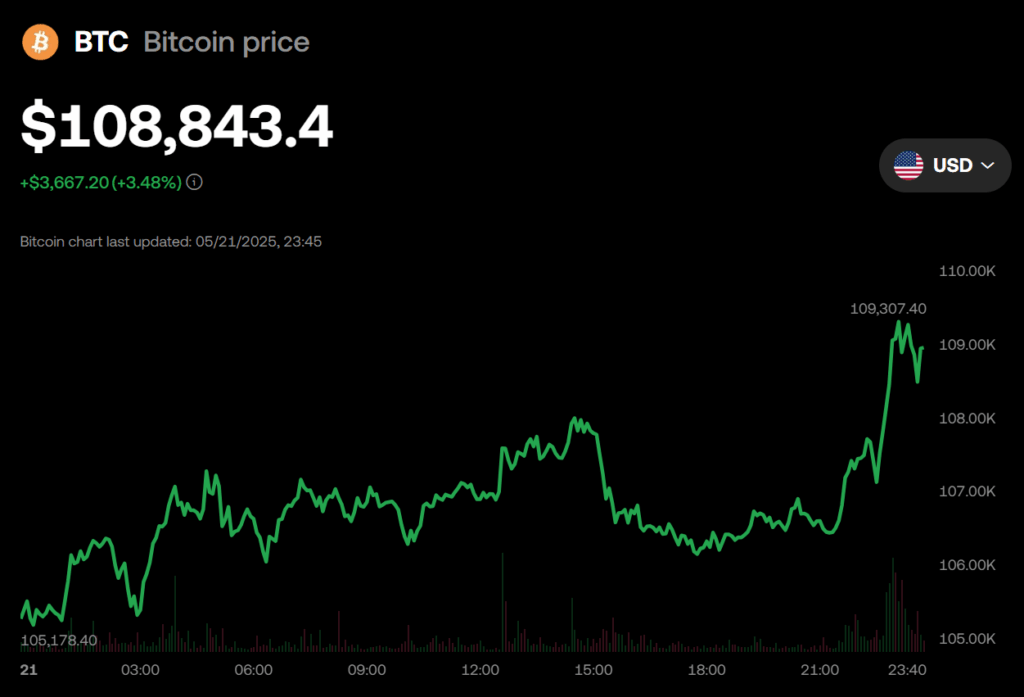

- Bitcoin hit a brand new all-time excessive of $109,458 on Might 21, pushing towards a historic month-to-month shut above $102,400.

- Technical indicators present blended alerts, with bullish short-term momentum however lingering bearish divergences on the weekly chart.

- Analysts are break up between a continued parabolic rally and a possible high, making the following few weeks essential for BTC’s 2025 outlook.

Bitcoin’s bull cost hit a contemporary milestone on Might 21, pushing to an all-time excessive of $109,458. This comes after a historic weekly shut above $106K and positions BTC for its strongest Might shut ever—if it will possibly maintain above $102,400. Analysts say if this retains up, we is perhaps getting into “worth discovery” mode, with merchants focusing on the $130K vary as the following attainable resistance. At this charge, the parabolic vibes are again in play.

Warning Indicators Brewing Beneath the Floor?

Regardless of the rally, some technical indicators are beginning to flash warning. The weekly RSI has been displaying bearish divergence since March, and MACD isn’t precisely bullish both. Whereas these alerts don’t assure a reversal, they recommend that momentum may very well be weakening at the same time as costs push increased. Up to now, Bitcoin has barely dipped—may very well be an indication of energy or a setup for a shock pullback.

Quick-Time period Charts Look Extra Bullish Than Bearish

On shorter timeframes, Bitcoin’s breakout from a rising channel seems robust. The transfer got here proper after bullish divergences confirmed up in each RSI and MACD, which usually precedes extra upside. This helps the concept that BTC’s current consolidation section is behind it, and new highs may nonetheless be on deck—no less than within the quick run. Merchants are watching carefully to see if this energy holds.

The Greater Image: Which Elliott Wave Are We In?

Zooming out, there are two competing wave counts in play. Bulls imagine we’re in wave three, the strongest leg of a five-wave rally. Bears, nonetheless, suppose this is perhaps wave 5—the ultimate push earlier than a significant correction. The bear case struggles with symmetry points in earlier corrections, nevertheless it’s nonetheless technically legitimate. The following few weeks may tip the scales by some means.

Outlook for the Remainder of 2025

Whether or not BTC is gearing up for a large breakout or an end-of-cycle high, one factor’s clear—these subsequent few weeks are important. Worth motion is teetering at historic ranges, and whichever manner it breaks may set the tone for the second half of 2025. For now, momentum is king. But when historical past’s taught us something, it’s to anticipate the surprising when Bitcoin is that this scorching.