Ethereum’s value has surged by 5% over the previous 24 hours, amid the broader market restoration. The main altcoin at present trades above the psychological $2,500 value zone, reinforcing short-term bullish sentiment.

Nonetheless, key technical and on-chain indicators counsel that the upward momentum could also be waning.

ETH’s Technical Setup Turns Bearish

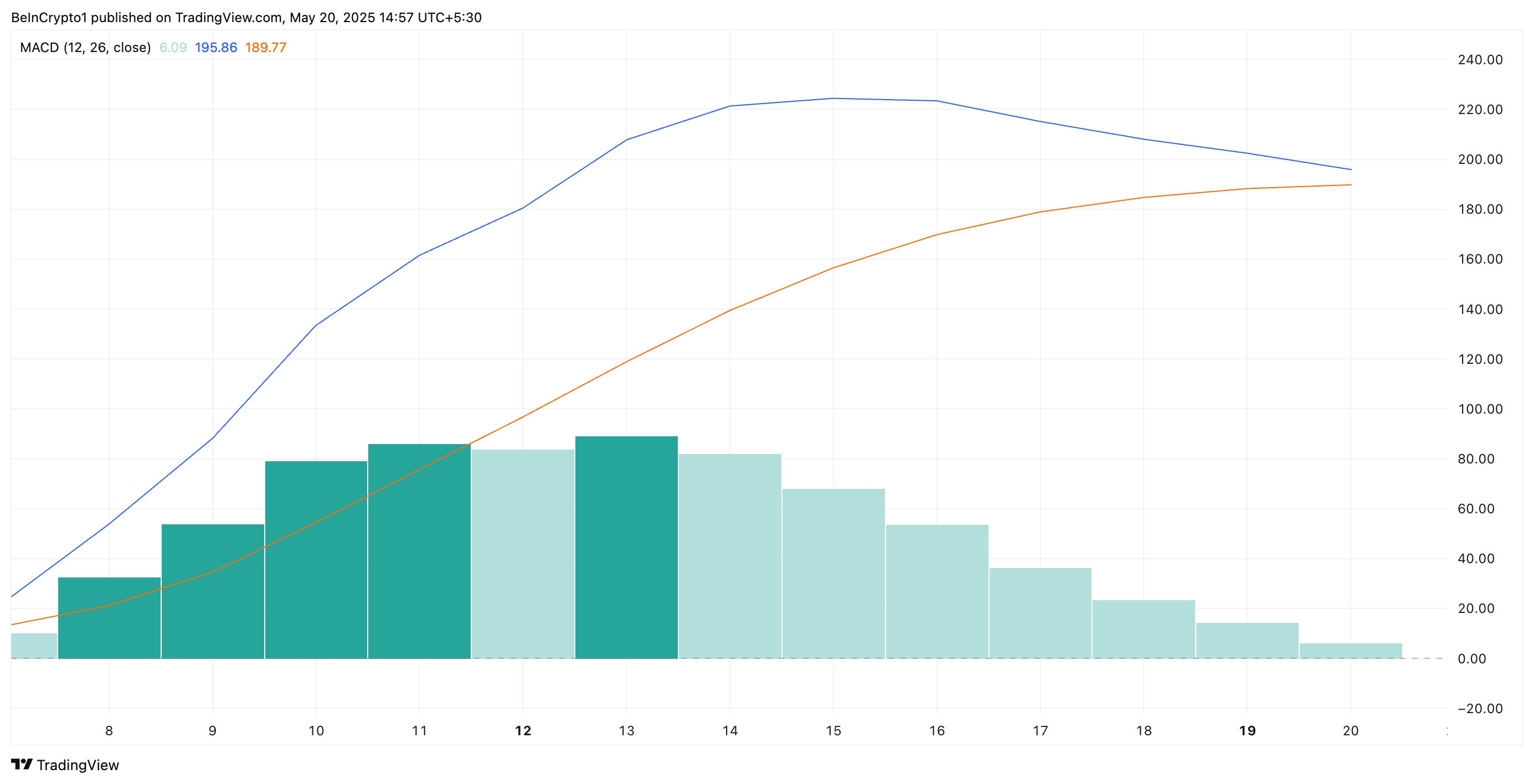

An evaluation of the ETH/USD one-day chart reveals the potential formation of a demise cross on its Transferring Common Convergence Divergence (MACD) indicator.

This bearish sample emerges when an asset’s MACD line (blue) breaks beneath the sign line (orange), signaling a shift from bullish to bearish momentum. Such a sample typically precedes vital value drops, particularly when accompanied by weakening optimistic sentiment.

