On Monday, Bitcoin’s worth surged previous the psychological $105,000 mark, fueling renewed confidence amongst institutional traders and prompting capital inflows into spot Bitcoin exchange-traded funds (ETFs).

That day, inflows into these funds exceeded $650 million, led by BlackRock’s IBIT ETF.

Spot BTC ETFs Publish 4-Day Influx Streak

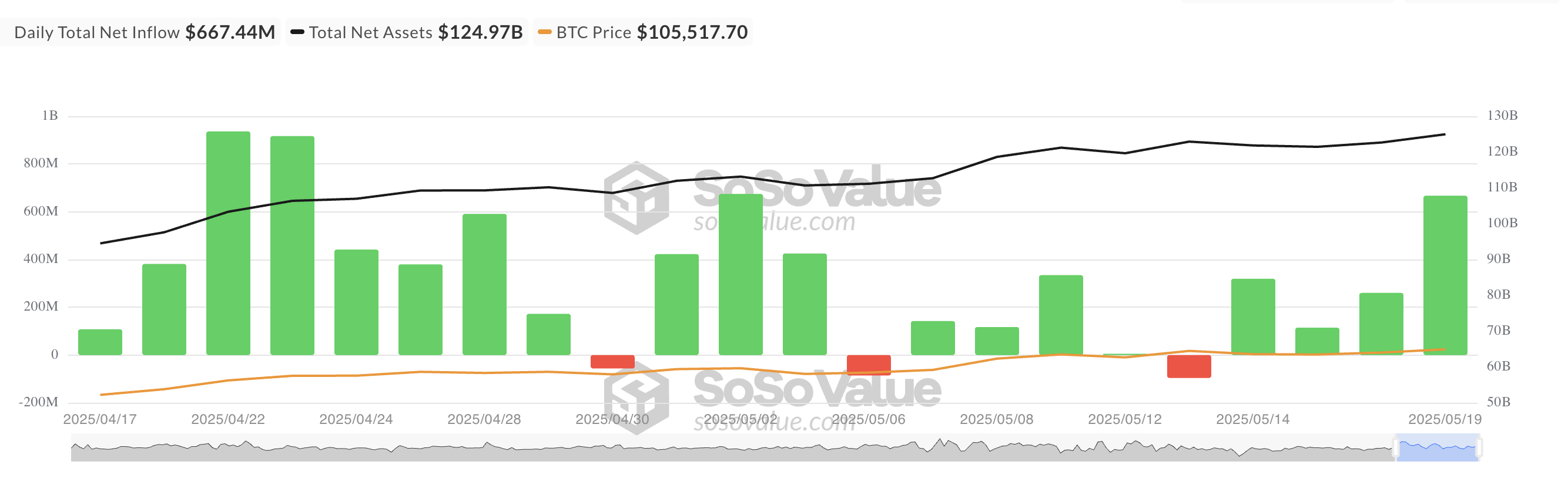

Yesterday, US-listed spot BTC ETFs recorded a mixed internet influx of over $667.44 million—their highest single-day influx since Could 2. It additionally marked the fourth consecutive day of constructive inflows into these funds, reflecting rising institutional urge for food amid indicators of a broader market restoration.

Throughout Monday’s intraday buying and selling session, BTC briefly rallied to a each day excessive of $107,108. Though it skilled a slight pullback, closing above the important thing $105,000 stage was sufficient to set off renewed investor confidence and drive important inflows into spot ETFs.

BlackRock’s ETF IBIT recorded the most important each day internet influx, totaling $305.92 million, bringing its complete cumulative internet inflows to $45.86 billion.

Constancy’s ETF FBTC recorded the second-highest internet influx of the day, attracting $188.08 million. The ETF’s complete historic internet inflows now stand at $11.78 billion.

