Hedera (HBAR) is below strain, down 3.6% within the final 24 hours and 13.6% over the previous week. Its value is struggling under $0.21 and hovering close to $0.185. Market cap has dropped under $8 billion, reflecting weakening sentiment.

Momentum indicators like RSI and BBTrend are bearish, and a potential EMA demise cross provides to draw back threat. HBAR is now at a key stage the place holding assist might stop additional losses.

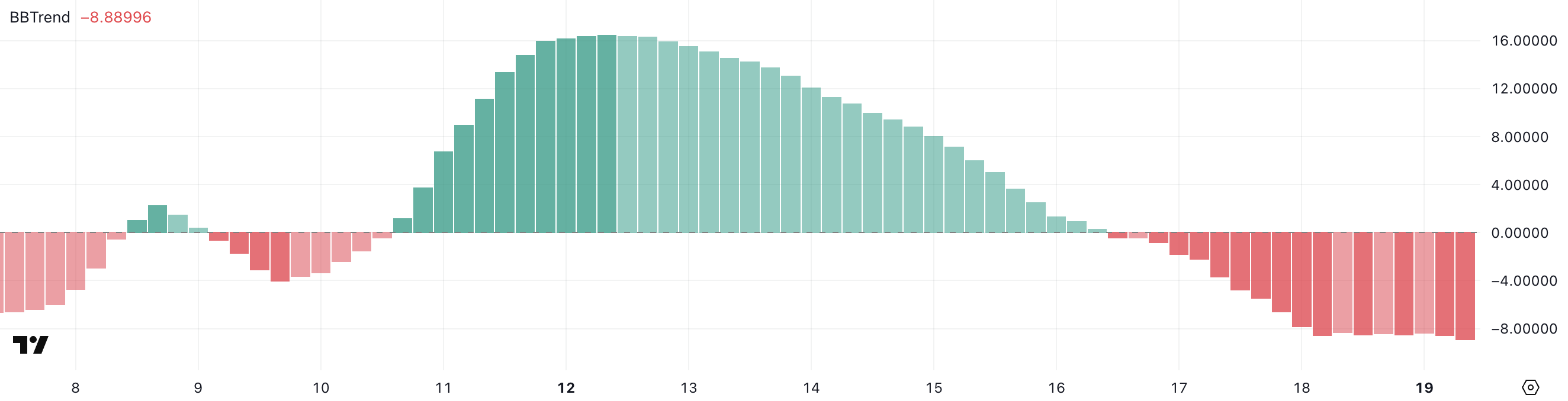

HBAR Momentum Fades as BBTrend Holds Under Zer

Hedera’s BBTrend has fallen to -8.88, turning destructive on the finish of Could 16 after sustaining constructive territory from Could 11 to Could 16.

Since then, the indicator has remained constantly bearish, hovering between -8 and -8.5 over the previous day.

This sustained drop means that bullish momentum has absolutely light, and HBAR is now experiencing stronger draw back strain.

BBTrend, or Bollinger Band Development, gauges the power and course of value actions by analyzing how far value deviates from its common relative to volatility.

Constructive values usually sign bullish momentum, whereas destructive values counsel bearish situations. With HBAR’s BBTrend now deeply destructive at -8.88, the token could also be coming into a weakening development section.

Except the development reverses quickly, this stage signifies that HBAR might proceed to face issue breaking resistance or regaining upward momentum.

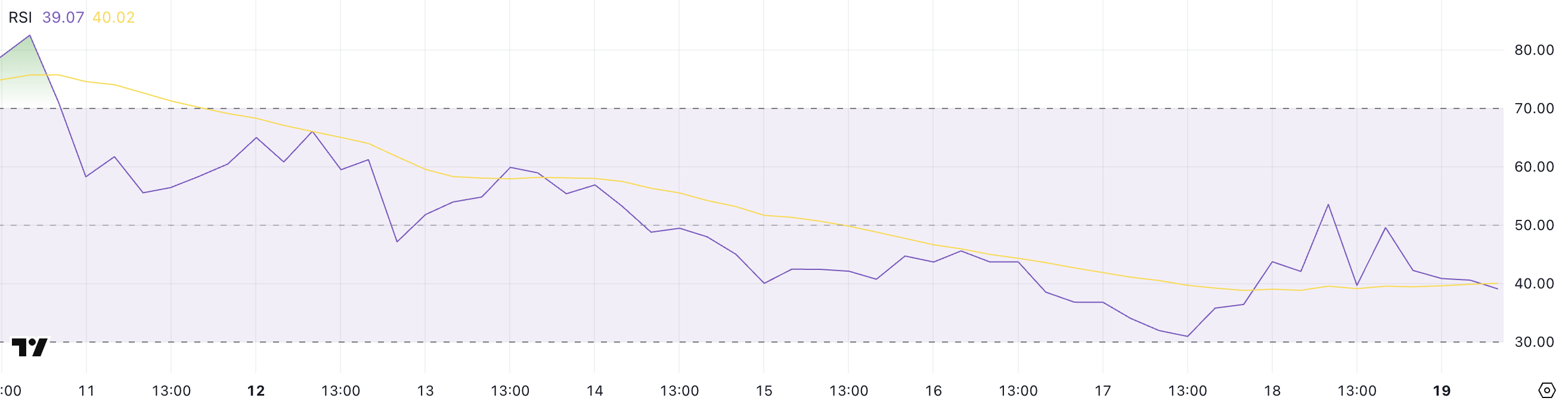

Hedera RSI Fails to Maintain Restoration, Slips Again Into Bearish Zone

Hedera’s RSI is at the moment at 39, reflecting a lack of momentum after a quick restoration try. Two days in the past, RSI hovered close to the oversold threshold at 30.92, suggesting that HBAR had been below sturdy promoting strain.

It rebounded sharply to 53.54 yesterday, briefly coming into impartial territory, however rapidly slipped again right down to 39—highlighting that the bounce was short-lived.

This sort of volatility within the RSI typically factors to an absence of conviction from patrons, with sellers nonetheless dominating the market within the brief time period.

The Relative Energy Index (RSI) is a momentum indicator that ranges from 0 to 100, generally used to guage whether or not an asset is overbought or oversold.

Readings above 70 counsel overbought situations and potential for a pullback, whereas values under 30 suggest the asset could also be oversold and ripe for a bounce. At 39, Hedera’s RSI sits in bearish territory—above the oversold zone however nonetheless removed from signaling sturdy shopping for strain.

This mid-low stage suggests warning amongst merchants. Except RSI can reclaim the 50 stage and maintain, HBAR might proceed to face draw back threat or stagnate and not using a clear development reversal.

HBAR Faces Make-or-Break Second Close to $0.185

Hedera value is buying and selling close to a important assist stage at $0.185, with its EMA traces signaling a possible demise cross. On this occasion, short-term shifting averages cross under long-term ones, typically related to the beginning of a deeper downtrend.

If this bearish crossover happens and the $0.185 assist fails to carry, HBAR might slide additional to $0.169.

A breakdown under that may expose the token to further losses, with $0.160 as the following main assist. Ought to promoting strain speed up, a transfer under $0.160 can’t be dominated out, particularly in a sustained bearish surroundings.

On the flip aspect, if HBAR manages to carry above $0.185 and keep away from triggering the demise cross, it might discover renewed shopping for curiosity.

A profitable protection of assist would open the door for a retest of the $0.192 resistance stage.

A breakout there might push HBAR towards $0.202, and if momentum builds, it could even attain as excessive as $0.228.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.