As of this writing, ETH’s MACD line is about to cross beneath its sign line. If this occurs, the demise cross would verify the brewing promoting strain and sign the beginning of an prolonged, downward pattern.

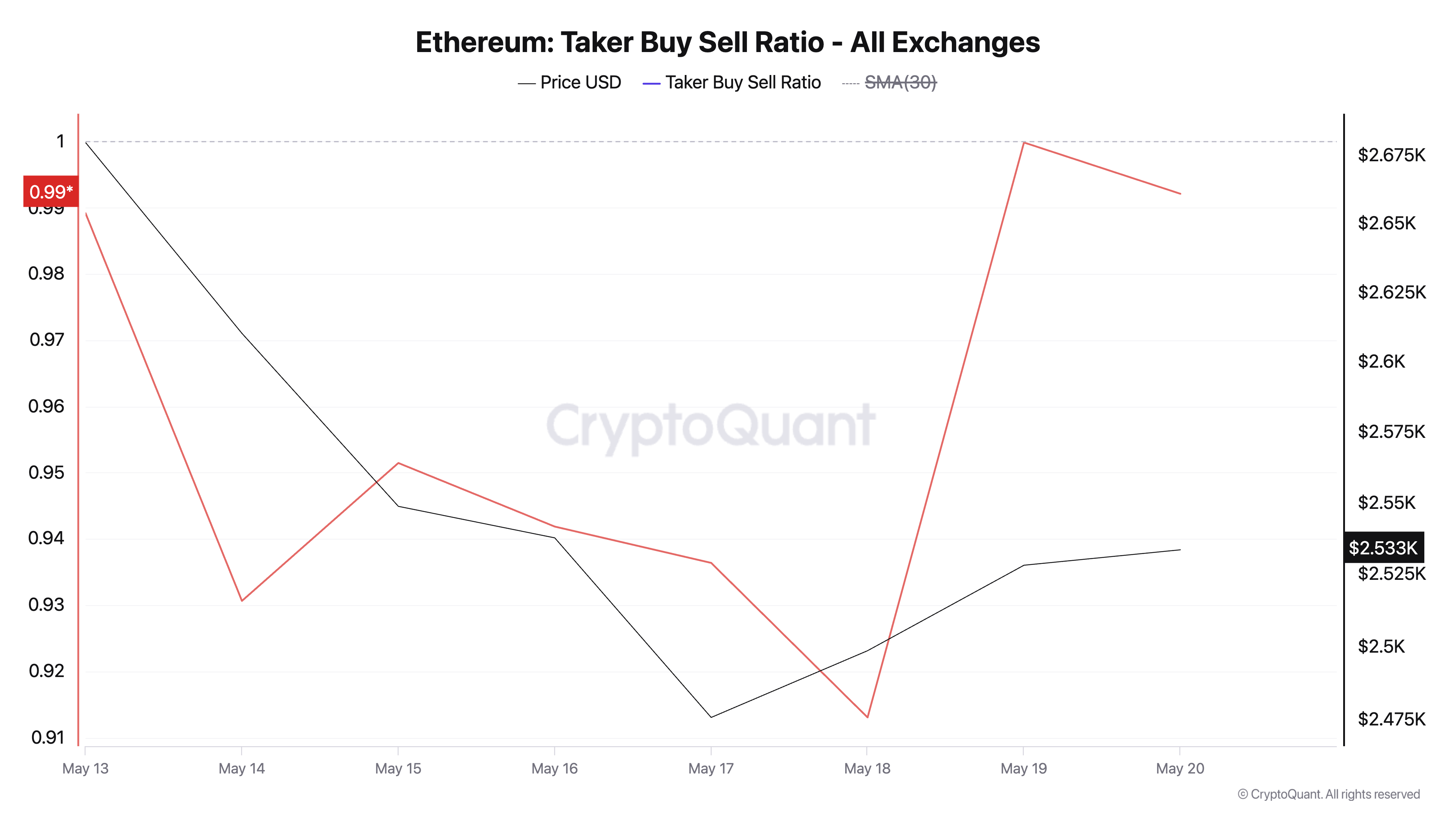

Moreover, ETH’s Taker Purchase-Promote Ratio is beneath one at press time, indicating persistent sell-side dominance in its derivatives market.

This metric measures the ratio between the purchase and promote volumes in ETH’s futures market. A worth above 1 means that extra merchants are aggressively shopping for ETH contracts than promoting, whereas values beneath 1 point out dominant promote strain.

