- Robust Fundamentals: Sui recorded $9.3M in fund inflows final week and noticed its DeFi TVL rise above $2B. Stablecoin market cap jumped 23.5%, and DEX quantity hit $4.14B.

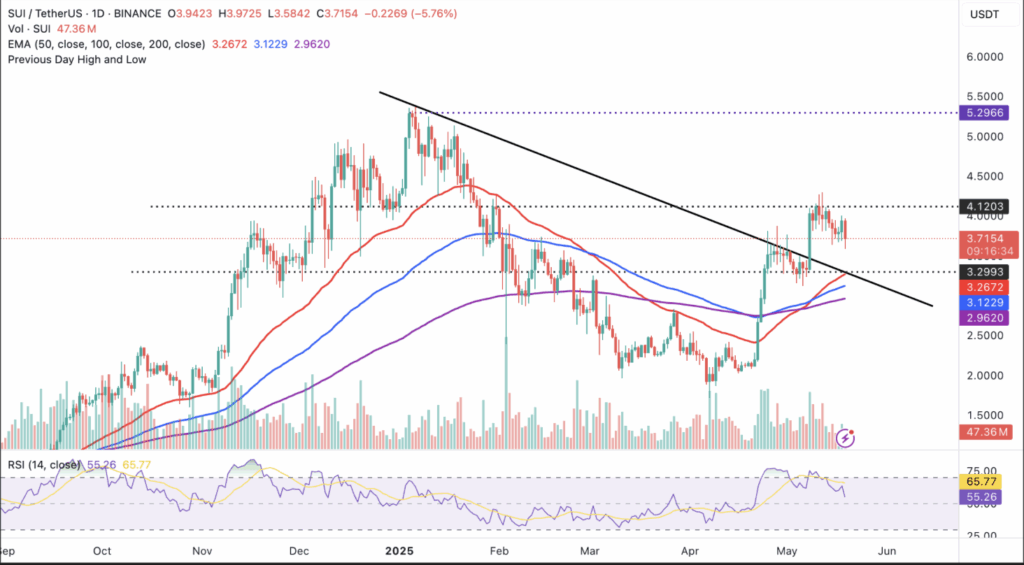

- Present Worth Motion: SUI is buying and selling round $3.71, down over 6% on the day, with RSI falling from overbought ranges — signaling short-term bearish momentum.

- Help & Pattern: Key assist lies at $3.50 and $3.26, with longer-term EMAs nonetheless rising; the general development stays bullish if SUI holds above these transferring averages.

Sui (SUI) has been dealing with some resistance round $3.71 on Monday, coming off a barely bullish weekend. After that sentiment-fueled bounce to $4.30 again on Could 12, the token’s been caught under the $4 mark — even with regular fund inflows.

Bullish Sentiment, However Worth Stalls

In line with CoinShares, Sui pulled in $9.3 million in digital asset fund inflows final week. Not unhealthy, but it surely nonetheless trails behind the large guys — XRP has $1.42B in AUM, and Solana’s at $1.6B, whereas Sui sits round $332 million.

Throughout the board, digital asset merchandise noticed $785 million in inflows, marking 5 weeks straight of features. Bitcoin took the largest slice ($557M), and Ethereum racked up $205M because of recent optimism across the Pectra improve.

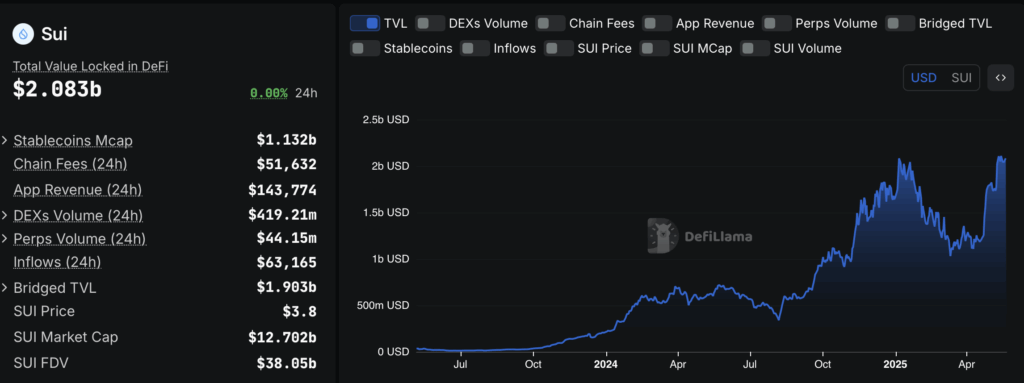

Sui’s fund inflows align with regular progress in its DeFi TVL (Complete Worth Locked), which is now sitting simply over $2 billion. That’s up from $1.78 billion firstly of Could — a very good signal, exhibiting confidence within the ecosystem. Rising TVL sometimes means folks belief the protocol and count on future upside.

Stablecoins and DEX Quantity Climb

Sui’s stablecoin market cap jumped 23.5% final week, hitting $1.09B, principally because of USDC. Decentralized alternate (DEX) quantity additionally popped off — up 10.47% to $4.14B in weekly trades. These are all stable indicators that person exercise is climbing.

The place’s SUI Headed Subsequent?

Proper now, SUI is down over 6% on the day, sitting round $3.71. It even dipped to $3.59 earlier Monday. The RSI has been falling too, now closing in on the 50 mark after being means overheated (75.53) on Could 8. This slide in RSI strains up with the drop from the current $4.30 excessive — exhibiting sellers nonetheless have the sting, not less than for now.

Key assist to observe? $3.50 (already examined earlier than), then $3.26 (close to the 50-day EMA), and additional down round $2.96 on the 200-day EMA.

Massive Image: Warning, However Not Panic

Quick-term, it’s a bit uneven. However SUI’s nonetheless holding above its key transferring averages: 50-day at $3.26, 100-day at $3.12, and 200-day at $2.96. These are all trending upward, which normally means bulls aren’t out of the sport but.

So yeah, it would look slightly bearish within the quick time period, however zooming out? The construction nonetheless favors patrons — so long as these EMAs maintain.