Solana (SOL) is down 5% over the previous seven days and has traded beneath $180 for six consecutive days. Regardless of this, institutional curiosity in SOL is rising, with giant gamers accumulating and staking vital quantities forward of a possible altcoin season.

Nonetheless, technical indicators are exhibiting indicators of weak spot, together with a damaging BBTrend, a bearish Ichimoku Cloud setup, and a looming EMA loss of life cross. These combined alerts recommend that whereas long-term confidence is rising, short-term momentum stays below strain.

Solana Attracts Institutional Curiosity, However Ichimoku Cloud Indicators Uncertainty

Institutional accumulation of Solana is intensifying in Might 2025, signaling robust confidence forward of a possible altcoin season.

Regardless of altcoin buying and selling volumes remaining beneath earlier peak ranges, main gamers have been stacking SOL—staking giant quantities and including to long-term holdings.

Over 65% of SOL’s provide is now staked, and Q1 2025 app income reached $1.2 billion, the strongest in a yr. These traits, mixed with constructive on-chain flows and ecosystem enlargement, place Solana as a frontrunner if altcoin momentum returns.

The Ichimoku Cloud chart for Solana presently displays market indecision with a slight bearish tilt. Value motion is hovering contained in the inexperienced cloud, suggesting consolidation and an absence of clear path.

The blue Tenkan-sen (conversion line) sits beneath the crimson Kijun-sen (baseline), indicating short-term weak spot. The Chikou Span (inexperienced lagging line) is tangled in latest value motion, reinforcing the neutral-to-bearish bias.

Forward, the cloud shifts to crimson and seems flat, pointing to potential resistance and low momentum except a robust breakout happens.

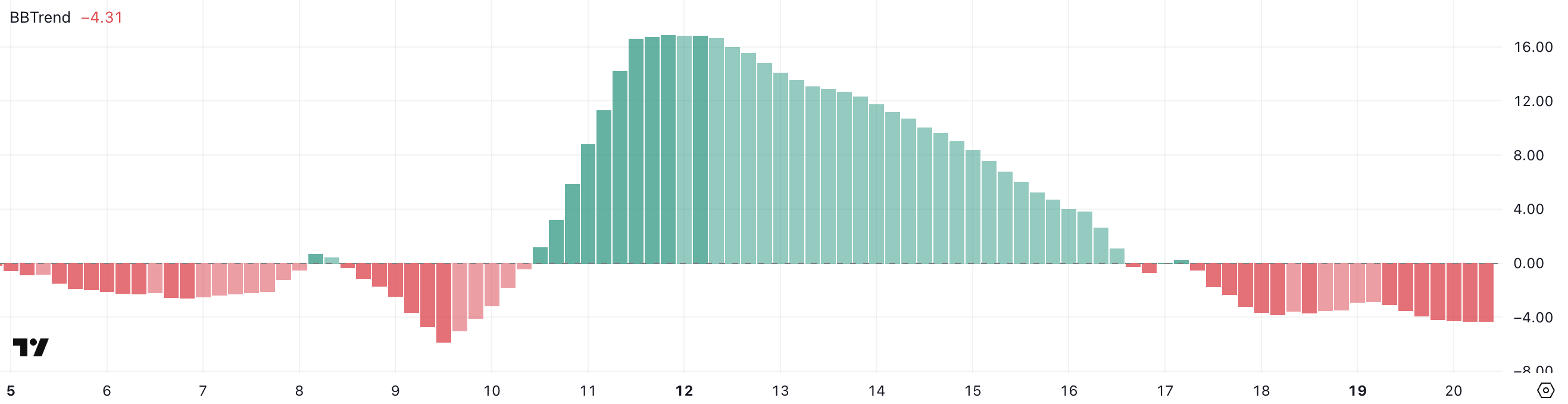

SOL BBTrend Stays Unfavorable, Bearish Momentum Holds Under -4

Solana’s BBTrend is presently at -4.31, marking its third consecutive day in damaging territory.

Over the previous a number of hours, the indicator has remained secure round -4, suggesting constant bearish strain within the brief time period.

The BBTrend (Bollinger Band Development) measures the power and path of value motion relative to the width of the Bollinger Bands.

Values above 0 usually point out bullish momentum, whereas values beneath 0 sign bearish momentum. A BBTrend at -4.31 displays robust downward strain and restricted volatility enlargement to the upside.

If this development continues, it might level to additional consolidation or perhaps a deeper pullback except a pointy reversal breaks the sample.

Demise Cross Setup May Push SOL Again To $141 If $160 Assist Fails

Solana’s EMA traces are converging and will quickly kind a loss of life cross, a bearish technical sign the place the short-term EMA crosses beneath the long-term EMA. If that happens, SOL value may check the assist stage at $160.

A breakdown beneath this stage may push the value all the way down to $153.99, and if bearish momentum accelerates, Solana could decline additional towards $141.

Alternatively, if Solana regains bullish momentum, the primary resistance to observe is at $176.77.

A profitable breakout above this stage may open the door for an additional rally towards the $184.88 zone.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.