- Germany offered 49,858 BTC in mid-2024 for about $2.86 billion, averaging $57,900 per coin.

- By Could 2025, these cash could be value over $5.2 billion, indicating a missed revenue of round $2.3 billion.

- This situation highlights the potential advantages of long-term Bitcoin holding and the dangers of untimely liquidation.

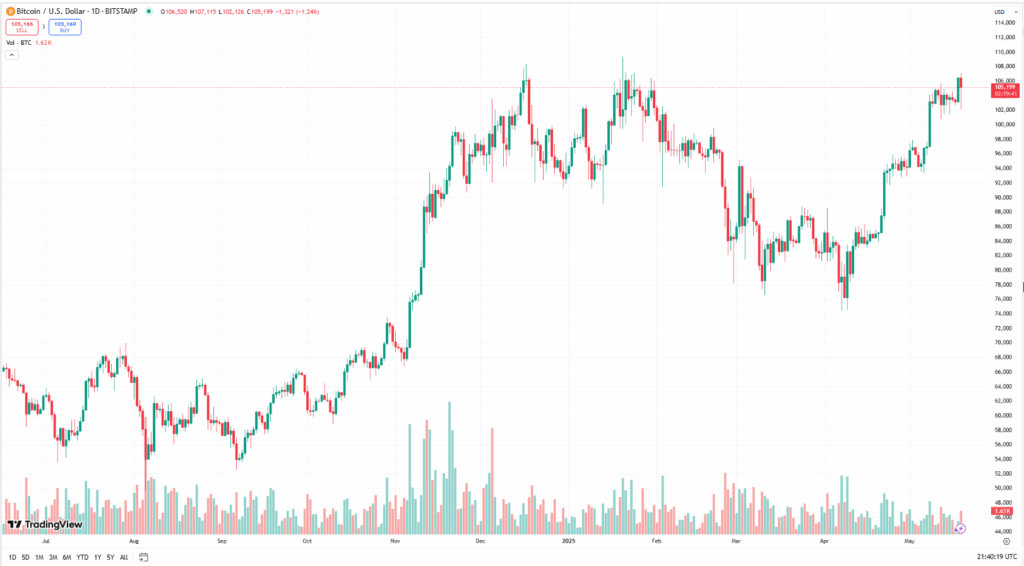

In mid-2024, German authorities offered off 49,858 BTC—seized from the Movie2K piracy case—between June 19 and July 12, netting roughly $2.86 billion at a median value of $57,900 per coin. The sale was performed throughout a number of exchanges, together with Bitstamp, Kraken, and Coinbase, to mitigate market influence.

The Missed Alternative

Quick ahead to Could 2025, and Bitcoin‘s value has surged to over $107,000 and now sits round $105K on the time of writing. The BTC offered by Germany would now be value roughly $5.2 billion, indicating a missed revenue of round $2.3 billion.

Authorized Obligations and Market Impression

Beneath German legislation, seized property have to be offered if their worth fluctuates by greater than 10% to forestall potential losses on account of volatility. This authorized requirement compelled the authorities to liquidate the Bitcoin holdings promptly.

Nonetheless, the large-scale sale exerted downward strain on Bitcoin’s value throughout that interval, contributing to a market dip.

Classes Discovered

Germany’s expertise underscores the challenges of managing digital property inside inflexible authorized frameworks. Whereas the sale was legally mandated, the timing resulted in important missed features.

For particular person buyers, this serves as a reminder of Bitcoin’s long-term potential. Holding by volatility, slightly than reacting to short-term market actions, can result in substantial features.

Conclusion

Germany’s $2.3 billion missed alternative illustrates the significance of strategic decision-making in asset administration. For Bitcoin holders, it reinforces the worth of endurance and long-term perspective in navigating the cryptocurrency market.