Core Scientific (CORZ), Robinhood Markets (HOOD), and Technique Integrated (MSTR) are drawing consideration at this time. CORZ rose after appointing Elizabeth Crain to its Board and reinforcing its shift towards AI infrastructure.

HOOD confirmed a $250 million CAD acquisition of WonderFi, increasing into Canada and going head-to-head with Wealthsimple. MSTR purchased 7,390 BTC for $765 million, elevating its complete holdings to over 576,000 BTC, whereas going through a class-action lawsuit over its Bitcoin-focused technique.

Core Scientific (CORZ)

Core Scientific (CORZ) closed yesterday with a modest acquire of 0.65% and is already up 5% in pre-market buying and selling, following the appointment of Elizabeth Crain to its Board of Administrators.

Crain brings over thirty years of expertise in funding banking and personal fairness, having co-founded Moelis & Firm and held senior roles at UBS. She can even Chair the Audit Committee, a key place as Core Scientific continues its strategic shift towards AI-related infrastructure.

Her appointment, together with Jordan Levy’s being named Chairman, marks a pivotal second for the corporate because it enhances its management group amid a broader transition in enterprise focus and operations.

CORZ’s chart exhibits indicators of renewed power, with a possible golden cross forming on its EMA traces. Analyst sentiment stays overwhelmingly bullish—16 out of 17 analysts charge the inventory as both a “Sturdy Purchase” or “Purchase,” with a one-year value goal averaging $18.28, representing a 68.49% potential upside.

If momentum holds, the following key resistance degree is $13.18, which might be examined within the brief time period.

Nevertheless, traders ought to look ahead to assist at $10.34; if it fails, the inventory could retrace to $9.45 and even $8.49.

Robinhood (HOOD)

Robinhood has formally introduced its $250 million CAD acquisition of Toronto-based WonderFi, signaling a serious step in its Canadian growth technique.

The deal, which presents a 41% premium over WonderFi’s final closing value, will carry WonderFi’s 115-person group and established crypto manufacturers—Bitbuy, Coinsquare, and SmartPay—underneath Robinhood Crypto’s umbrella.

The acquisition is about to shut within the second half of 2025 and is anticipated to considerably bolster Robinhood’s crypto presence in Canada.

Robinhood Crypto govt Johann Kerbrat not too long ago emphasised the corporate’s deal with tokenization and monetary accessibility, highlighting how fractionalized property like actual property can open up beforehand inaccessible markets to on a regular basis traders.

The corporate submitted a 42-page proposal to the SEC looking for a federal framework for tokenized real-world property. It goals to carry conventional monetary markets on-chain with legally acknowledged asset-token equivalence.

