- A dealer offered ETH at $1,570 and re-bought at $2,670, lacking out on over $2.6 million in beneficial properties.

- Ethereum’s market cap hit $321B, surpassing Coca-Cola and shutting in on Financial institution of America.

- ETH led crypto funding inflows final week with $205M, boosted by the Pectra improve and new management.

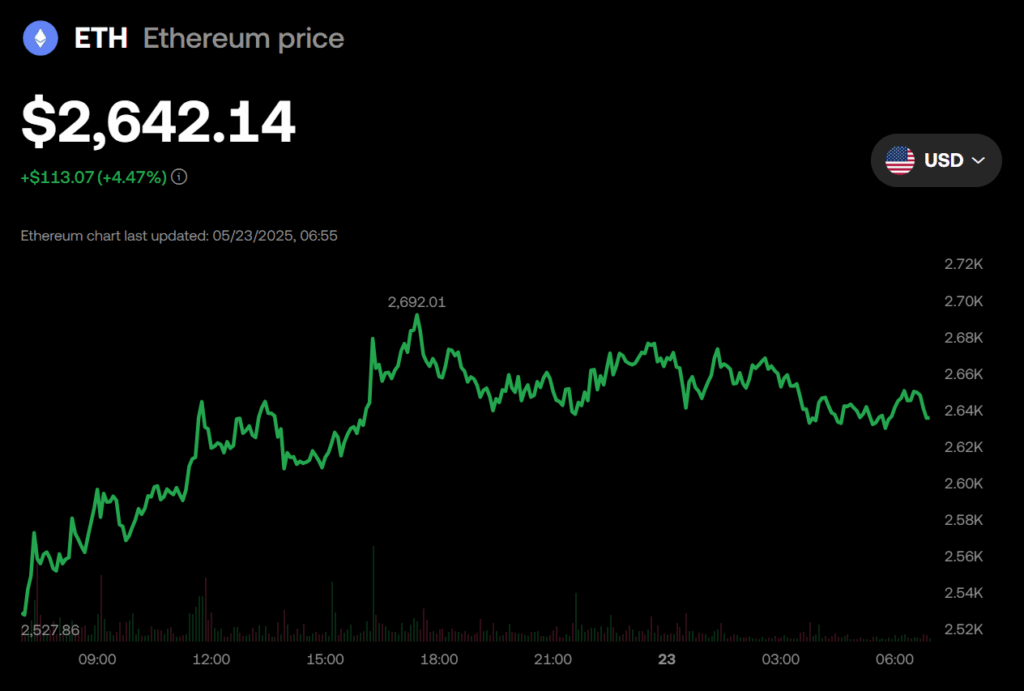

Oof. That’s gotta sting. A crypto dealer simply purchased 1,425 ETH for $3.8 million at round $2,670 per coin, leaping again into Ethereum after its sharp rally. The kicker? Only a month in the past, this identical pockets offered 2,522 ETH for almost the identical quantity—$3.9 million—when ETH was buying and selling round $1,570. Ouch.

Lookonchain, the blockchain sleuths, flagged the pockets exercise on Could 22. Their takeaway? “Assume twice earlier than promoting your luggage.” Yeah… no kidding.

If the dealer had merely held as a substitute of promoting and rebuying, their unique stash could be value about $6.7 million proper now. As a substitute, they’ve misplaced greater than 1,000 ETH—roughly $2.67 million—simply making an attempt to time the market.

Ethereum Blows Previous Coca-Cola in Market Cap

As ETH pushed greater, it didn’t simply break private data—it began climbing world ranks. Ethereum now boasts a market cap of $321 billion, in response to 8marketcap. That places it forward of giants like Coca-Cola, Alibaba, and AbbVie, and it’s creeping up on Financial institution of America. ETH is at the moment the thirty eighth Most worthy asset on the earth. No large deal, proper?

A giant chunk of this momentum got here from the Pectra improve, which launched efficiently and delivered some long-awaited enhancements. Scalability? Examine. Smarter wallets? Examine. Simpler validator UX? Yep. All this has fueled hopes that Ethereum’s mainnet adoption will decide up steam within the months forward.

ETH Dominates Crypto Inflows With $205M in a Week

ETH hasn’t simply been making waves in value motion—it’s crushing it within the funding product area too.

A latest CoinShares report (Could 19) confirmed that U.S.-based crypto funding merchandise introduced in a whopping $785 million in a single week. ETH led the cost, pulling in $205 million—that’s 26% of the whole pie. Yr-to-date? ETH ETPs at the moment are sitting on over $575 million in inflows.

Analysts are crediting the surge to the Pectra improve hype and the appointment of Tomasz Stańczak as a co-executive director on the Ethereum Basis. New management and contemporary tech? Yeah, that tends to excite buyers.

So whereas some merchants are fumbling the bag making an attempt to time the market, others are doubling down—and so they may simply be on the precise facet of this rally.