Bitcoin has been on a six-week uptrend, pushing the worth previous the essential psychological barrier of $110,000.

Regardless of rising issues that the rally could face a saturation level or a possible drawdown, Bitcoin’s current efficiency and historic traits recommend that the crypto king is much from over, with extra good points seemingly on the horizon.

Bitcoin Traders Sign Additional Development

Traditionally, one of many key indicators of a bull cycle within the cryptocurrency market is the lower within the common age of Bitcoin held. Over the previous 5 years, three main bull markets have been preceded by this pattern. Since April 16, the Imply Greenback Age of Bitcoin has decreased from 441 days to 429 days.

This pattern is a robust sign of a seamless upward motion for Bitcoin. Youthful cash in circulation imply that recent investments are coming into the market, suggesting sturdy ongoing curiosity. If this pattern persists, it additional justifies the expectation of further bullish conduct, doubtlessly prolonging the present rally and propelling Bitcoin towards new value milestones.

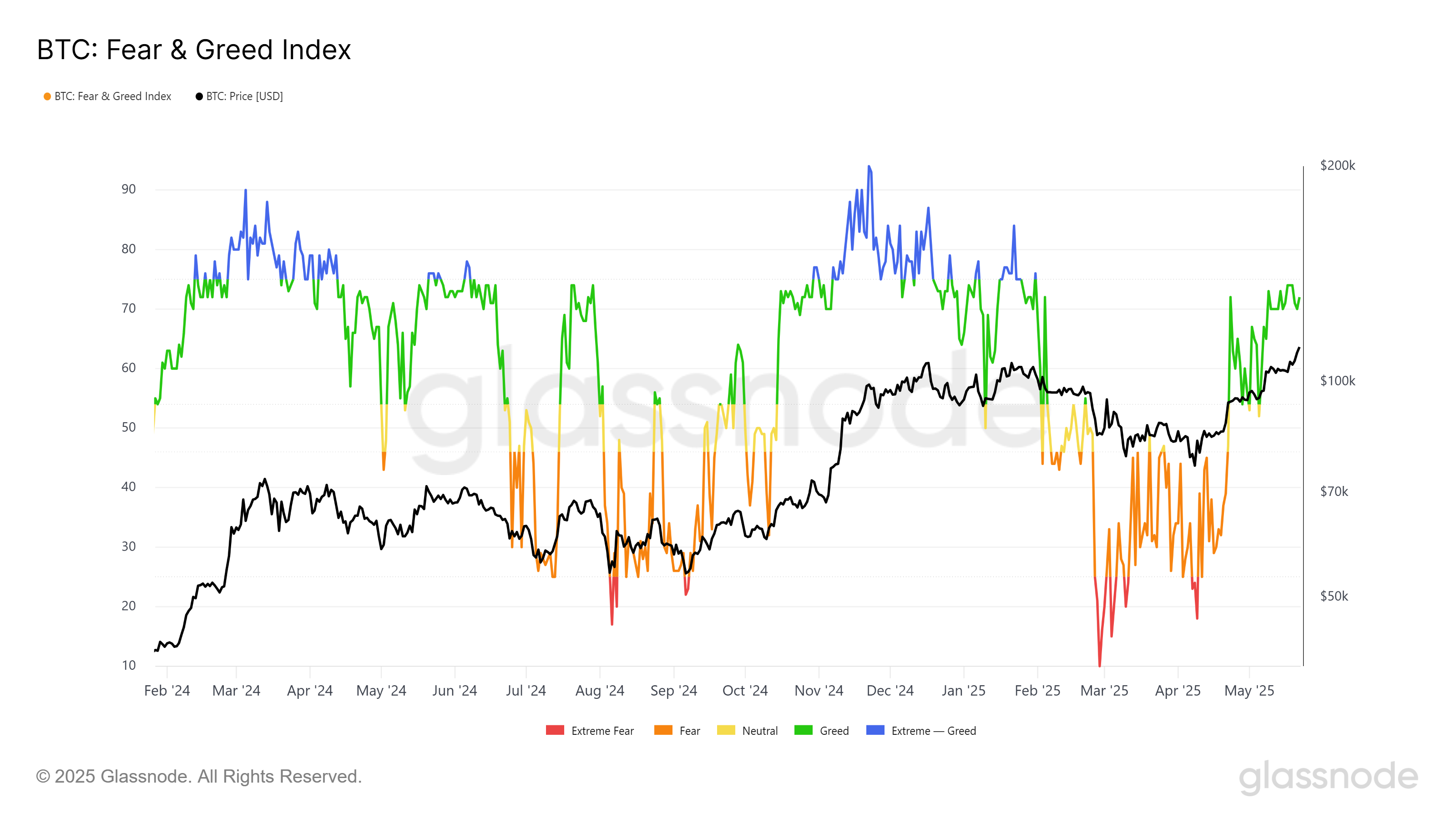

The Concern and Greed index additionally signifies that Bitcoin’s bullish momentum has not but saturated. Traditionally, when the index breaches the Excessive Greed zone, it has been adopted by a pointy improve in Bitcoin’s value.

Nevertheless, Bitcoin has but to achieve this threshold, leaving room for additional value will increase. This implies that the market isn’t but in overbought territory, and there may be nonetheless important upside potential. The index’s place within the Greed zone indicators that buyers stay optimistic about Bitcoin’s future value trajectory.

BTC Value Goals To Proceed Uptrend

Bitcoin’s value has seen a gentle improve over the previous six weeks, culminating in a brand new all-time excessive (ATH) of $111,980. Lennix Lai, World CCO of OKX, highlighted the macroeconomic components, reminiscent of favorable market circumstances and rising institutional curiosity, contributing to Bitcoin’s current rally.

“Bitcoin breaking via $111,000 to a brand new all-time excessive reveals simply how sturdy its technical setup has grow to be. I’m notably impressed by the way it dealt with the Moody’s US credit score downgrade with barely a hiccup earlier than pushing greater… This isn’t your typical crypto hype cycle – we’re seeing real structural shifts with the Senate’s 66-32 GENIUS Act vote and firms snatching up Bitcoin 3 times quicker than miners can produce it.”

Wanting forward, Bitcoin’s value is poised to interrupt via its present ATH and doubtlessly attain $115,000. This continued progress will seemingly appeal to extra buyers, additional fueling the rally. If the optimistic momentum continues, Bitcoin could solidify its place as a number one asset out there.

Nevertheless, if buyers start to promote their holdings to safe income, Bitcoin might expertise a short-term pullback. A drop under $106,265 would sign weakening investor sentiment, doubtlessly resulting in a decline towards $102,734. If this happens, the bullish outlook could also be invalidated, inflicting a brief consolidation section for Bitcoin’s value.

The put up Bitcoin Value Surge Defined: What’s Subsequent for BTC After Hitting $111,980 All-Time Excessive? appeared first on BeInCrypto.