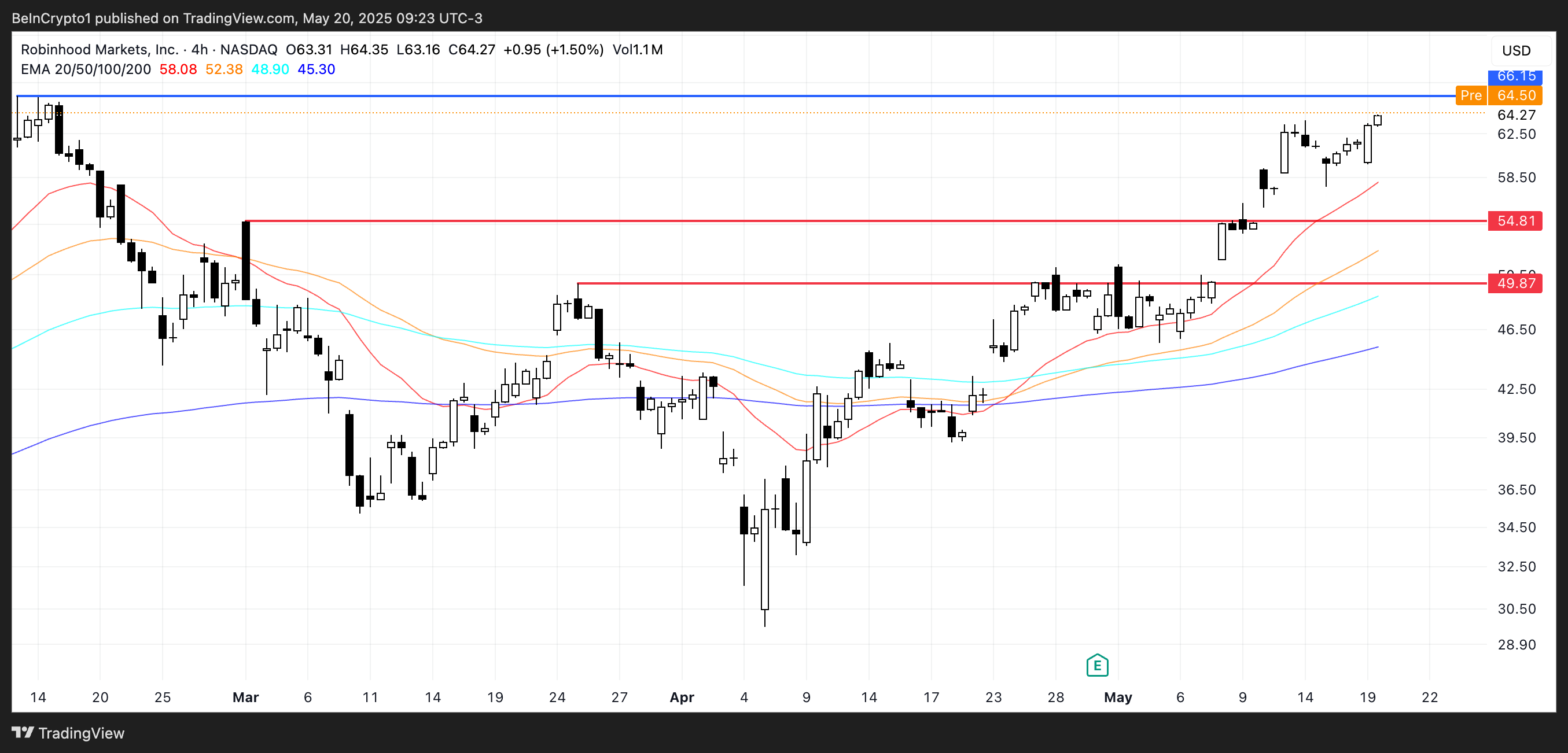

HOOD shares closed up 4% yesterday and are up barely in pre-market buying and selling, extending a exceptional 56% rally over the previous 30 days. Technically, the inventory’s chart exhibits sturdy momentum, with its short-term EMA traces clearly above the long-term development—suggesting sustained bullish sentiment.

The subsequent key resistance sits at $66.15; a clear break above that might push HOOD into uncharted territory, surpassing the $70 mark for the primary time and establishing new all-time highs.

Technique Integrated (MSTR)

Technique (previously MicroStrategy) has added one other 7,390 BTC to its company treasury, spending roughly $765 million as Bitcoin traded above $100,000.

This newest accumulation brings its complete holdings to 576,230 BTC—acquired for $40.2 billion—now valued at over $59.2 billion, reflecting an unrealized acquire of roughly $19.2 billion. Nevertheless, the aggressive Bitcoin technique continues to draw scrutiny.

The corporate and its executives, together with Government Chairman Michael Saylor, have been hit with a class-action lawsuit alleging they misrepresented the dangers tied to their Bitcoin-centric funding strategy.

Technique remains to be the most important company holder of Bitcoin, regardless of authorized stress. Its Bitcoin-first strategy has impressed related treasury methods in Asia and the Center East.

MSTR closed yesterday up 3.4% and is down 0.47% within the pre-market. The inventory is up practically 43% in 2025. It’s buying and selling close to key assist at $404; if misplaced, it may fall to $383.

If momentum returns, MSTR may rise to $437. Analyst sentiment is robust—16 out of 17 charge it a “Sturdy Purchase” or “Purchase.” The one-year common value goal is $527, implying a 27.5% upside.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.