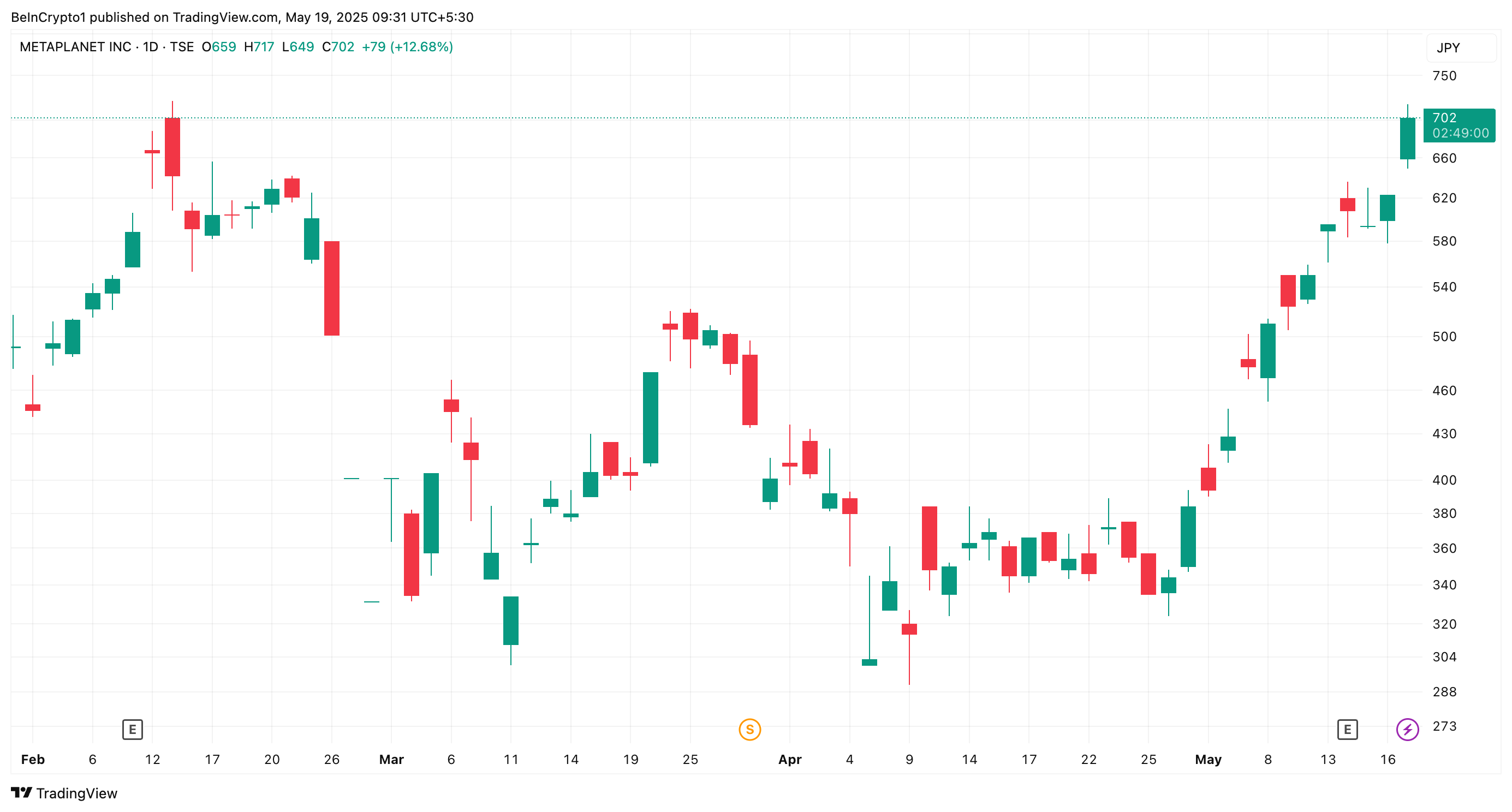

In the meantime, following the information, Metaplanet inventory, 3350.T, appreciated by 12.6%, in line with Yahoo Finance knowledge. At press time, its buying and selling worth was 702 yen ($4.8), marking highs final seen on February 13.

Over the previous month alone, 3350.T’s worth has elevated by 101.7%, drastically benefiting from Bitcoin’s newest rally. Actually, since adopting a Bitcoin reserve technique, the inventory costs have elevated over 15-fold.

The agency’s monetary efficiency additional helps this upward trajectory. In its Q1 FY2025 earnings report, Metaplanet disclosed revenues of $6 million, with 88% derived from Bitcoin choices buying and selling.

This highlighted the vital function BTC performs in its monetary success. Because the agency continues integrating Bitcoin into its financial technique, it’s setting a brand new benchmark for company crypto adoption within the area.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.