- About $300 million in crypto liquidations hit after Trump threatened a 50% tariff on the EU.

- Most losses got here from lengthy positions as BTC reversed sharply after touching $110K.

- Analysts say the liquidation displays a correction after overheating close to all-time highs.

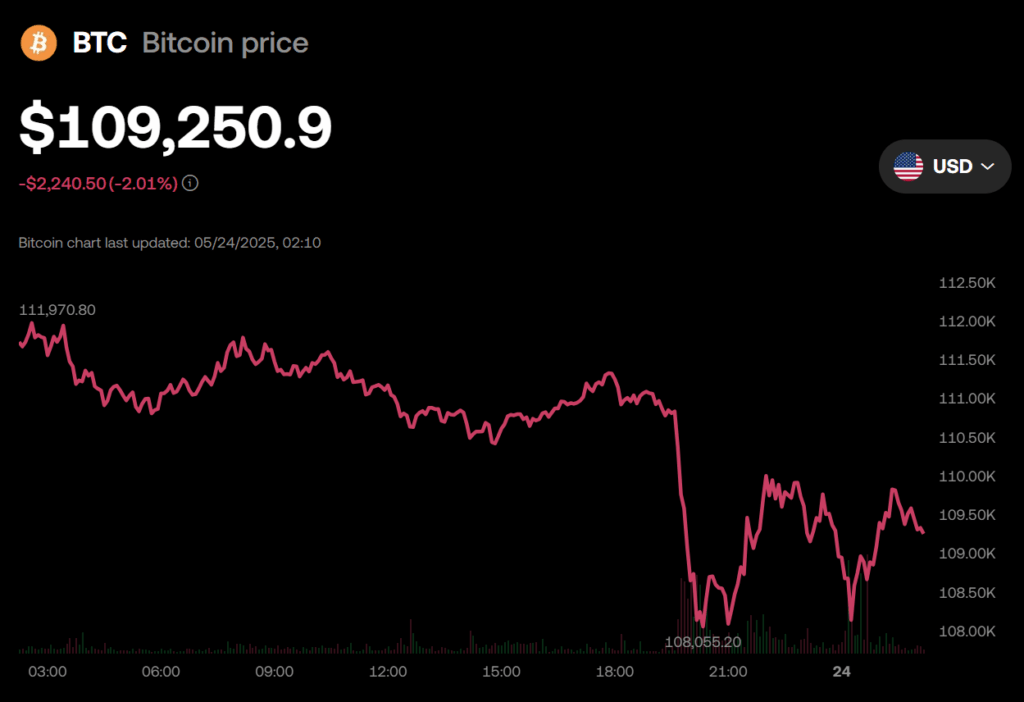

Issues obtained messy within the crypto market this week. On Might 23, round $300 million in compelled liquidations swept throughout main exchanges—proper after U.S. President Donald Trump dropped a shock 50% tariff menace on the European Union. The shock announcement didn’t simply shake world inventory markets—it hit crypto onerous, too.

Longs Received Wrecked as BTC Tumbled Off $110K

Information from CoinGlass exhibits nearly all of the losses got here from lengthy positions, which means merchants who had been betting costs would maintain going up. Many jumped in after Bitcoin (BTC) and Ethereum (ETH) surged—solely to get slammed when the market turned.

Bitcoin, which briefly touched $110,000, reversed onerous. That single drop liquidated a wave of bulls who had gone lengthy through the hype. Ethereum didn’t fare a lot better, pulling again sharply simply minutes later.

“This is without doubt one of the greatest liquidation occasions of the month,” CoinGlass famous.

Tariff Speak + Market Highs = Immediate Overheat

Analysts say this transfer got here at a delicate time—proper because the market had been pushing new all-time highs. “Trump’s feedback created a spike in geopolitical uncertainty,” one analyst mentioned. “Threat urge for food shrank shortly, and crypto obtained caught within the center.”

Many see this as a correction—possibly overdue—after weeks of parabolic features. Timing-wise? Not preferrred. However in a market that runs sizzling, generally all it takes is a tweet (or on this case, a commerce menace) to chill issues off quick.