Hedera (HBAR) is buying and selling dangerously near the important thing psychological degree of $0.20, with technical indicators flashing blended indicators. The BBTrend has turned barely constructive at 0.97 however continues to battle to interrupt above the bullish affirmation degree of 1, signaling weak momentum.

In the meantime, the RSI has dropped sharply from near-overbought territory to a impartial 49.58, reflecting fading confidence after Bitcoin’s current decline. With HBAR hovering at a make-or-break degree, merchants are watching carefully to see whether or not help holds or if a deeper correction occurs.

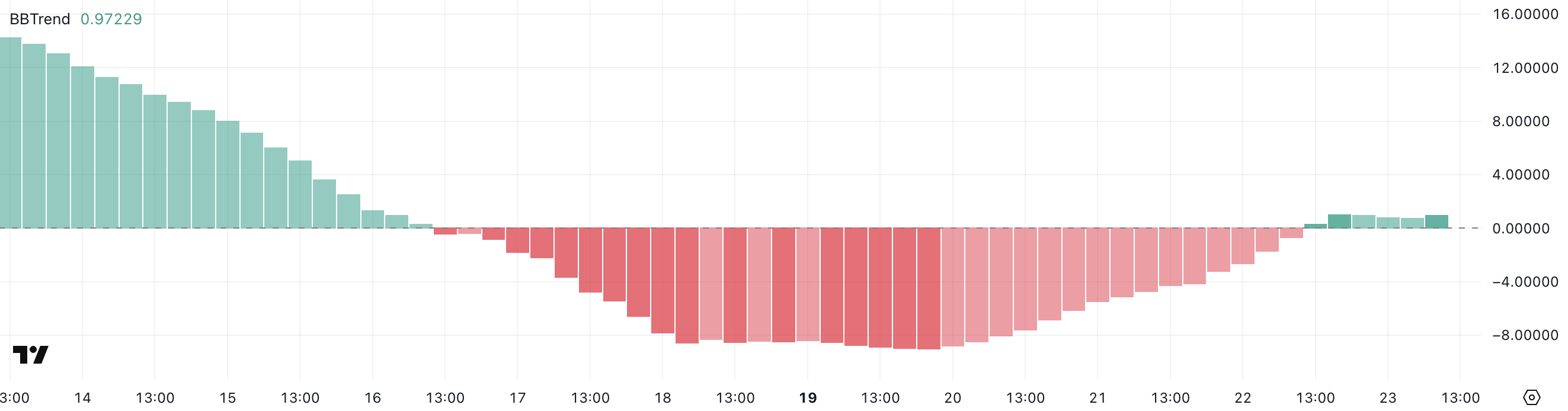

HBAR BBTrend Turns Optimistic, However Struggles to Verify Bullish Momentum

The BBTrend (Bollinger Band Development) indicator measures the power and path of worth tendencies primarily based on how far costs deviate from a transferring common throughout the Bollinger Bands.

Optimistic values recommend upward momentum and shopping for power, whereas detrimental values point out downward strain. The deeper the worth, the stronger the pattern, making it helpful for recognizing breakouts or pattern reversals.

When BBTrend hovers close to zero, it indicators indecision or consolidation, and sustained values above 1 are usually seen as affirmation of a bullish transfer gaining traction.

HBAR’s present BBTrend studying of 0.97 marks a restoration from its current bearish section, the place it bottomed at -8.99 on Might 19 and remained detrimental via Might 22.

This return to constructive territory suggests momentum is making an attempt to shift in Hedera’s favor, however the incapacity to carry above 1 factors to fragile bullish conviction.

Whereas the studying displays an bettering pattern, it additionally highlights hesitation from patrons, indicating that HBAR could stay range-bound except stronger momentum emerges.

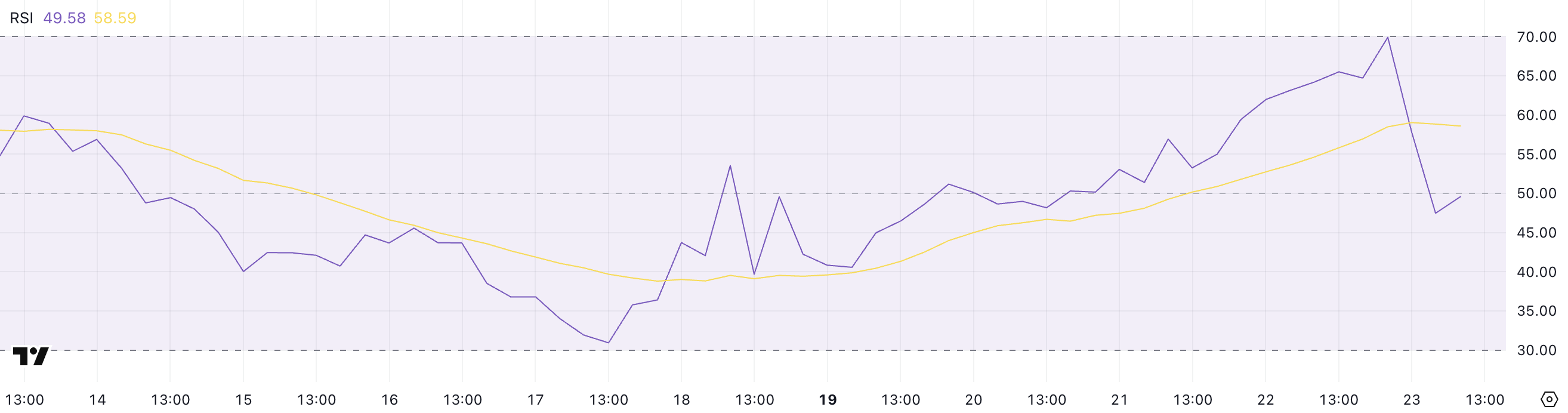

Hedera RSI Drops to Impartial Zone Amid BTC-Pushed Promote-Off

Hedera’s Relative Energy Index (RSI) has dropped to 49.58, falling sharply from 69.91 only a day earlier.

This sudden shift displays a transparent lack of shopping for momentum, as broader market sentiment turned risk-off following Bitcoin’s 3% drop in response to Donald Trump’s risk of imposing a 50% tariff on the European Union.

The RSI’s decline highlights how shortly investor confidence in HBAR light alongside BTC’s pullback, pulling the token again into impartial territory after practically touching overbought situations.

The RSI is a momentum indicator that measures the magnitude of current worth modifications to guage whether or not an asset is overbought or oversold.

It ranges from 0 to 100, with ranges above 70 usually signaling overbought situations and potential for a pullback, whereas values beneath 30 recommend oversold situations and potential for a rebound.

With HBAR’s RSI now sitting close to the midline, the token lacks a transparent pattern, indicating indecision amongst merchants. For momentum to return, HBAR would wish both renewed bullish sentiment or broader market stabilization—notably from Bitcoin.

HBAR Nears $0.20 Breakdown — Key Assist Ranges in Focus

Hedera worth is presently at a crucial technical juncture, hovering simply above the psychological degree of $0.20. If bearish momentum persists, the token is vulnerable to breaking beneath this degree and will slide towards the following help at $0.192.

A breach there would expose additional draw back to $0.184, doubtlessly accelerating short-term promoting strain.

This state of affairs displays broader weak point within the crypto market, notably after Bitcoin’s current pullback.

Nevertheless, if sentiment stabilizes and HBAR reverses course, the primary resistance to observe is at $0.209. A profitable breakout above this degree may open the door to a transfer towards $0.228, a zone that may probably require sturdy quantity and broader market help to reclaim.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.