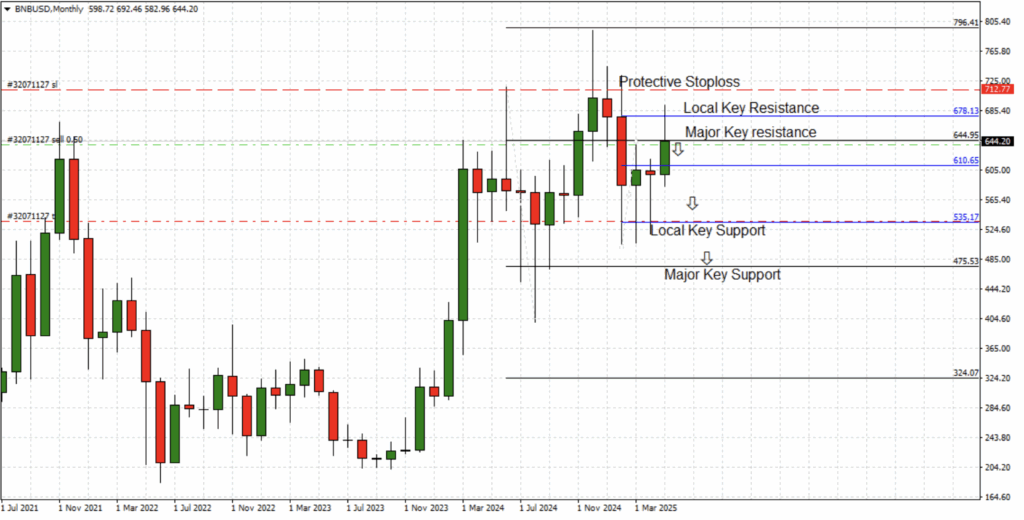

- Bearish Stress: BNB failed to interrupt above $644.95 resistance, signaling weakening momentum; draw back targets embrace $610.65, $535.17, and $475.53.

- Worth Motion: Decrease highs and bearish divergence counsel additional declines, with potential acceleration if assist at $610.65 cracks.

- Market Dynamics: Regardless of Binance’s sturdy ecosystem, regulatory pressures and macro uncertainty are weighing on BNB’s worth outlook.

Binance Coin (BNB) is dealing with mounting bearish strain after hitting a significant resistance zone at $644.95. Regardless of current makes an attempt by bulls to push increased, the broader technical outlook stays weak, with indicators pointing to a possible draw back reversal as sentiment cools off.

Key Ranges to Watch

BNB not too long ago examined the $644.95 resistance however failed to interrupt by way of, establishing it as a key ceiling. Quick positions might take into account inserting stops above the following resistance at $712.80, the place robust promoting strain is more likely to emerge.

On the draw back, fast assist is seen at $610.65. If this stage cracks, BNB may slide additional to $535.17. Beneath that, the following main assist rests at $475.53, a stage that might develop into a magnet if bearish momentum accelerates. In a deeper market correction, $324.07 is the longer-term assist to watch.

Worth Motion and Momentum

BNB’s technical construction reveals persistent weak point, with decrease highs forming on the month-to-month chart. The shortcoming to clear $644.95 suggests fading bullish momentum, and momentum indicators now trace at a doable pattern reversal. If BNB slips beneath $610.65, bearish strain may intensify, concentrating on $535.17 and probably decrease ranges.

Expertise and Market Dynamics

Basically, Binance stays a significant participant with a sturdy ecosystem spanning DeFi, NFTs, and a high-performance blockchain. Nonetheless, regulatory headwinds and shifting market dynamics have weighed on BNB’s worth motion. Whereas the long-term imaginative and prescient for Binance stays intact, merchants are presently extra targeted on short-term technical dangers and macro uncertainty.

Conclusion

BNB is struggling to regain its footing above $644.95, with bearish momentum constructing beneath this stage. Additional declines towards $610.65 and $535.17 are doable if key helps fail to carry, setting the stage for deeper draw back strikes.