The continued prevalence of taker-sell quantity means that, regardless of the worth uptick, underlying demand stays weak within the ETH market.

ETH Value Dangers Deeper Drop as Sellers Goal $2,027

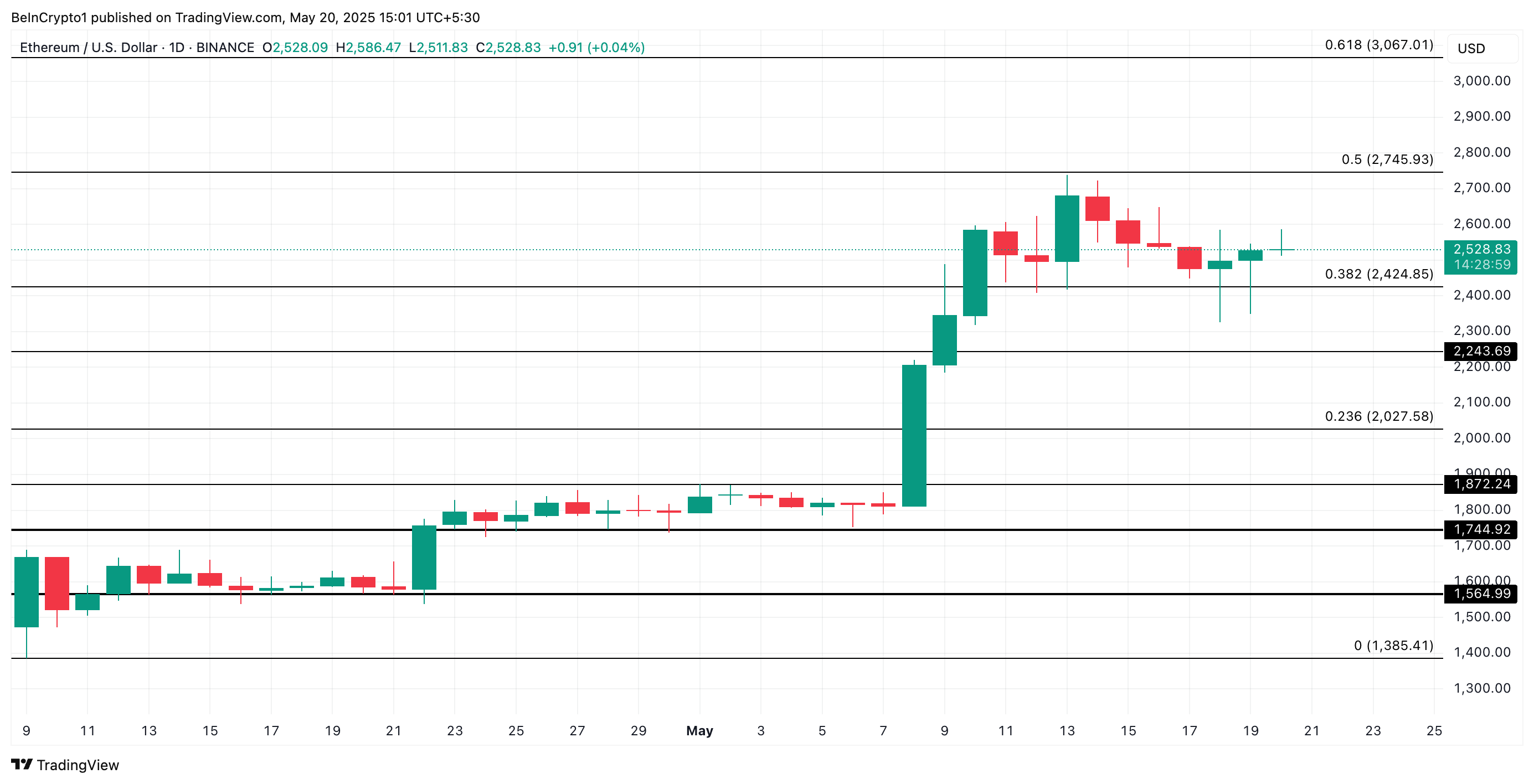

At press time, ETH trades at $2,528. With waning underlying shopping for strain, the main altcoin dangers dropping towards assist at $2,424.

If bearish strain strengthens at this degree, ETH sellers may breach this assist flooring, triggering additional declines to $2,027.

Nonetheless, if the bulls regain dominance and new demand for ETH spikes, its value may regain energy and climb to $2,745.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.