BTC Rally Gathers Steam

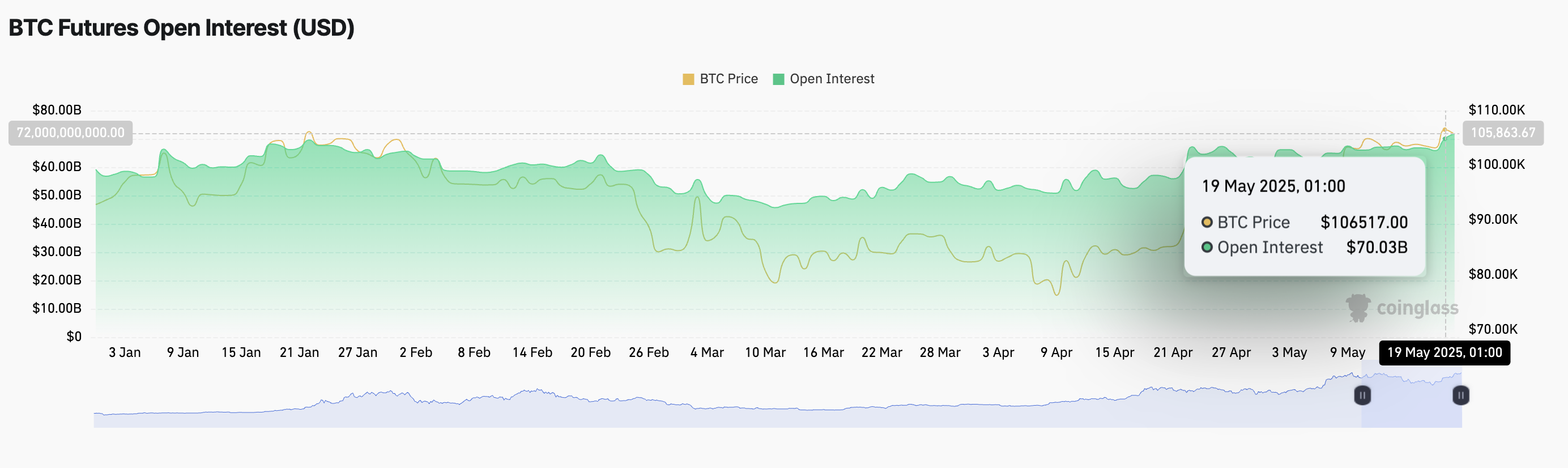

Up 3% over the previous day, BTC at the moment trades at $105,543 and is witnessing a strengthening bullish bias. That is mirrored in its futures open curiosity, which has climbed to its highest stage year-to-date. At press time, it’s over $70 billion, climbing 1% over the previous 24 hours.

When an asset’s open curiosity rises alongside its worth, new cash is coming into the market to assist the upward pattern. This pattern signifies sturdy bullish sentiment and the potential for a sustained BTC worth rally.

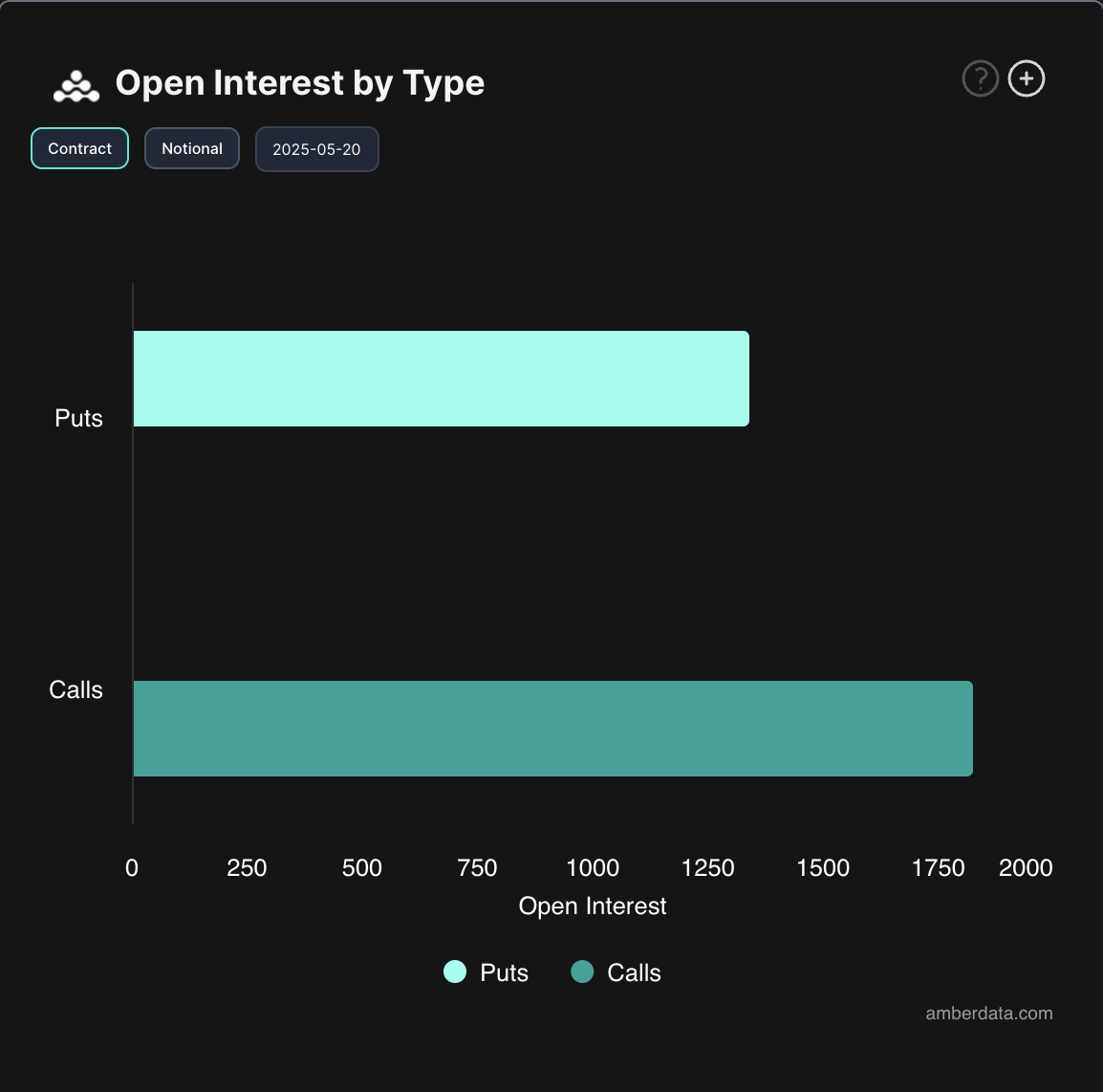

Furthermore, in the present day, the choices market has seen elevated demand for name choices—contracts that wager on greater costs—additional confirming the prevailing market optimism.

One could say that the numerous ETF inflows, climbing derivatives exercise, and BTC’s reclaiming of a key psychological worth stage sign a possible shift in sentiment and trace on the chance of the king coin touching a brand new all-time excessive within the close to time period.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.